29 AUGUST, 2023 | VANCOUVER, BC

Tribeca Resources Investor Presentation and Conference Participation

Tribeca Resources Corporation (TSXV: TRBC) (OTCQB: TRRCF) (“Tribeca Resources”, the “Company”) is pleased to advise of an upcoming technical conference, at which our management team will be presenting and participating.

Fexmin (Santiago, 29-31 August 2023)

Tribeca Resources’ CEO, Dr. Paul Gow, will participate in the “New Discoveries – Mines of the Future” symposium, presenting the Company’s recent discovery at the La Higuera IOCG Project on 29 August at 17:00 CLT/EDT. Tribeca was invited by the organising committee to present alongside Antofagasta Plc (the Cachorro and Encierro discoveries) and Atex Resources Inc (the Valeriano discovery).

FEXMIN is an exploration and mining fair held each year in Santiago, Chile and is organised by the professional association of Chilean geologists, the Colegio de Geólogos de Chile.

A copy of the presentation, entitled, “The La Higuera Project – Exploration under cover in a historic district, the Coastal IOCG Belt, Chile” is now available on the company’s website at http://tribecaresources.com/investors/presentation. A live stream will be available via https://fexmin.cl/producto/inscripcion-general-online-pase-3-dias.

About Tribeca Resources

Tribeca Resources is a copper exploration company focused on discovering and developing assets in the Coastal IOCG Belt of northern Chile. The Company’s management team, whose members are significant shareholders of the Company, has world-leading expertise and a discovery history with iron oxide copper-gold deposits in the world’s great IOCG Belts of the Carajás district in Brazil and the Gawler and Cloncurry provinces of Australia.

Tribeca Resources’ objective is to provide the mineral resources for the next generation of copper mines in Chile. It is focused on building a portfolio of projects, with emphasis on mid to advanced-stage copper exploration and resource development projects. To this end, mineral targets are regularly assessed in pursuit of acquisition, strategic exploration and significant discovery.

Tribeca’s flagship property is the La Higuera IOCG project that comprises 4,147 hectares of granted mining and exploration licences and is located towards the southern end of the Chilean Coastal IOCG Belt in the Coquimbo Region of northern Chile. The 822 hectare Gaby concession area is held under a purchase option (5% Exploration Levy on expenditure incurred during the option period; a US$2 million final payment due March 2024; with a 1% NSR Royalty granted to the owner), with the remainder of the concessions being outright owned (100%) by Tribeca Resources. Further information about the project can be found in the NI 43-101 Technical Report lodged by Tribeca on SEDAR on 24 October 2022.

On behalf of Tribeca Resources Corporation

| Paul Gow | Thomas Schmidt | |

| CEO and Director | President and Director | |

| admin@tribecaresources.com | admin@tribecaresources.com | |

| +1 604 685 9316 | +1 604 685 9316 |

Cautionary Note

Neither the TSX Venture Exchange Inc. nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange Inc.) accepts responsibility for the adequacy or accuracy of this press release.

This press release does not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in the United States. The securities referred to herein have not been and will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), or with any securities regulatory authority of any state or other jurisdiction in the United States, and may not be offered or sold, directly or indirectly, within the United States or to, or for the account or benefit of, U.S. persons, as such term is defined in Regulation S under the Securities Act (“Regulation S”), except pursuant to an exemption from or in a transaction not subject to the registration requirements of the Securities Act.

Forward Looking Information

This press release contains forward-looking statements and information that are based on the beliefs of management and reflect the Company's current expectations. When used in this press release, the words "estimate", "project", "belief", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information in this press release include information relating to the ability of the Company to close the Private Placement on the timing and terms described herein, or at all, the operations of the Company, that the Company’s results or potential results have or will attract potential investors and regulatory approval.

Such statements and information reflect the current view of the Company. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: new laws or regulations could adversely affect the business and results of operations of the Company and anticipated work on the Project.

There are several important factors that could cause the Company’s actual results to differ materially from those indicated or implied by forward-looking statements and information. Such factors include, among others: reliance on key management; changes in the credit or security markets; results of operation activities; unanticipated costs and expenses; fluctuations in commodity prices; and general market and industry conditions. The Company cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

The Company has assumed that the material factors referred to in the previous paragraph will not cause such forward-looking statements and information to differ materially from actual results or events. The forward-looking information contained in this press release represents the expectations of the Company as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While the Company may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

AUGUST 14, 2023 | VANCOUVER, BC

NOT FOR DISSEMINATION IN THE UNITED STATES OR THROUGH U.S. NEWS WIRES

Tribeca Resources Closes Oversubscribed C$3.3 Million Non-Brokered Private Placement

Tribeca Resources Corporation (TSXV: TRBC) (OTCQB: TRRCF) (“Tribeca Resources”, the “Company”) is pleased to announce that, further to the news releases dated July 11, 2023 and July 24, 2023, it has now closed the second and final tranche of an oversubscribed non-brokered private placement (the “Private Placement”). Together with the first tranche, Tribeca Resources raised gross proceeds of C$3,309,863.

In connection with the final tranche, the Company raised gross proceeds of $503,488 via the sale of Units consisting of one common share of the Company (a "Common Share") and one-half of one Common Share purchase warrant of the Company (each whole warrant, a "Warrant"). Each Warrant entitles the holder thereof to purchase one additional Common Share at an exercise price of C$0.55 for a period of 24 months from the date of issuance of the Warrant, subject to certain acceleration provisions described below.

No finder’s fees were paid in connection with the final tranche of the Private Placement.

The proceeds of the Private Placement will be used to advance the Company's La Higuera Project, for wider business development activities and general corporate purposes, as the Board of Directors of the Company may approve and direct.

Tribeca Resources CEO, Dr Paul Gow commented:

“We are very pleased with the response to our financing. The quality of investors we have been able to attract are, we believe, the result of the significant exploration potential at our La Higuera copper-gold project.”

“With a treasury of over C$4M Tribeca is now fully funded for what will be an exciting Phase 2 drill program at the project. "

"Our plan to test the open extensions at the Gaby discovery, and potentially to include additional drill-ready targets at La Higuera, means we are well placed to make the upcoming period a rewarding one for our shareholders."

All securities issued pursuant to the Private Placement, including the Common Shares issued in consideration for services rendered in connection with introducing the Company to investors, are subject to a four month hold period from the closing date of the respective tranche of the Private Placement. If for a period of ten consecutive trading days between the date that is four (4) months following the closing of the Private Placement and the expiry of the Warrants, the closing price of the Common Shares on the TSX Venture Exchange (or such other exchange on which the Common Shares may principally trade at such time) is greater than C$0.75 per share, then upon the Company disseminating a press release, the expiry date of the Warrants will automatically accelerate, and the Warrants will expire on the 30th day following the date on which such press release is disseminated.

Closing of the Private Placement is subject to receipt of all necessary regulatory approvals and final acceptance by the TSX Venture Exchange.

The subscription of an insider of the Company in the Private Placement accounted for $19,999.98 or approximately 0.60% of the total gross proceeds. Participation by such insider was exempt from the valuation and minority shareholder approval requirements of Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions (“MI 61-101”) by virtue of the exemptions contained in Section 5.5(b) and 5.7(1)(b) of MI 61-101.

About Tribeca Resources

Tribeca Resources is a copper exploration company focused on discovering and developing assets in the Coastal IOCG Belt of northern Chile. The Company’s management team, whose members are significant shareholders of the Company, has world-leading expertise and a discovery history with iron oxide copper-gold deposits in the world’s great IOCG Belts of the Carajás district in Brazil and the Gawler and Cloncurry provinces of Australia.

Tribeca Resources’ objective is to provide the mineral resources for the next generation of copper mines in Chile. It is focused on building a portfolio of projects, with emphasis on mid to advanced-stage copper exploration and resource development projects. To this end, mineral targets are regularly assessed in pursuit of acquisition, strategic exploration and significant discovery.

Tribeca’s flagship property is the La Higuera IOCG project that comprises 4,147 hectares of granted mining and exploration licences and is located towards the southern end of the Chilean Coastal IOCG Belt in the Coquimbo Region of northern Chile. The 822 hectare Gaby concession area is held under a purchase option (5% Exploration Levy on expenditure incurred during the option period; a US$2 million final payment due March 2024; with a 1% NSR Royalty granted to the owner), with the remainder of the concessions being outright owned (100%) by Tribeca Resources. Further information about the project can be found in the NI 43-101 Technical Report lodged by Tribeca on SEDAR on 24 October 2022.

On behalf of Tribeca Resources Corporation

| Paul Gow | Thomas Schmidt | |

| CEO and Director | President and Director | |

| admin@tribecaresources.com | admin@tribecaresources.com | |

| +1 604 685 9316 | +1 604 685 9316 |

Cautionary Note

Neither the TSX Venture Exchange Inc. nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange Inc.) accepts responsibility for the adequacy or accuracy of this press release.

This press release does not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in the United States. The securities referred to herein have not been and will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), or with any securities regulatory authority of any state or other jurisdiction in the United States, and may not be offered or sold, directly or indirectly, within the United States or to, or for the account or benefit of, U.S. persons, as such term is defined in Regulation S under the Securities Act (“Regulation S”), except pursuant to an exemption from or in a transaction not subject to the registration requirements of the Securities Act.

Forward Looking Information

This press release contains forward-looking statements and information that are based on the beliefs of management and reflect the Company's current expectations. When used in this press release, the words "estimate", "project", "belief", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information in this press release include information relating to the ability of the Company to close the Private Placement on the timing and terms described herein, or at all, the use of proceeds of the Private Placement, the operations of the Company, the drilling program, that the Company’s results have or will attract potential investors and approval of the TSXV and any other regulatory bodies.

Such statements and information reflect the current view of the Company. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: new laws or regulations could adversely affect the business and results of operations of the Company and anticipated work on the Project.

There are several important factors that could cause the Company’s actual results to differ materially from those indicated or implied by forward-looking statements and information. Such factors include, among others: reliance on key management; changes in the credit or security markets; results of operation activities; unanticipated costs and expenses; fluctuations in commodity prices; and general market and industry conditions. The Company cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

The Company has assumed that the material factors referred to in the previous paragraph will not cause such forward-looking statements and information to differ materially from actual results or events. The forward-looking information contained in this press release represents the expectations of the Company as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While the Company may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

JULY 27, 2023 | VANCOUVER, BC

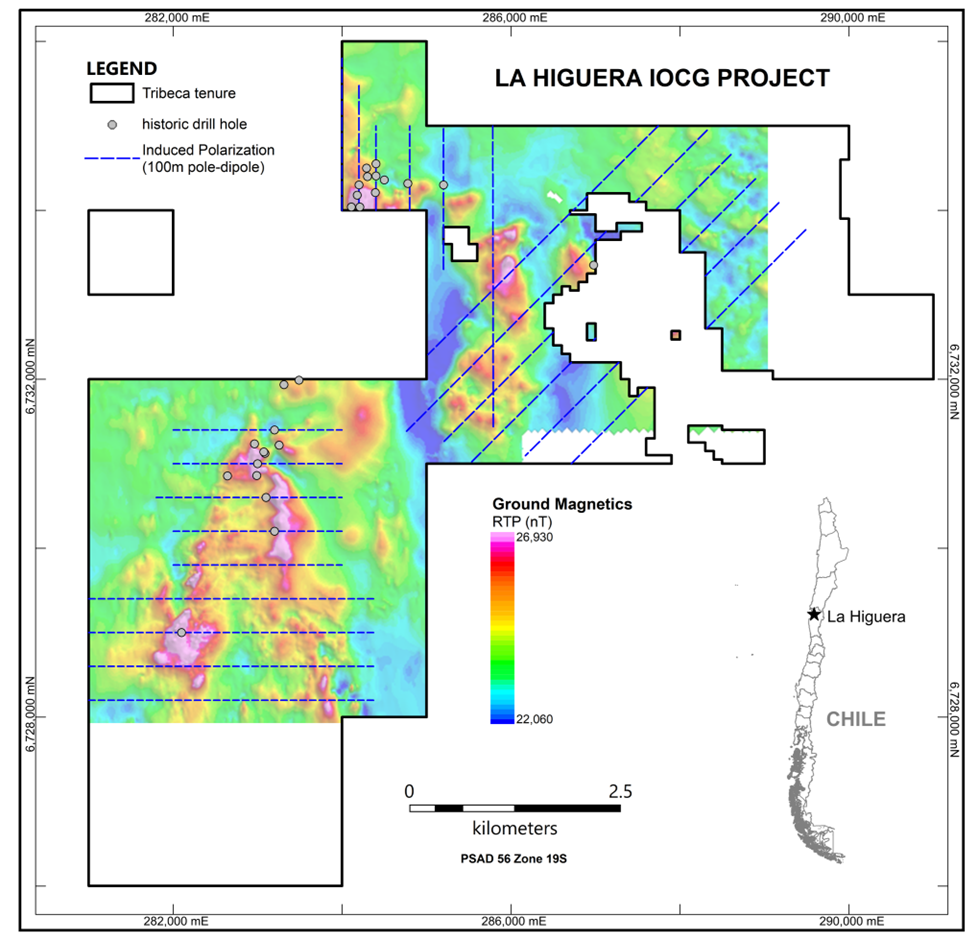

Tribeca Resources extends IP anomaly north of the Gaby discovery at the La Higuera IOCG project

Tribeca Resources Corporation (TSXV: TRBC) (OTCQB: TRRCF) (“Tribeca Resources”, the “Company”) is pleased to announce results from extension geophysical surveying (Induced Polarization - IP) at the Gaby discovery, which is part of the La Higuera IOCG project in northern Chile. The results provide new chargeability anomalies that significantly extend the chargeable zone at Gaby to the north, providing encouragement that recently intersected mineralization continues beyond the limits of current drilling.

Highlights:

- Two lines of extension IP geophysical surveying at the northern end of the Gaby IOCG target have returned significant IP chargeability anomalism, up to 26 mV/V in inverted data, consistent with the presence of disseminated sulphide minerals. The new data extends the chargeable zone at Gaby by an additional 600m to the north.

- The eastern line (1400E) also identified a promising coincident low resistivity – high chargeability anomaly at its southern end, which presents a strong drill target, and is located in the vicinity of small historic pits hosting both oxide and chalcopyrite copper mineralization.

This IP survey was designed to test the area to the north of the Gaby discovery, where ground magnetic and gravity anomalism are present, but not coincident. Chargeability anomalism consistent with sulphide mineralization has been recorded adjacent to the previously reported 1mGal gravity anomaly. This data is supportive of mineralization intersected in the northernmost hole of the last program (e.g. 264m @ 0.31% Cu, 0.06 g/t Au in GBY007) continuing further to the north.

Tribeca Resources CEO, Dr Paul Gow commented:

“These are excellent results from the extension IP surveying at Gaby, which significantly extend the one-kilometre-long chargeability anomaly we have been successfully drilling.

Off the back of our recently announced financing, we are now preparing for the Phase 2 drill program in which we will drill further north under cover and attempt to expand the known size of this copper-gold system.”

IP Geophysical Survey

The IP survey comprised two lines, for 4.4 line-kilometres, located approximately 650 metres apart (Figure 1). The survey lines were configured in a NNE orientation (025°), slightly oblique to the north-south lines historically surveyed in the area, in order to avoid additional infrastructure (a road upgrade and new transmission powerline) erected in the area since the original surveying in 2004-2008.

The survey used a 100m pole-dipole array and utilized a n=1 to 20 configuration that nominally represents a greater depth penetration than previous surveying at the target in 2004-2008, which utilized a n=1 to 6 configuration. The survey was undertaken by the same contractor that completed the original survey.

Line 750E

- Line 750E hosts an 800m long +20 mV/V chargeability anomaly, peaking at 26 mV/V in the inverted data. The resistivity inversion indicates a resistive basement in this zone, beneath a highly conductive horizontal layer that represents the gravel cover and weathered top of basement.

- Importantly, this line indicates that the 20 mV/V chargeable anomalism defined in the historical surveying continues to the north. The two drillholes that have pierced this cross-section (GBY006 and GBY007) are on the flank of and within the southern portion of the anomaly, with both intersecting significant copper-gold mineralization.

- This chargeability anomaly represents a strong drill target and given the NNE orientation of the survey line there is also potential that the mineralization drilled to date may also expand, or trend, towards the east off the current north-south zone drilled to date.

Line 1400E

- Line 1400E hosts a strong coincident chargeability and low resistivity anomaly at its southern end. The geometry of the anomaly suggests a potentially north-dipping low resistivity zone. Drilling in the two holes to the west, 30-60m off-section, encountered intervals of copper mineralization towards the end of the holes (e.g. 22m @ 0.15% Cu in RCH-LH-12 and 14m @ 0.24% Cu in RCH-LH-10). These coincident chargeability and low resistivity anomalies represent a new drill target well east of Tribeca’s drilling to date.

- The northern end of Line 1400E hosts a chargeability anomaly of 17-19 mV/V amplitude (Error! Reference source not found.), evident over approximately 450m length of the line. It is not known if this is related to the highly chargeable zone in the northern end of Line 750E.

Together the two new lines of IP data provide strong encouragement for the extension of mineralization to the north of current drilling and provide an additional target to the east of the main Gaby trend.

Notes on geophysical surveying

The Induced Polarization (IP) surveying reported here was completed by Argali Geofisica E.I.R.L., which is a longstanding and reputable Chilean geophysical contracting and consulting company. The IP data were acquired with the pole-dipole array and a dipole spacing of 100 m expanded through 20 separations (n= 1 to 20). A time-domain waveform with a frequency of 0.125 Hz was employed. Survey location was determined by handheld GPS using the Prov. S. America 1956 (mean) datum, which has been converted by the Company to the WGS84 datum.

Qualified Person

All scientific and technical information in this press release has been prepared by, or approved by, Dr. Paul Gow, who is the CEO of Tribeca Resources. He is a Member of the Australian Institute of Geoscientists (MAIG), a Member of the Australasian Institute of Mining and Metallurgy (MAusIMM) and a qualified person for the purposes of NI 43-101.

About Tribeca Resources

Tribeca Resources is a copper exploration company focused on discovering and developing assets in the Coastal IOCG Belt of northern Chile. The Company’s management team, whose members are significant shareholders of the Company, have world-leading expertise and a discovery history with iron oxide copper-gold deposits in the world’s great IOCG Belts of the Carajás district in Brazil and the Gawler and Cloncurry provinces of Australia.

Tribeca Resources’ objective is to provide the mineral resources for the next generation of copper mines in Chile. It is focused on building a portfolio of projects, with emphasis on mid to advanced-stage copper exploration and resource development projects. To this end, mineral targets are regularly assessed in pursuit of acquisition, strategic exploration and significant discovery.

Tribeca Resources’ flagship property is the La Higuera IOCG project that comprises 4,147 hectares of granted mining and exploration licences and is located towards the southern end of the Chilean Coastal IOCG Belt in the Coquimbo Region of northern Chile. The 822 hectare Gaby concession area is held under a purchase option (5% Exploration Levy on expenditure incurred during the option period; a US$2 million final payment due March 2024; with a 1% NSR Royalty granted to the owner), with the remainder of the concessions being outright owned (100%) by Tribeca Resources. Further information about the project can be found in the NI 43-101 Technical Report lodged by Tribeca Resources on SEDAR on 24 October 2022.

On behalf of Tribeca Resources Corporation

| Paul Gow | Thomas Schmidt | |

| CEO and Director | President and Director | |

| admin@tribecaresources.com | admin@tribecaresources.com | |

| +1 604 685 9316 | +1 604 685 9316 |

Cautionary Note

Neither the TSX Venture Exchange Inc. nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange Inc.) accepts responsibility for the adequacy or accuracy of this press release.

FORWARD LOOKING INFORMATION

This press release contains forward-looking statements and information that are based on the beliefs of management and reflect the Company's current expectations. When used in this press release, the words "estimate", "project", "belief", “believe”, "anticipate", "intend", "expect", "plan", "predict", "may" or "should" and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information in this press release include information relating to the drilling program, the ability of the Company to develop and define a suitable resource at the La Higuera IOCG project and the relationship between geophysical survey results and potential mineralization.

Such statements and information reflect the current view of the Company. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: new laws or regulations could adversely affect the business and results of operations of the Company and anticipated work on the Project.

There are several important factors that could cause the Company’s actual results to differ materially from those indicated or implied by forward-looking statements and information. Such factors include, among others: reliance on key management; changes in the credit or security markets; results of operation activities; unanticipated costs and expenses; fluctuations in commodity prices; and general market and industry conditions. The Company cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

The Company has assumed that the material factors referred to in the previous paragraph will not cause such forward-looking statements and information to differ materially from actual results or events. The forward-looking information contained in this press release represents the expectations of the Company as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While the Company may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

JULY 24, 2023 | VANCOUVER, BC

NOT FOR DISSEMINATION IN THE UNITED STATES OR THROUGH U.S. NEWS WIRES

Tribeca Resources Upsizes Private Placement Financing and Announces First Closing

Tribeca Resources Corporation (TSXV: TRBC) (OTCQB: TRRCF) (“Tribeca Resources”, the “Company”) is pleased to announce an increase to its previously announced non-brokered private placement (the "Private Placement"). As a result of strong investor interest, the Private Placement to raise gross proceeds of up to $3,000,000 has been upsized to raise aggregate gross proceeds of up to $3,500,000. The Company has received commitments for approximately 90% of the upsized total financing to date.

All terms of the Private Placement remain the same and the Company now intends to issue up to 10,606,060 units (the "Units") at a price of $0.33 per Unit for aggregate proceeds of up to $3,500,000 under the Private Placement. Each Unit will consist of one common share of the Company (a "Common Share") and one-half of one Common Share purchase warrant of the Company (each whole warrant, a "Warrant"). Each Warrant will entitle the holder thereof to purchase one additional Common Share at an exercise price of C$0.55 for a period of 24 months from the date of issuance of the Warrant.

The Company also announced that it has closed the first tranche of the Private Placement. Under the first tranche of the Private Placement, the Company issued an aggregate of 8,504,165 Units to raise gross proceeds of $2,806,374.

In connection with closing of the first tranche, the Company paid $102,000 and issued 309,091 Finder's Warrants to Tamesis Partners LLP in consideration for introducing certain subscribers to the Private Placement. Each Finder’s Warrant is exercisable at a price of $0.33 for a period of two (2) years from the date of issuance for one Common Share.

Tribeca Resources CEO, Dr Paul Gow commented:

“We are delighted with the strong response from existing shareholders and new investors for this Private Placement and expect to complete the financing in the coming weeks."

“The strong demand, we believe, is a result of the exciting exploration potential at our La Higuera copper-gold project.”

A second and final tranche of the Private Placement of up to an additional $693,626 is expected to close shortly.

All securities issued pursuant to the Private Placement, including the Common Shares issued in consideration for services rendered in connection with introducing the Company to investors, are subject to a four month hold period.

About Tribeca Resources

Tribeca Resources is a copper exploration company focused on discovering and developing assets in the Coastal IOCG Belt of northern Chile. The Company’s management team, whose members are significant shareholders of the Company, has world-leading expertise and a discovery history with iron oxide copper-gold deposits in the world’s great IOCG Belts of the Carajás district in Brazil and the Gawler and Cloncurry provinces of Australia.

Tribeca Resources’ objective is to provide the mineral resources for the next generation of copper mines in Chile. It is focused on building a portfolio of projects, with emphasis on mid to advanced-stage copper exploration and resource development projects. To this end, mineral targets are regularly assessed in pursuit of acquisition, strategic exploration and significant discovery.

Tribeca’s flagship property is the La Higuera IOCG project that comprises 4,047 hectares of granted mining and exploration licences and is located towards the southern end of the Chilean Coastal IOCG Belt in the Coquimbo Region of northern Chile. The 822 hectare Gaby concession area is held under a purchase option (5% Exploration Levy on expenditure incurred during the option period; a US$2 million final payment due March 2024; with a 1% NSR Royalty granted to the owner), with the remainder of the concessions being outright owned (100%) by Tribeca Resources. Further information about the project can be found in the NI 43-101 Technical Report lodged by Tribeca on SEDAR on 24 October 2022.

On behalf of Tribeca Resources Corporation

| Paul Gow | Thomas Schmidt | |

| CEO and Director | President and Director | |

| admin@tribecaresources.com | admin@tribecaresources.com | |

| +1 604 685 9316 | +1 604 685 9316 |

Cautionary Note

Neither the TSX Venture Exchange Inc. nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange Inc.) accepts responsibility for the adequacy or accuracy of this press release.

This press release does not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in the United States. The securities referred to herein have not been and will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), or with any securities regulatory authority of any state or other jurisdiction in the United States, and may not be offered or sold, directly or indirectly, within the United States or to, or for the account or benefit of, U.S. persons, as such term is defined in Regulation S under the Securities Act (“Regulation S”), except pursuant to an exemption from or in a transaction not subject to the registration requirements of the Securities Act.

Forward Looking Information

This press release contains forward-looking statements and information that are based on the beliefs of management and reflect the Company's current expectations. When used in this press release, the words "estimate", "project", "belief", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information in this press release include information relating to the ability of the Company to close the Private Placement on the timing and terms described herein, or at all, the operations of the Company, that the Company’s results or potential results have or will attract potential investors and regulatory approval.

Such statements and information reflect the current view of the Company. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: new laws or regulations could adversely affect the business and results of operations of the Company and anticipated work on the Project.

There are several important factors that could cause the Company’s actual results to differ materially from those indicated or implied by forward-looking statements and information. Such factors include, among others: reliance on key management; changes in the credit or security markets; results of operation activities; unanticipated costs and expenses; fluctuations in commodity prices; and general market and industry conditions. The Company cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

The Company has assumed that the material factors referred to in the previous paragraph will not cause such forward-looking statements and information to differ materially from actual results or events. The forward-looking information contained in this press release represents the expectations of the Company as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While the Company may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

JULY 11, 2023 | VANCOUVER, BC

NOT FOR DISSEMINATION IN THE UNITED STATES OR THROUGH U.S. NEWS WIRES

Tribeca Resources Announces Non-Brokered Private Placement of up to C$3M with Lead Orders from Three Sophisticated Investors

Tribeca Resources Corporation (TSXV: TRBC) (OTCQB: TRRCF) (“Tribeca Resources”, the “Company”) is pleased to announce its intention to complete a non-brokered private placement pursuant to which it will issue up to 9,090,909 units ("Units") at a price of C$0.33 per Unit for aggregate gross proceeds of up to C$3,000,000 (the “Private Placement”).

Each Unit will be comprised of one common share of the Company (a "Common Share") and one-half of one Common Share purchase warrant of the Company (each whole warrant, a "Warrant"). Each Warrant will entitle the holder thereof to purchase one additional Common Share at an exercise price of C$0.55 for a period of 24 months from the date of issuance of the Warrant.

The proceeds of the Private Placement will be used to advance the Company's La Higuera Project, for wider business development activities and general corporate purposes, as the Board of Directors of the Company may approve and direct.

The Company has received lead orders from a group of sophisticated European investors, including one existing shareholder and two new investors, totalling $2,150,000.

Tribeca Resources CEO, Dr Paul Gow commented:

“This additional capital, underpinned by lead orders from one existing and two new cornerstone investors, means we are financed, not only to test the open extensions at the Gaby discovery, but potentially also to include further drill-ready targets at La Higuera in our planned Phase 2 drill programme. The quality of investors we have been able to attract are, we believe, a result of the exciting exploration potential at our La Higuera copper-gold project.”

In connection with the Private Placement, the Company will pay a finder's fee comprised of 6% cash and 6% warrants to eligible finders in accordance with applicable securities laws and the policies of the TSX Venture Exchange (the “TSXV”). Closing of the Private Placement is expected to occur on or about July, 14 2023 and is subject to customary closing conditions, including receipt of all regulatory approvals, including the approval of the TSXV.

All securities issued pursuant to the Private Placement, including the Common Shares issued in consideration for services rendered in connection with introducing the Company to investors, are subject to a four month hold period.

About Tribeca Resources

Tribeca Resources is a copper exploration company focused on discovering and developing assets in the Coastal IOCG Belt of northern Chile. The company’s management team, whose members are significant shareholders of the Company, has world-leading expertise and a discovery history with iron oxide copper-gold deposits in the world’s great IOCG Belts of the Carajás district in Brazil and the Gawler and Cloncurry provinces of Australia.

Tribeca Resources’ objective is to provide the mineral resources for the next generation of copper mines in Chile. It is focused on building a portfolio of projects, with emphasis on mid to advanced-stage copper exploration and resource development projects. To this end, mineral targets are regularly assessed in pursuit of acquisition, strategic exploration and significant discovery.

Tribeca’s flagship property is the La Higuera IOCG project that comprises 4,047 hectares of granted mining and exploration licences and is located towards the southern end of the Chilean Coastal IOCG Belt in the Coquimbo Region of northern Chile. The 822 hectare Gaby concession area is held under a purchase option (5% Exploration Levy on expenditure incurred during the option period; a US$2 million final payment due March 2024; with a 1% NSR Royalty granted to the owner), with the remainder of the concessions being outright owned (100%) by Tribeca Resources. Further information about the project can be found in the NI 43-101 Technical Report lodged by Tribeca on SEDAR on 24 October 2022.

On behalf of Tribeca Resources Corporation

| Paul Gow | Thomas Schmidt | |

| CEO and Director | President and Director | |

| admin@tribecaresources.com | admin@tribecaresources.com | |

| +1 604 685 9316 | +1 604 685 9316 |

Cautionary Note

Neither the TSX Venture Exchange Inc. nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange Inc.) accepts responsibility for the adequacy or accuracy of this press release.

This press release does not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in the United States. The securities referred to herein have not been and will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), or with any securities regulatory authority of any state or other jurisdiction in the United States, and may not be offered or sold, directly or indirectly, within the United States or to, or for the account or benefit of, U.S. persons, as such term is defined in Regulation S under the Securities Act (“Regulation S”), except pursuant to an exemption from or in a transaction not subject to the registration requirements of the Securities Act.

Forward Looking Information

This press release contains forward-looking statements and information that are based on the beliefs of management and reflect the Company's current expectations. When used in this press release, the words "estimate", "project", "belief", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information in this press release include information relating to the ability of the Company to close the Private Placement on the timing and terms described herein, or at all, the use of proceeds of the Private Placement, the operations of the Company, the drilling program, that the Company’s results have or will attract potential investors and approval of the TSXV and any other regulatory bodies

Such statements and information reflect the current view of the Company. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: new laws or regulations could adversely affect the business and results of operations of the Company and anticipated work on the Project.

There are several important factors that could cause the Company’s actual results to differ materially from those indicated or implied by forward-looking statements and information. Such factors include, among others: reliance on key management; changes in the credit or security markets; results of operation activities; unanticipated costs and expenses; fluctuations in commodity prices; and general market and industry conditions. The Company cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

The Company has assumed that the material factors referred to in the previous paragraph will not cause such forward-looking statements and information to differ materially from actual results or events. The forward-looking information contained in this press release represents the expectations of the Company as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While the Company may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

JUNE 16, 2023 | VANCOUVER, BC

Tribeca Resources Announces New U.S. Quotation on OTCQB Venture Market under Symbol TRRCF

Tribeca Resources Corporation (TSXV: TRBC) (“Tribeca Resources”, the “Company”) is pleased to announce that its common shares have been approved for quotation on the OTCQB® Venture Market (the “OTCQB”) effective June 15. The Company’s U.S. listing will be quoted under the symbol TRRCF, whilst the Company’s primary Canadian listing will continue to trade on the TSX Venture Exchange under the symbol TRBC.

The OTCQB provides value and convenience to U.S. investors, brokers and institutions seeking to trade the shares of the company. Alongside this effort, the Company also received approval for DTC eligibility which acts as a clearing house to settle trades in the United States, furthering the liquidity of the Common Shares.

The OTCQB® Venture Market offers investors transparent trading in entrepreneurial and development stage U.S. and international companies. To qualify for OTCQB, companies must meet high financial and securities reporting standards, pass a bid test, and undergo annual verification. As a verified market with access for U.S. investors, OTCQB helps companies build shareholder value, achieve liquidity and a fair valuation. It will also enable the Company to expand its awareness and broaden its range of potential investors into the North American market.

Tribeca Resources CEO, Dr Paul Gow commented:

“The OTCQB quotation provides Tribeca Resources with access to the world’s largest investment market. Since listing on the TSX Venture Exchange in October 2022, Tribeca has drawn growing interest from US based investors who recognise the potential at our La Higuera project, following the discovery of a kilometre long mineralised copper gold at the Gaby target”.

“As we complete an on-going geophysics program to systematically delineate new drill targets, prior to drilling designed to understand the size of our exciting new Gaby discovery, we will continually strive to grow our investor base.”

The Company confirms that the OTCQB quotation does not impose any material additional compliance or regulatory standards over the Company’s TSXV listing. The Company further confirms that no shares are being issued to facilitate to the OTCQB quotation. Burns Figa & Will P.C. acted as the Company’s OTCQB advisor and sponsor.

About Tribeca Resources

Tribeca Resources is a copper exploration company focused on discovering and developing assets in the Coastal IOCG Belt of northern Chile. The company’s management team, whose members are significant shareholders of the Company, has world-leading expertise and a discovery history with iron oxide copper-gold deposits in the world’s great IOCG Belts of the Carajás district in Brazil and the Gawler and Cloncurry provinces of Australia.

Tribeca Resources’ objective is to provide the mineral resources for the next generation of copper mines in Chile. It is focused on building a portfolio of projects, with emphasis on mid to advanced-stage copper exploration and resource development projects. To this end, mineral targets are regularly assessed in pursuit of acquisition, strategic exploration and significant discovery.

Tribeca’s flagship property is the La Higuera IOCG project that comprises 4,047 hectares of granted mining and exploration licences and is located towards the southern end of the Chilean Coastal IOCG Belt in the Coquimbo Region of northern Chile. The 822 hectare Gaby concession area is held under a purchase option (5% Exploration Levy on expenditure incurred during the option period; a US$2 million final payment due March 2024; with a 1% NSR Royalty granted to the owner), with the remainder of the concessions being outright owned (100%) by Tribeca Resources. Further information about the project can be found in the NI 43-101 Technical Report lodged by Tribeca on SEDAR on 24 October 2022.

On behalf of Tribeca Resources Corporation

| Paul Gow | Thomas Schmidt | |

| CEO and Director | President and Director | |

| admin@tribecaresources.com | admin@tribecaresources.com | |

| +1 604 685 9316 | +1 604 685 9316 |

Cautionary Note

Neither the TSX Venture Exchange Inc. nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange Inc.) accepts responsibility for the adequacy or accuracy of this press release.

This press release does not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in the United States. The securities referred to herein have not been and will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), or with any securities regulatory authority of any state or other jurisdiction in the United States, and may not be offered or sold, directly or indirectly, within the United States or to, or for the account or benefit of, U.S. persons, as such term is defined in Regulation S under the Securities Act (“Regulation S”), except pursuant to an exemption from or in a transaction not subject to the registration requirements of the Securities Act.

Forward Looking Information

This press release contains forward-looking statements and information that are based on the beliefs of management and reflect the Company's current expectations. When used in this press release, the words "estimate", "project", "belief", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information in this press release include information relating to the drilling program, the ability of the Company to develop and define a suitable resource at the Project and the relationship between geophysical survey results and potential mineralization.

Such statements and information reflect the current view of the Company. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: new laws or regulations could adversely affect the business and results of operations of the Company and anticipated work on the Project.

There are several important factors that could cause the Company’s actual results to differ materially from those indicated or implied by forward-looking statements and information. Such factors include, among others: reliance on key management; changes in the credit or security markets; results of operation activities; unanticipated costs and expenses; fluctuations in commodity prices; and general market and industry conditions. The Company cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

The Company has assumed that the material factors referred to in the previous paragraph will not cause such forward-looking statements and information to differ materially from actual results or events. The forward-looking information contained in this press release represents the expectations of the Company as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While the Company may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

MAY 17, 2023 | VANCOUVER, BC

Tribeca Resources reports drill results from second target at La Higuera IOCG project and commences Phase 2 work program

Tribeca Resources Corporation (TSXV: TRBC) (“Tribeca Resources”, the “Company”) is pleased to announce final drill results from its recently completed first phase exploration program at the La Higuera IOCG project in northern Chile. These results mark a significant additional milestone in the Company's pursuit of copper-gold systems in this well-endowed and infrastructure-rich district.

Highlights:

- The Phase 1 drilling program concluded with hole CHS002, which intersected a substantial zone of copper mineralization. Over a length of 167 meters, the copper grade averaged 0.21%, including a section of 12 meters at 0.91% copper and 0.24 g/t gold, starting from a depth of 56 meters.

- A field campaign has been initiated to systematically develop additional drill targets. This campaign involves comprehensive geological mapping and soil sampling activities at the Benja and Don Baucha targets.

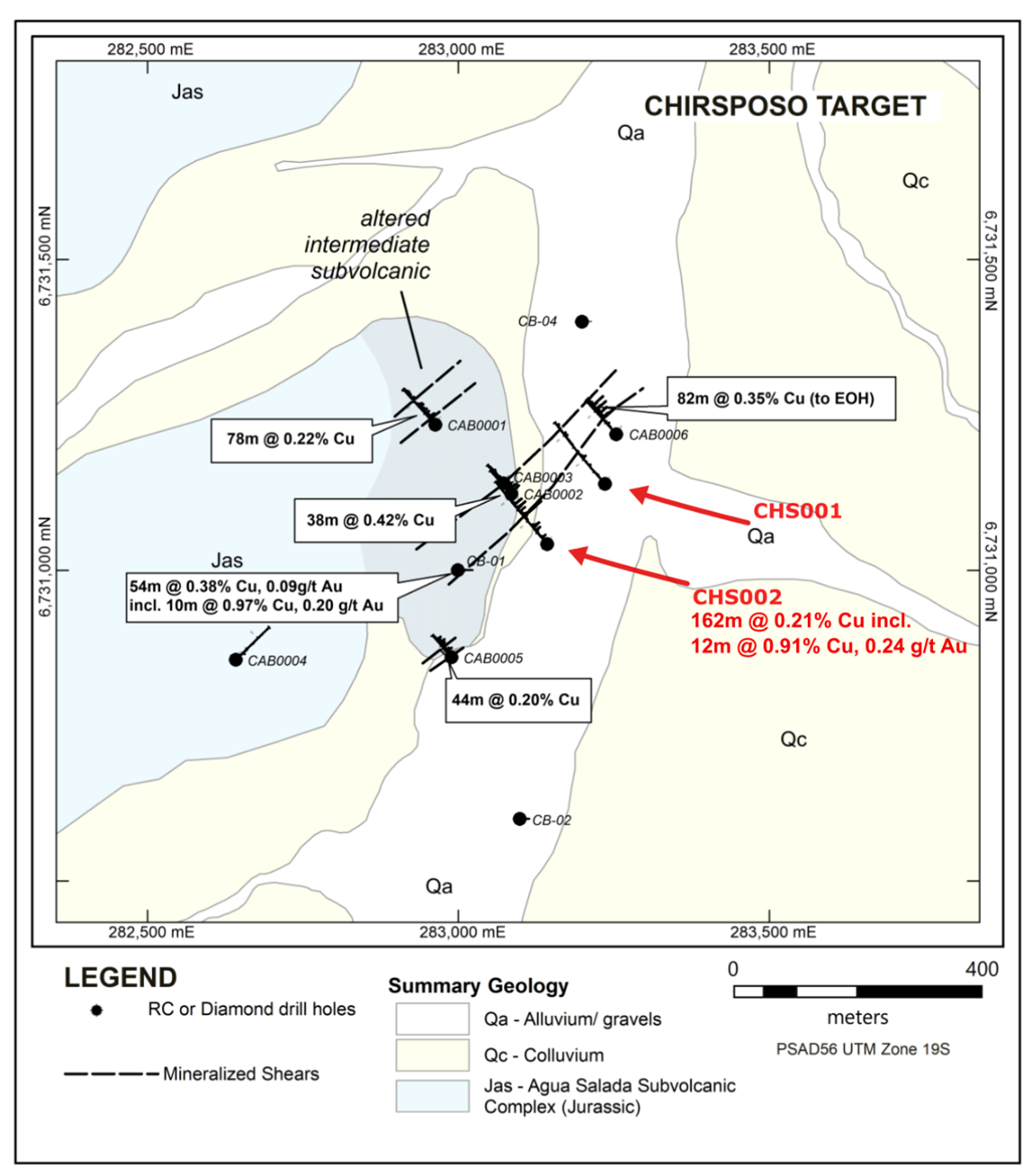

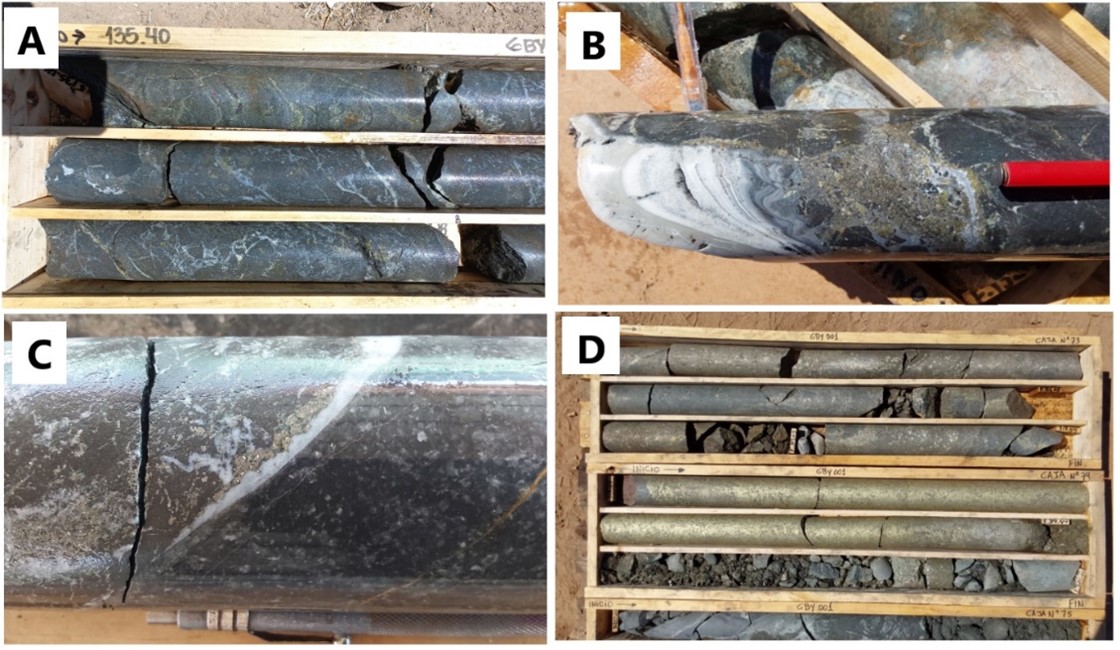

The results from CHS002, combined with historic exploration data, confirm the presence of three distinct copper-gold mineralized shear zones within a zone measuring 700 meters in length by 400 meters in width at Chirsposo. The characteristics of the mineralization closely resemble those from the previously reported Gaby discovery, as highlighted in Tribeca Resources' news releases from January to April 2023.

Tribeca Resources CEO, Dr Paul Gow commented:

“With an abundance of exciting exploration targets on our La Higuera district mineral concessions, we believe Tribeca Resources has only started to scratch the surface of this copper district. We look forward to systematically delineating new drill targets as well as recommencing drilling to understand the size of our exciting new Gaby discovery.”

Chirsposo drill results

The combination of historic RC-dominant drilling, trenching, soil sampling, and geophysical ground magnetic data has revealed the presence of a large IOCG alteration system at the Chirsposo project. This system spans approximately 700 meters by 400 meters and contains mineralization within several southeast-dipping shear zones.

During the recent drill program, two diamond drill holes with RC pre-collars were completed at the Chirsposo target, totaling 524 meters. These holes were designed to test the interpreted geometry of the controlling shear zones and explore potential down-dip extensions of mineralization encountered in historic holes CAB0006 and CB-01 (which returned notable intervals including 82 meters at 0.35% Cu from 64 meters in CAB0006 and 54 meters at 0.38% Cu, 0.09 g/t Au, including 10 meters at 0.97% Cu, 0.20 g/t Au from 122 meters in CB-01).

Results from the final two holes of Phase 1 drilling are as follows:

- The first hole, CHS001, encountered 24 meters of gravel cover before intersecting diorite and porphyritic andesite with strong magnetite-scapolite-albite alteration. Pyrite-chalcopyrite mineralization was observed throughout much of the hole, with an average copper grade ranging between 0.1% and 0.2% in four intervals of 4-14 meters downhole thickness.

- The second hole, CHS002, encountered 4 meters of gravel cover before intersecting porphyritic andesite with strong magnetite-amphibole-scapolite alteration. This section exhibited more intense pyrite-chalcopyrite mineralization, with localized sulphide content reaching 15% in thin intervals. The rock was weathered to a depth of 52 meters. The hole intersected significant thicknesses of 0.2-0.3% Cu and one 12m interval of 0.91% Cu and 0.24 g/t Au (Table 1). Importantly, this higher-grade interval may correlate with a similar interval of high-grade mineralization in CB-01 130m along strike to the southwest (Figure 1).

The strike extension of the mineralization to the northeast remains untested beyond drillhole CAB0006 (Figure 1).

The interpreted approximate 70° southeast dip of the mineralization and the northwest drilling direction at 60° dip suggest the true thickness of the mineralization will be approximately 75% of the downhole thickness.

Table 1: Significant intersections from drill hole CHS002 at the Chirsposo target. No significant intersections were present in drill hole CHS001.

| HoleID | From | To | Interval | Cu (%) | Au (g/t) | Co (ppm) | CuEq (%) |

| CHS002 | 56 | 223 | 167 | 0.21 | 0.06 | 84 | 0.24 |

| incl | 56 | 78 | 22 | 0.26 | 0.07 | 31 | 0.28 |

| incl | 118 | 130 | 12 | 0.91 | 0.24 | 512 | 1.05 |

| incl | 198 | 214 | 16 | 0.24 | 0.07 | 72 | 0.27 |

| Note: Apart from the summary intersection (from 56-223m in CHS002) the grade intersections are calculated for intervals >0.2% Cu with maximum internal dilution of 10m @ 0.05% Cu and a minimum interval width of 10m. CuEq (%) grades have been calculated using recoveries from metallurgical test work undertaken in 2006 on drill core from the project, which are 90% for copper, 65% for gold and 50% for cobalt. Metal prices utilised were US$3.74/lb copper, US$2,019.90/oz gold and US$15.84/lb cobalt (based on 12 May 2023 closing spot prices). | |||||||

Targets at the La Higuera IOCG Project

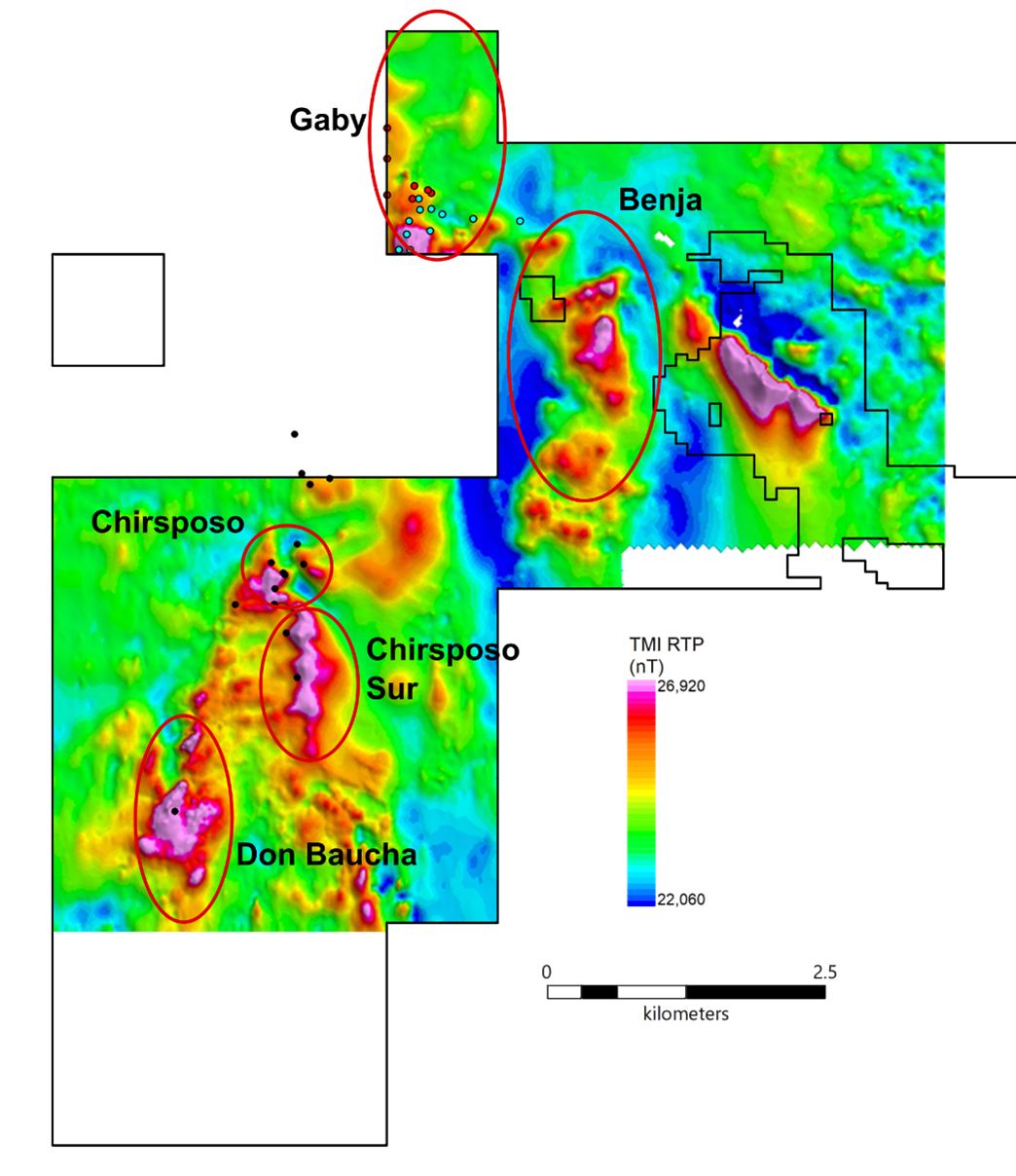

Tribeca Resources has strategically acquired a land holding of 4,047 hectares along the Atacama Fault System, covering a length of 8km. In combination with historic exploration data, the recent drilling by Tribeca Resources has demonstrated a strong copper endowment in this section of the fault system. Through integration of the pre-existing geophysical database with new data, Tribeca Resources has identified numerous potential targets, particularly in areas with shallow gravel cover.

To date, Tribeca Resources has conducted drilling on two of five targets and is now focused on developing potential drill targets at the remaining three before proceeding to the next phase of drilling.

The target areas are shown on Figure 2 and comprise:

- Gaby (drill tested in Phase 1): Gaby has shown significant intersections indicating the presence of a mineralized IOCG system over a strike length of at least one kilometer. The system remains open to the north and at depth, requiring further drilling. Gravity targets on the eastern flank will be explored using extension IP surveying.

- Benja (not yet drilled): Located between the Gaby discovery and the historic La Higuera mine, Benja exhibits significant IOCG-style alteration based on reconnaissance mapping and ground magnetic data. A soil sampling program is underway to further evaluate the zone.

- Chirsposo (drill tested in Phase 1): Chirsposo consists of an outcropping ridge that disappears under thin gravel to the northeast. Historic data and the drilling reported here indicate the presence of a large northeast-trending, locally copper-bearing, system spanning 700m x 400m.

- Chirsposo South (not yet drilled): Chirsposo South features coincident ground magnetic (3000-5000nT) and IP chargeability anomalies (> 25 mV/V) beneath gravel cover. Limited drilling off the western flank of these anomalies has shown sporadic copper intervals with maximum individual assays up to 0.8% copper (CB-02)

- Don Baucha (single historic drill hole): Hosting an intense magnetic anomaly (5000nT) with a coincident IP chargeability anomaly (up to 40 mV/V), Don Baucha comprises andesite outcrop cut by magnetite veins. The single historic drill hole intersected sporadic copper mineralization with individual assay intervals up to 0.38% copper.

A geological mapping and soil sampling program has commenced at the Benja and Don Baucha targets, which both host significant outcrop. The objective is to understand the location and geometry of any mineralized zones within these large areas that have been defined through the ground magnetic data.

Notes on sampling and assaying

Analytical samples were collected using 1/8 of the material from each 2m interval for the reverse circulation drilling or ½ HQ core for the diamond drilling and sent to the ALS Laboratory in La Serena, Chile for preparation and then to ALS in Santiago, Chile and Lima, Peru for analysis. Preparation included crushing the RC and core samples to 70% < 2mm and pulverizing 1000g of crushed material to better than 85% < 75 microns. All samples are assayed using 30g nominal weight fire assay with AAS finish (Au-AA23) and a multi-element four acid digest ICP-AES method (ME-ICP61). Where the ME-ICP61 results were greater than 10,000 ppm Cu the assays were repeated with an ore grade four acid digest method (Cu-OG62). The QA/QC procedure for this drilling program utilizes field duplicates, certified reference standards and blanks that comprise approximately 10% of the total samples submitted. The QA/QC results indicate appropriate accuracy and precision in the assaying program.

Qualified Person

All scientific and technical information in this press release has been prepared by, or approved by, Dr. Paul Gow, who is the CEO of Tribeca Resources. He is a Member of the Australian Institute of Geoscientists (MAIG), a Member of the Australasian Institute of Mining and Metallurgy (MAusIMM) and a qualified person for the purposes of NI 43-101. Dr. Gow has not verified any of the information regarding any of the properties or projects referred to herein other than the La Higuera IOCG Property. Mineralization on any other properties referred to herein is not necessarily indicative of mineralization on the La Higuera IOCG Property.

About Tribeca Resources

Tribeca Resources is a copper exploration company focused on discovering and developing assets in the Coastal IOCG Belt of northern Chile. The company’s management team, whose members are significant shareholders of the Company, has world-leading expertise and a discovery history with iron oxide copper-gold deposits in the world’s great IOCG Belts of the Carajás district in Brazil and the Gawler and Cloncurry provinces of Australia.

Tribeca Resources’ objective is to provide the mineral resources for the next generation of copper mines in Chile. It is focused on building a portfolio of projects, with emphasis on mid to advanced-stage copper exploration and resource development projects. To this end, mineral targets are regularly assessed in pursuit of acquisition, strategic exploration and significant discovery.

Tribeca’s flagship property is the La Higuera IOCG project that comprises 4,047 hectares of granted mining and exploration licences and is located towards the southern end of the Chilean Coastal IOCG Belt in the Coquimbo Region of northern Chile. The 822 hectare Gaby concession area is held under a purchase option (5% Exploration Levy on expenditure incurred during the option period; a US$2 million final payment due March 2024; with a 1% NSR Royalty granted to the owner), with the remainder of the concessions being outright owned (100%) by Tribeca Resources. Further information about the project can be found in the NI 43-101 Technical Report lodged by Tribeca Resources on SEDAR on 24 October 2022.

On behalf of Tribeca Resources Corporation

| Paul Gow | Thomas Schmidt | |

| CEO and Director | President and Director | |

| admin@tribecaresources.com | admin@tribecaresources.com | |

| +1 604 685 9316 | +1 604 685 9316 |

Cautionary Note

Neither the TSX Venture Exchange Inc. nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange Inc.) accepts responsibility for the adequacy or accuracy of this press release.

FORWARD LOOKING INFORMATION

This press release contains forward-looking statements and information that are based on the beliefs of management and reflect the Company's current expectations. When used in this press release, the words "estimate", "project", "belief", “believe”, "anticipate", "intend", "expect", "plan", "predict", "may" or "should" and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information in this press release include information relating to the drilling program, the ability of the Company to develop and define a suitable resource at the Project and the relationship between geophysical survey results and potential mineralization.

Such statements and information reflect the current view of the Company. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: new laws or regulations could adversely affect the business and results of operations of the Company and anticipated work on the Project.

There are several important factors that could cause the Company’s actual results to differ materially from those indicated or implied by forward-looking statements and information. Such factors include, among others: reliance on key management; changes in the credit or security markets; results of operation activities; unanticipated costs and expenses; fluctuations in commodity prices; and general market and industry conditions. The Company cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

The Company has assumed that the material factors referred to in the previous paragraph will not cause such forward-looking statements and information to differ materially from actual results or events. The forward-looking information contained in this press release represents the expectations of the Company as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While the Company may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

APRIL 3, 2023 | VANCOUVER, BC

Tribeca Resources confirms the discovery of a 1km long mineralized copper-gold system at its La Higuera IOCG project in Chile

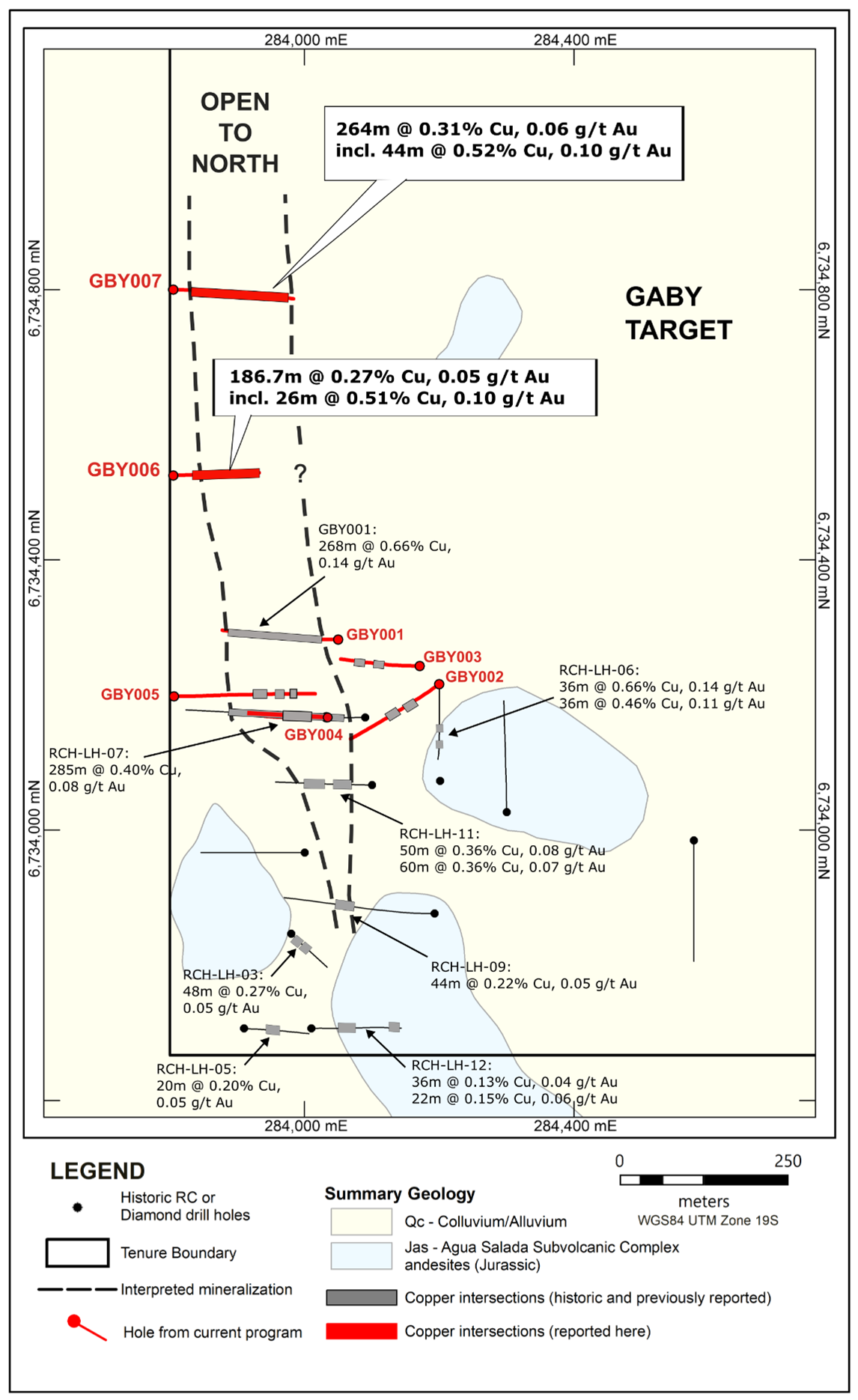

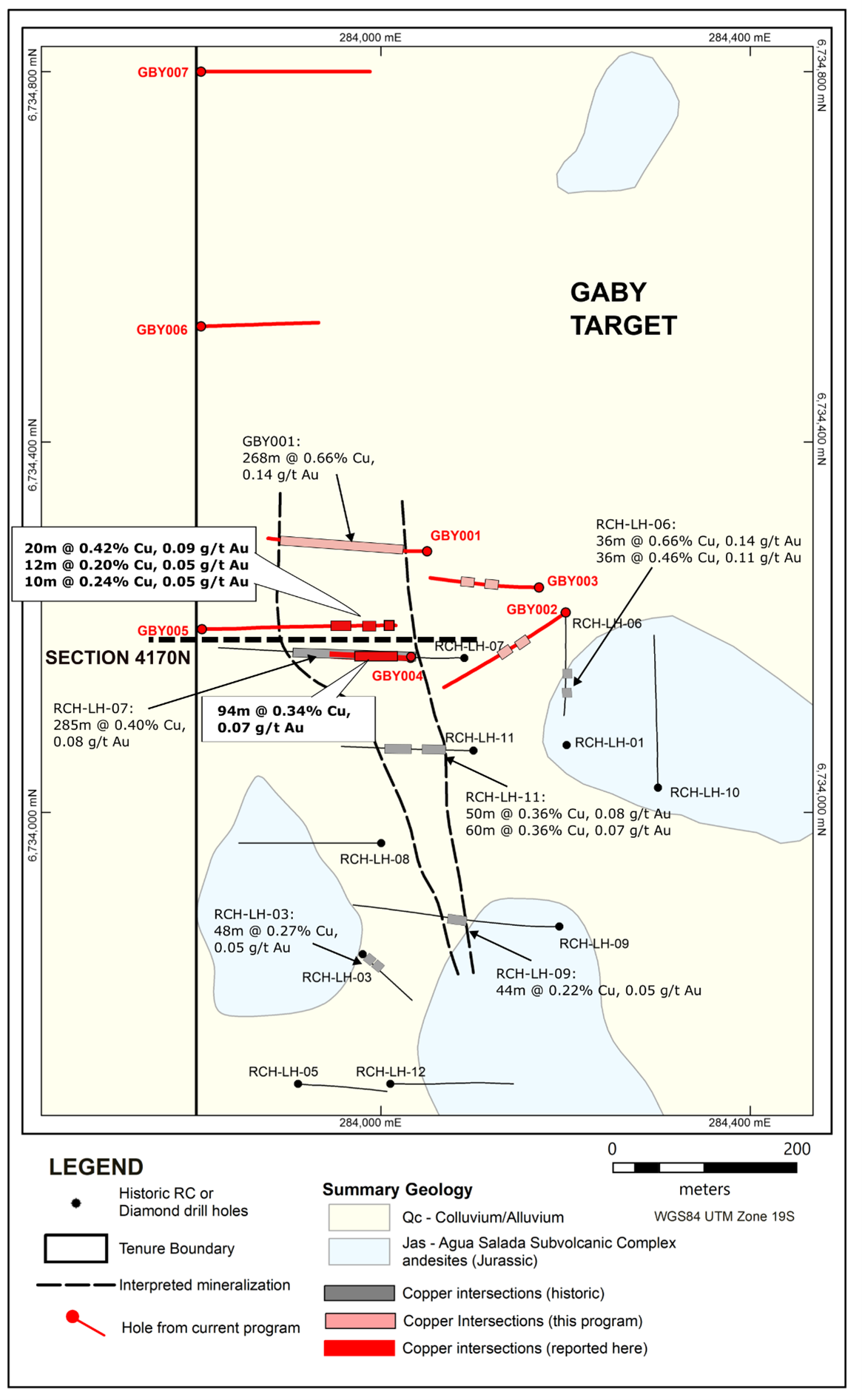

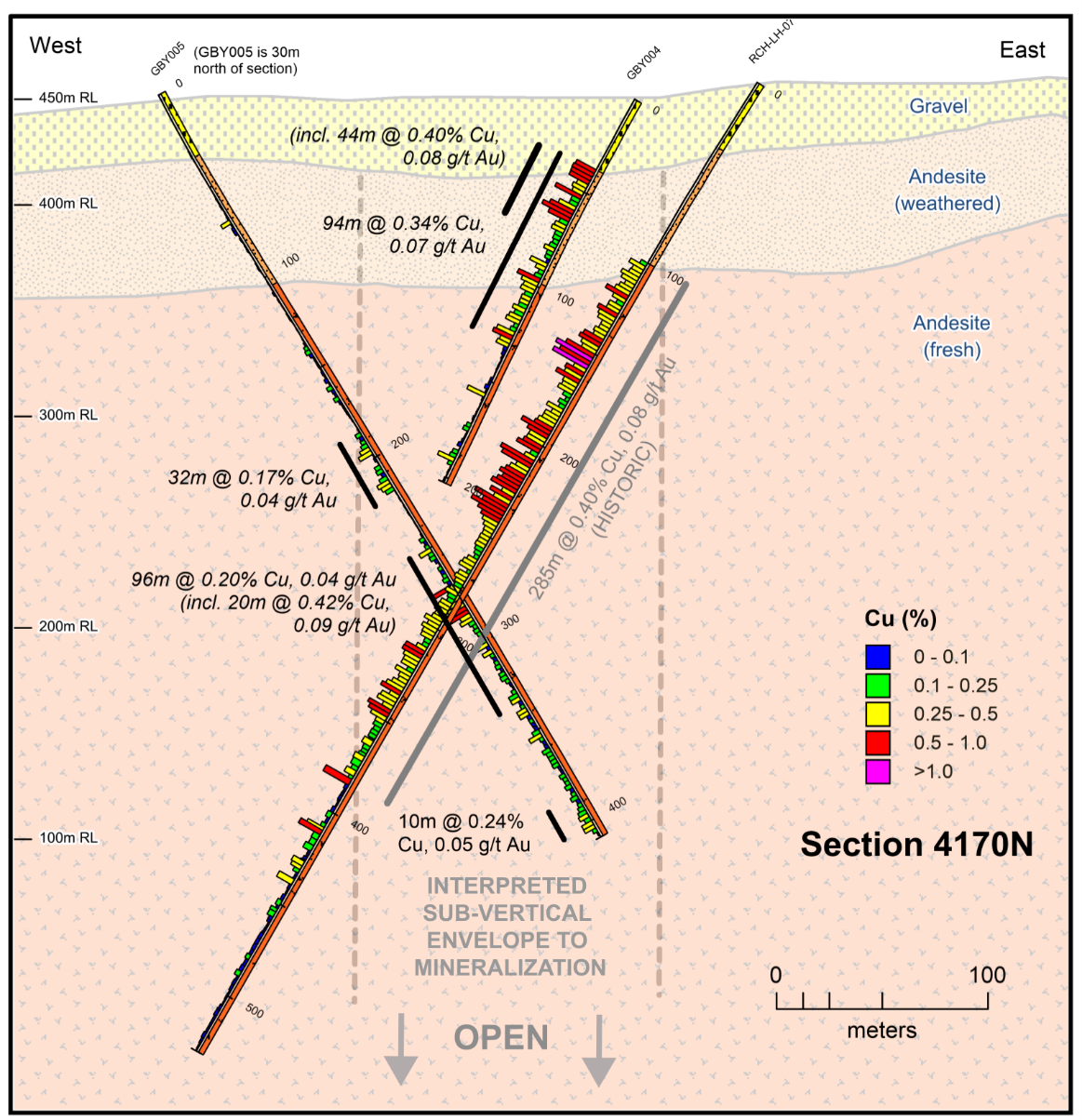

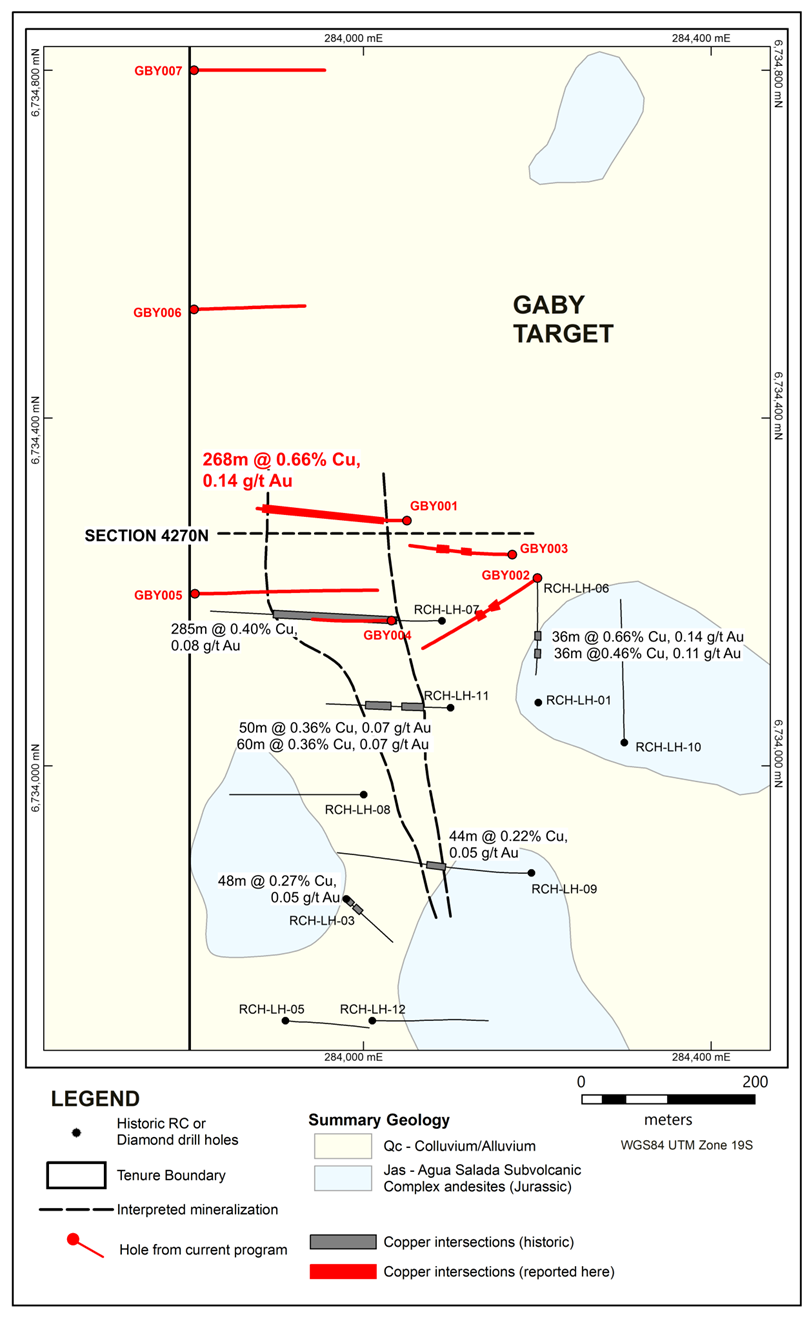

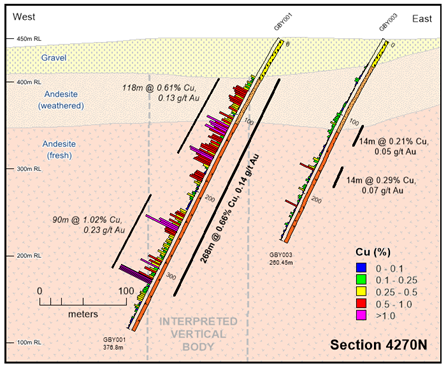

Tribeca Resources Corporation (TSXV: TRBC) (“Tribeca Resources”, the “Company”) is pleased to announce results from two 250m step-out drill holes, adding 500m of additional strike length for a total of 1 km to this discovery at the Gaby target. This new discovery is part of the Company’s La Higuera iron oxide copper-gold (IOCG) project, located in the Coquimbo region of northern Chile.

Highlights:

- Results from two drill holes forming a 500m step-out to the north have doubled the strike length of known significant copper-gold sulphide mineralization, at what is now a 1km long mineralized zone at the Gaby discovery.

- Drill hole GBY007 intersected 44m @ 0.52% copper, 0.10 g/t gold from 96m depth within a larger mineralized interval of 264m @ 0.31% copper, 0.06 g/t gold.

- Drill hole GBY006 intersected 26m @ 0.51% copper, 0.10 g/t gold from 228m depth within 186.7m @ 0.27% copper, 0.05 g/t gold from 76m to end-of-hole.

- The mineralization remains clearly open to the north and at depth. Integration of the step-out results with new geophysical data provides additional promising drill targets both along strike and adjacent to this discovery.

- Logging and data collection from the drill core is being completed before planning the next phase of drilling to expand what is now a growing copper-gold discovery.

The two holes reported here have intersected an interpreted approximately 130m-wide NNW-trending sub-vertical zone of magnetite-related IOCG-style copper sulphide mineralization.

Tribeca Resources CEO, Dr Paul Gow commented:

“These drill results are highly encouraging and further validate our approach of aggressively stepping out to drill well-reasoned geophysical targets under thin gravel cover.”

“Located at just 450 metres above sea-level, and 10 km from the coast, the La Higuera project benefits from extremely favourable access to infrastructure and the possibility of year-round drilling. We look forward to continuing our efforts to increase the known size of this mineralized system during 2023.”

Table 1. Summary of significant mineralized intersections in drill holes GBY006 and GBY007.

| HoleID | From (m) |

To (m) |

Downhole Interval (m) |

Cu (%) |

Au (g/t) |

Co (ppm) |

CuEq (%) |

| GBY006 | 76 | 262.7 | 186.7 | 0.27 | 0.05 | 240 | 0.31 |

| incl. | 122 | 178 | 56 | 0.35 | 0.07 | 271 | 0.40 |

| incl. | 190 | 224 | 34 | 0.28 | 0.06 | 362 | 0.35 |

| incl. | 228 | 254 | 26 | 0.51 | 0.10 | 312 | 0.56 |

| GBY007 | 88 | 352 | 264 | 0.31 | 0.06 | 142 | 0.33 |

| incl. | 96 | 140 | 44 | 0.52 | 0.10 | 151 | 0.54 |

| incl. | 144 | 170 | 26 | 0.32 | 0.07 | 119 | 0.34 |

| incl. | 184 | 220 | 36 | 0.39 | 0.08 | 131 | 0.41 |

| incl. | 232 | 250 | 18 | 0.28 | 0.05 | 75 | 0.29 |

| incl. | 272 | 298 | 26 | 0.34 | 0.07 | 175 | 0.37 |

Note: Apart from the summary intersections (from 26-262.7m in GBY006 and 88-352m in GBY007) the grade intersections are calculated over intervals >0.2% Cu with maximum internal dilution of 10m @ 0.05% Cu and a minimum interval width of 10m. CuEq (%) grades have been calculated using recoveries from metallurgical test work undertaken in 2006 on drill core from the project, which are 90% for copper, 65% for gold and 50% for cobalt. Metal prices utilised were US$4.10/lb copper, US$1,965.80/oz gold and US$15.84/lb cobalt (based on 30 March 2023 closing spot prices).

Drill hole discussion: GBY006 and GBY007

The presence of an approximately 130m-wide NNW-trending sub-vertical mineralized envelope has been interpreted at the Gaby target. It has now been intersected in four drill holes (RCH-LH-07, GBY001, GBY006 and GBY007) on four drill sections over a 650m strike length. Together with thinner, but consistent intersections on the southern end of the zone (RCH-LH-03, RCH-LH-09 and RCH-LH-11) this provides a known strike length of 1km. The mineralization is typically present from the base of thin gravel cover that ranges in thickness from 0 to 76m.

Details of the two new drill holes reported here are as follows:

- Drill hole GBY006 was drilled approximately 250m to the north of GBY001 (268m @ 0.66% Cu, 0.14 g/t Au) to a depth of 262.7m on section 4520N. After penetrating 76m of gravel cover it immediately encountered mineralized strongly faulted, veined and locally brecciated andesite with significant magnetite-dominated IOCG alteration. The mineralization was near continuous in the range of 0.1-0.4% Cu, with occasional 2m intervals up to a maximum of 1.48% Cu and 0.33 g/t Au, to the end of hole at 262.7m. It included a zone of higher-grade mineralization near the bottom of the hole of 26m @ 0.51% Cu, 0.10 g/t Au (0.57% CuEq) from 228-254m. The hole stopped in mineralization with the final 10.7m of the hole averaging 0.39% copper.

- Drill hole GBY007 was located a further 280m north on section 4800N and completed at a depth of 365.85m. It penetrated 68m of gravel cover before intersecting mineralized andesite. The IOCG alteration, faulting, veining and local brecciation was similar to that encountered in GBY006. The lower portion of the hole included several thick (10-20cm) veins of hematite+chalcopyrite, one of which recorded a single 1m interval of 1.94% Cu, 0.18 g/t Au. The highest grade interval of 44m @ 0.52% Cu, 0.10 g/t Au (0.55% CuEq) was located 28m below the base of cover from 96-140m.

The holes reported here were drilled at an angle of 60°, such that if the body is vertical as interpreted the true thickness will be approximately half of the downhole thickness.

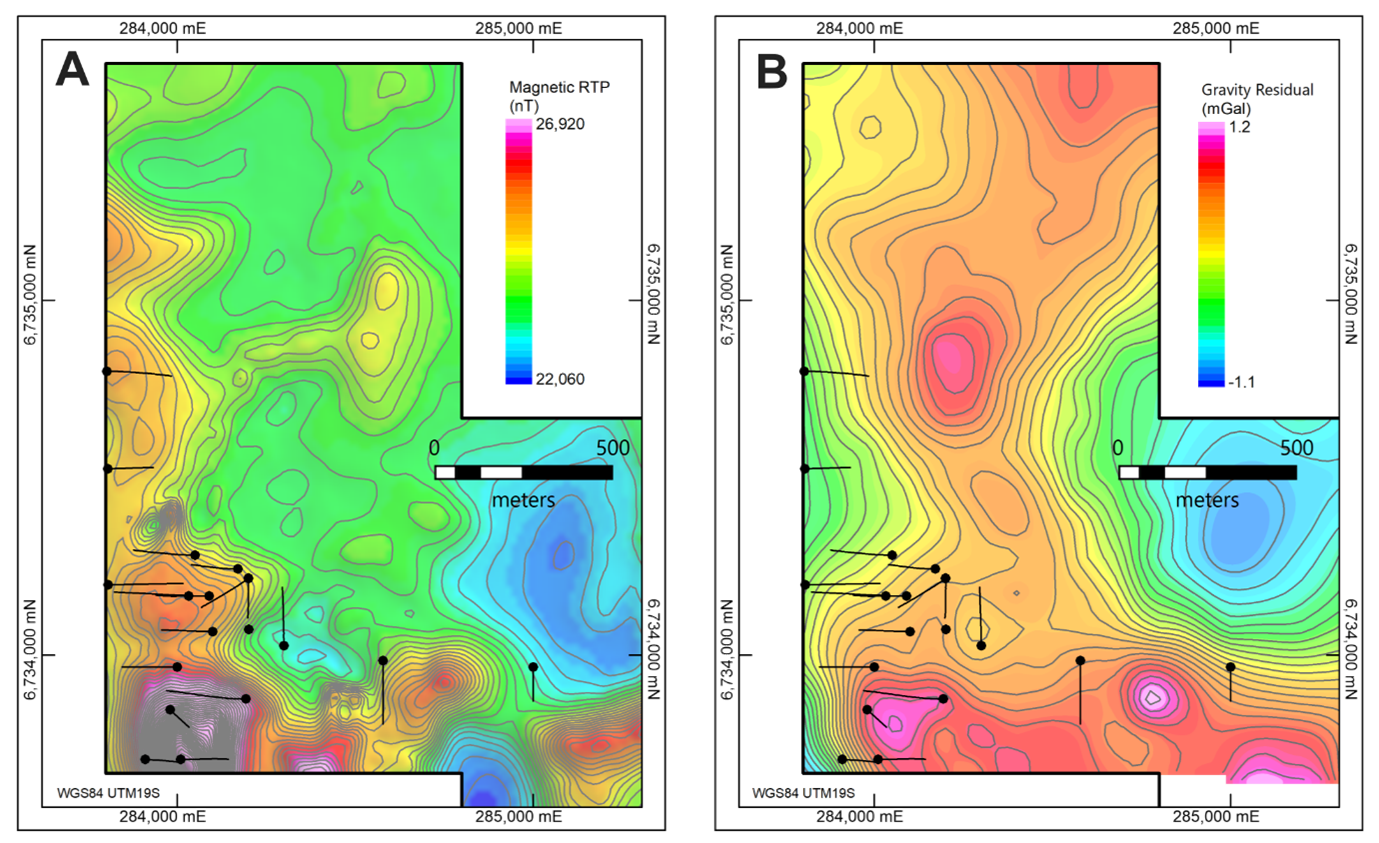

Geophysical Data

Figure 2 provides an overview of the gravity and additional ground magnetic data collected in Q4 2022 at the Gaby target. The interpretation of magnetic susceptibility data conducted on the project has yielded valuable insights, and the magnetite-associated mineralization drilled to date shows a strong spatial correlation with moderate intensity magnetic anomalism (approximately 1000 nT). The moderate magnetic trend continues to at least 400m north of drill hole GBY007.

A strong gravity anomaly of approximately 1 mGal intensity is present 400m to the east of drill hole GBY007, and is coincident with a small copper showing on sporadic outcrop. This provides an additional significant exploration target.

A. reduced-to-pole (RTP) ground magnetic data, and

B. gravity (bouguer) residual data. Contour intervals of 200nT and 0.1mGal for the magnetic and gravity data, respectively. The black outline is the mineral licence boundary, and the drilling to date, including by the previous operator, is shown.

Next Steps

- Complete drill core logging and receive all assays results from the Phase I program, and revise the 3D geological model.

- Analyze and integrate the geophysical data received as part of the Phase 1 program

- Select targets for detailed geological mapping, surface geochemistry, and/or further geophysical surveying from the five current targets at the La Higuera project

- Develop the Phase 2 work program

Notes on sampling and assaying

Analytical samples were collected using 1/8 of the material from each 2m interval for the reverse circulation drilling or ½ HQ core for the diamond drilling and sent to the ALS Laboratory in La Serena, Chile for preparation and then to ALS in Santiago, Chile and Lima, Peru for analysis. Preparation included crushing the RC and core samples to 70% < 2mm and pulverizing 1000g of crushed material to better than 85% < 75 microns. All samples are assayed using 30g nominal weight fire assay with AAS finish (Au-AA23) and a multi-element four acid digest ICP-AES method (ME-ICP61). Where the ME-ICP61 results were greater than 10,000 ppm Cu the assays were repeated with an ore grade four acid digest method (Cu-OG62). The QA/QC procedure for this drilling program utilizes field duplicates, certified reference standards and blanks that comprise approximately 10% of the total samples submitted. The QA/QC results indicate appropriate accuracy and precision in the assaying program.

Qualified Person

All scientific and technical information in this press release has been prepared by, or approved by, Dr. Paul Gow, who is the CEO of Tribeca Resources. He is a Member of the Australian Institute of Geoscientists (MAIG), a Member of the Australasian Institute of Mining and Metallurgy (MAusIMM) and a qualified person for the purposes of NI 43-101. Dr. Gow has not verified any of the information regarding any of the properties or projects referred to herein other than the La Higuera IOCG Property. Mineralization on any other properties referred to herein is not necessarily indicative of mineralization on the La Higuera IOCG Property.

About Tribeca Resources

Tribeca Resources is a copper exploration company focused on discovering and developing assets in the Coastal IOCG Belt of northern Chile. The company’s management team, whose members are significant shareholders of the Company, has world-leading expertise and a discovery history with iron oxide copper-gold deposits in the world’s great IOCG Belts of the Carajás district in Brazil and the Gawler and Cloncurry provinces of Australia.

Tribeca Resources’ objective is to provide the mineral resources for the next generation of copper mines in Chile. It is focused on building a portfolio of projects, with emphasis on mid to advanced-stage copper exploration and resource development projects. To this end, mineral targets are regularly assessed in pursuit of acquisition, strategic exploration and significant discovery.

Tribeca’s flagship property is the La Higuera IOCG project that comprises 4,047 hectares of granted mining and exploration licences and is located towards the southern end of the Chilean Coastal IOCG Belt in the Coquimbo Region of northern Chile. The 822 hectare Gaby concession area is held under a purchase option (5% Exploration Levy on expenditure incurred during the option period; a US$2 million final payment due March 2024; with a 1% NSR Royalty granted to the owner), with the remainder of the concessions being outright owned (100%) by Tribeca Resources. Further information about the project can be found in the NI 43-101 Technical Report lodged by Tribeca on SEDAR on 24 October 2022.

On behalf of Tribeca Resources Corporation

| Paul Gow | Thomas Schmidt | |

| CEO and Director | President and Director | |

| admin@tribecaresources.com | admin@tribecaresources.com | |

| +1 604 685 9316 | +1 604 685 9316 |

Cautionary Note

Neither the TSX Venture Exchange Inc. nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange Inc.) accepts responsibility for the adequacy or accuracy of this press release.

FORWARD LOOKING INFORMATION

This press release contains forward-looking statements and information that are based on the beliefs of management and reflect the Company's current expectations. When used in this press release, the words "estimate", "project", "belief", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information in this press release include information relating to the drilling program, the ability of the Company to develop and define a suitable resource at the Project and the relationship between geophysical survey results and potential mineralization.

Such statements and information reflect the current view of the Company. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: new laws or regulations could adversely affect the business and results of operations of the Company and anticipated work on the Project.

There are several important factors that could cause the Company’s actual results to differ materially from those indicated or implied by forward-looking statements and information. Such factors include, among others: reliance on key management; changes in the credit or security markets; results of operation activities; unanticipated costs and expenses; fluctuations in commodity prices; and general market and industry conditions. The Company cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.