15 DECEMBER, 2025 | VANCOUVER, BC

Tribeca Resources Provides Update on Activities Across its Expanded Chilean Copper Exploration Portfolio

Tribeca Resources Corporation (TSXV: TRBC) (OTCQB: TRRCF) (“Tribeca Resources”, the “Company”) is pleased to report that fieldwork has commenced on the Company’s Jiguata property in the Tarapacá region of northern Chile (the “Jiguata Property”). This follows the recent signing of a 5-year purchase option agreement (the “Jiguata Option Agreement”) and successful completion of a C$6.5 million financing as more fully described in the Company’s news releases dated October 29, 2025 and October 23, 2025, respectively.

Highlights:

- Field crews mobilized to the Jiguata porphyry copper-molybdenum property to commence mapping and sampling

- Global Ore Discovery, a highly experienced geological consultancy, engaged to deliver expert guidance on exploration activities and drill targeting at the Jiguata Property. Known for innovative, pragmatic, and leading-edge exploration solutions and technologies to optimise exploration success

- Historic Jiguata induced polarization (“IP”) geophysical data has been reprocessed and ground magnetic data acquisition planned to commence in second half of December

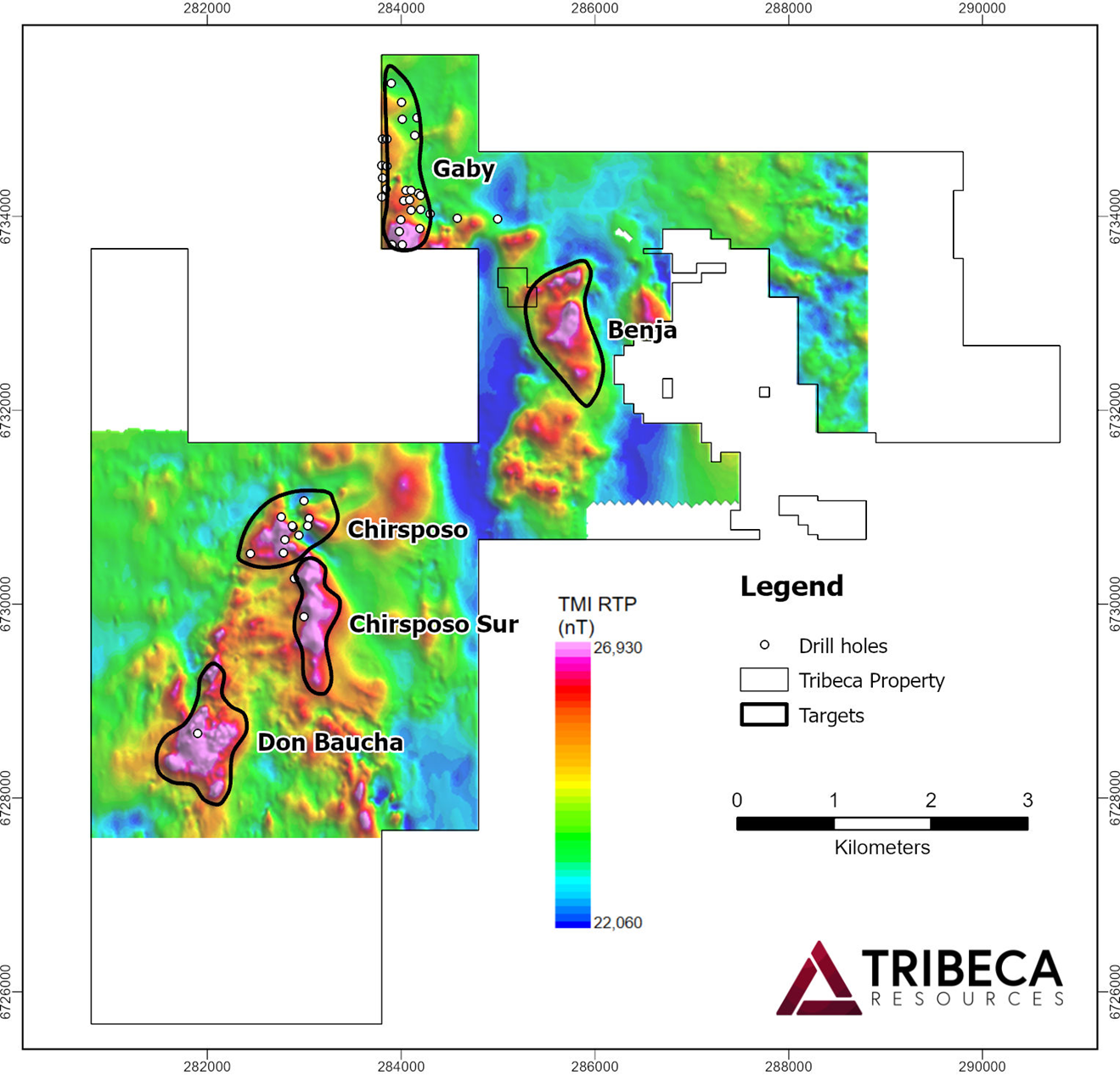

- Phase 3 drill program planned at La Higuera IOCG Project (as defined below), commencing with an initial three holes for approximately 1,000 metres at the Chirsposo Sur Target (as defined below) in Q1 2026, prior to further drilling at the Gaby target

Tribeca Resources CEO, Dr. Paul Gow commented:

“Following signing of the definitive purchase option agreement in late October, Tribeca Resources, has now mobilised field teams to the Jiguata porphyry copper-molybdenum property in northern Chile. An intensive phase of surface data acquisition over the coming months, in order to build a comprehensive geological, geochemical and geophysical picture of this very large alteration system, is now underway. We are optimistic that some compelling drill targets will emerge from this work, which we look forward to drill testing later in 2026. “

“At our cornerstone La Higuera IOCG Project in the coastal IOCG belt, we are planning to initially drill the Chirsposo Sur Target in Q1 2026. This target is entirely covered by shallow gravels, has not previously been drilled by Tribeca Resources, and has a geophysical footprint with strong similarities to our Gaby IOCG discovery, four kilometers to the north. The objective at the Chirsposo Sur Target is to intersect similar breccia-hosted copper-gold mineralization to that encountered over significant widths at Gaby.”

Jiguata Porphyry Copper-Molybdenum Property

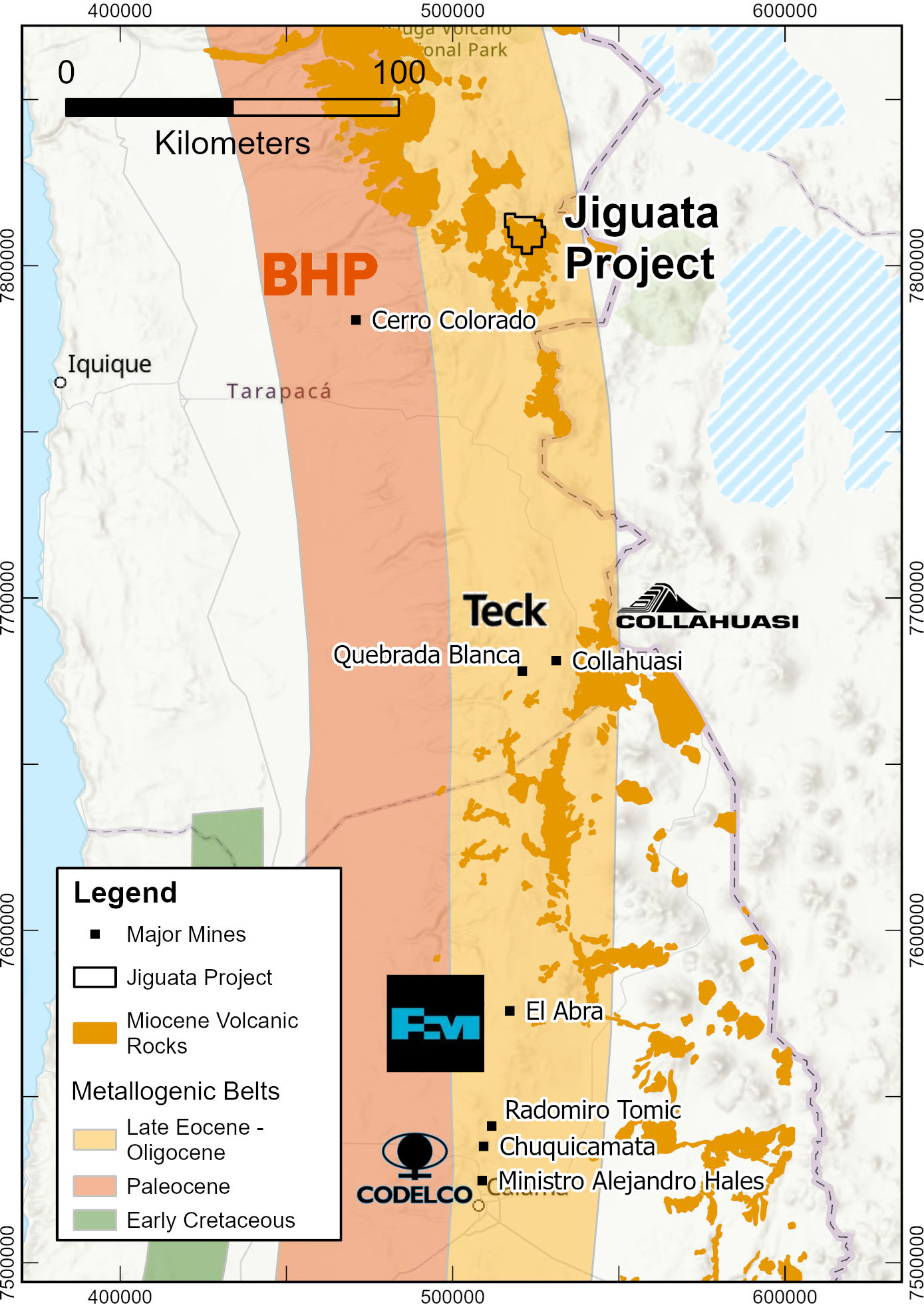

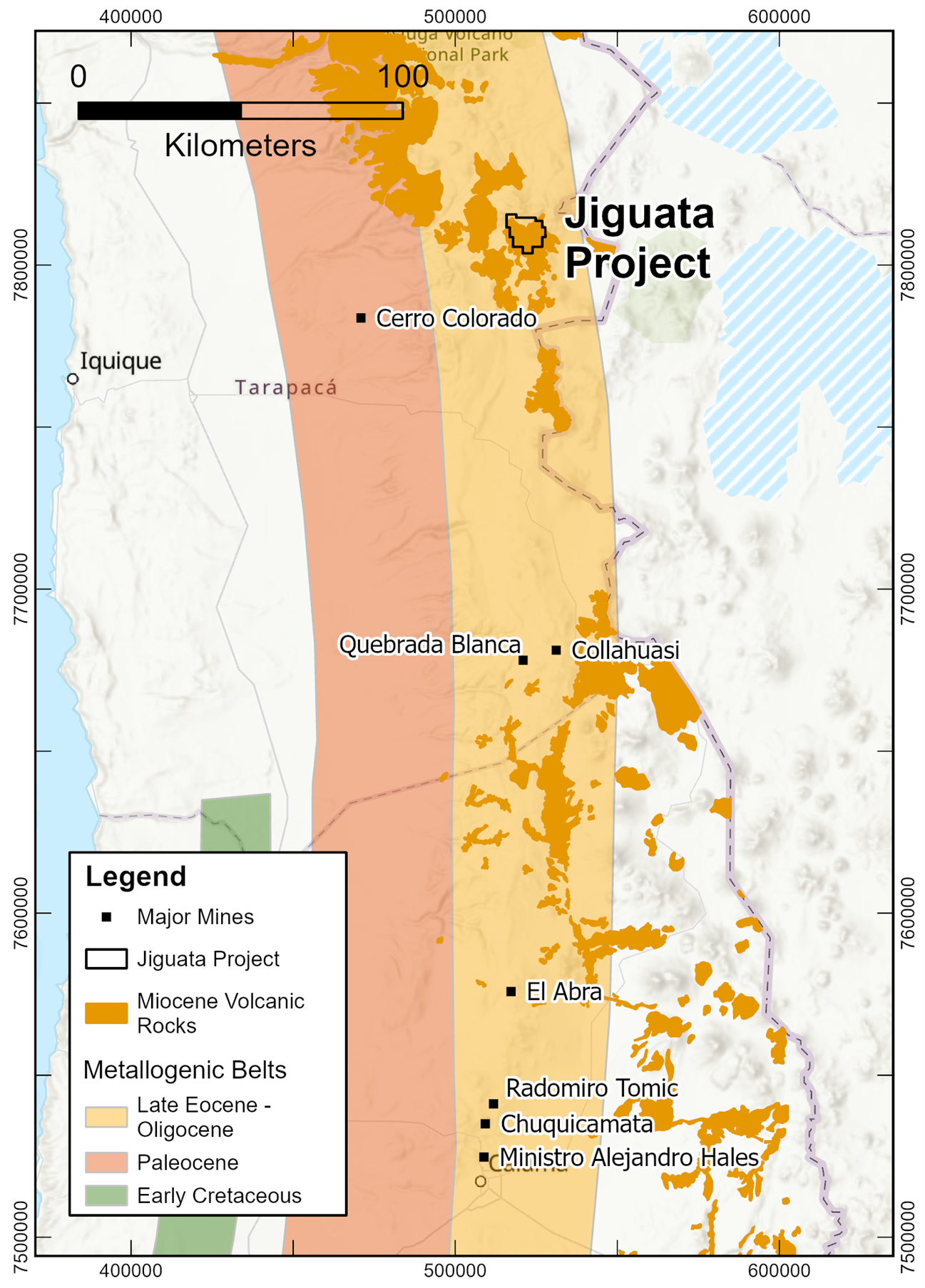

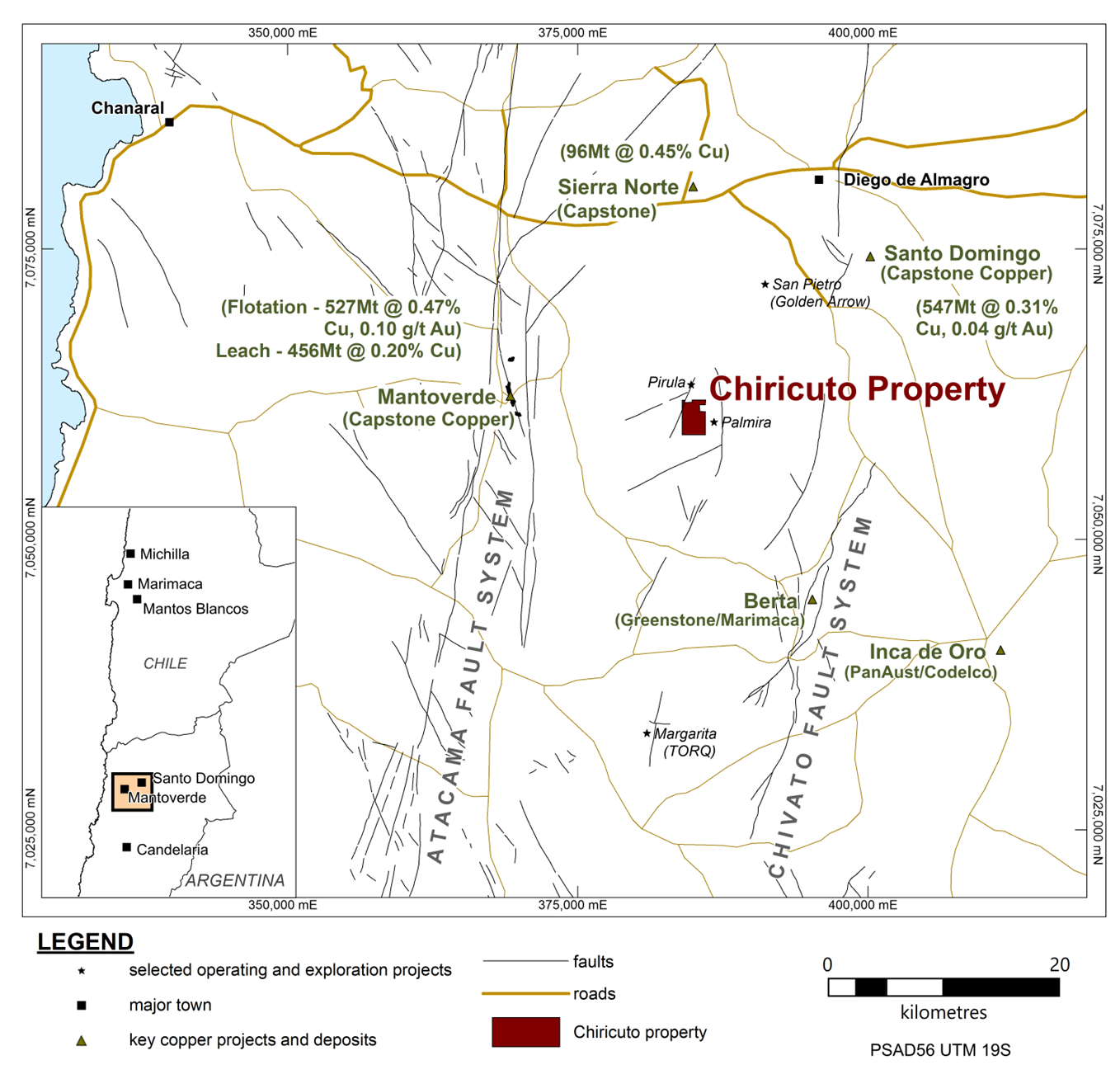

The Jiguata Property is a 10,000 hectare property located in the Tarapacá region in northern Chile. It is situated in the northern extension of the prolific Eocene-Oligocene porphyry copper belt of northern Chile, approximately 120km north of the Collahuasi and Quebrada Blanca copper-molybdenum deposits (Figure 1). Access to the area is via a maintained road that passes directly through the property.

Pre-existing geological mapping, soil and rock geochemistry, IP surveying and limited historic drill data outline several drill targets, with additional earlier stage targets elsewhere on the property remaining to be detailed with the additional field work currently underway. Further information about the property is available in Tribeca Resources’ news release dated June 19, 2025.

Field teams have commenced geological mapping and systematic soil and mapping-based selective rock chip sampling programs. The sampling is proposed to provide a comprehensive multielement geochemistry and hyperspectral database to aid in definition of vectors to copper mineralization within the extensive zones of intense epithermal alteration present in the area. In addition, acquisition and processing of detailed satellite hyperspectral imagery is underway to assist in detailing mineralogical zonation within the large alteration system.

Global Ore Discovery Pty Ltd (“GO”), a highly experienced geological consultancy, has been engaged to deliver expert guidance on exploration activities and drill targeting at the Jiguata Property. The GO team has experience working with companies exploring for porphyry and epithermal deposits, including Tier 1 mining companies and successful junior mining issuers throughout the world.

GO and its principals have extensive experience in many of the world’s premier porphyry and epithermal belts in the Americas, Australasia, and Central Asia where GO has a track record of directly contributing to a number of new discoveries and expanding deposit knowledge to guide focused exploration. Within the Chilean-Argentine porphyry and epithermal belts, GO has detailed knowledge of the Maricunga, Vicuña, Domeyko, and Alumbrera-Agua Rica districts.

Ground magnetic surveying is currently scheduled for commencement in the second half of December. The program will cover most of the 10,000-hectare property area at approximately 200m line spacing.

The historic IP geophysical database has been reprocessed. The historic surveying in 2013 comprised 1km-spaced lines of 8km length (150m pole-dipole) to cover approximately 40 square kilometres. A 3D inversion of this data has been completed and has more confidently constrained the location of the significant IP chargeability anomalies in the area, as well as providing a coherent model of the IP resistivity distribution. This 3D model will be integrated with the mapping, geochemistry and magnetic data as field acquisition progresses.

The data acquisition from the field activities outlined above is anticipated to continue through the period December 2025 to March 2026, with the time required dependent on the duration of any interruptions required due to adverse weather associated with the ‘Bolivian Winter’. Following this ground acquisition, data will be integrated and drill targets defined. Depending on progress of these pre-drilling field activities, drill testing of targets is envisaged to be undertaken in Q2 or Q3 of 2026.

La Higuera IOCG Project

The La Higuera project is located towards the southern end of the Chilean coastal iron-oxide copper-gold (“IOCG”) belt in the Coquimbo Region of Chile, and comprises 41 mining and five exploration licences for 4,547 hectares (the “La Higuera IOCG Project”). It hosts multiple copper-gold targets, two of which have to date been drilled by Tribeca Resources. At the Gaby target, Tribeca Resources has drilled 17 holes, with mineralization identified over a 1.5km strike length, with a best intersection of 268m @ 0.66% Cu, 0.14 g/t Au, 330ppm Co and 24.7% Fe from 52m in drill hole GBY001 (see Tribeca Resources’ news release dated January 30, 2023). Drilling has also been completed at the Chirsposo target, with a best result from two drill holes of 167m @ 0.21% Cu, 0.06 g/t Au from 56m in hole CHS002 (see Tribeca Resources’ news release dated May 17, 2023) (the “Chirsposo Sur Target”).

Drilling has been planned at the Chirsposo Sur Target, which is an interpreted strong hydrothermal magnetite alteration system under thin gravel cover in the southern project area. Inversion of the ground magnetic data indicates the system comprises a steeply-dipping north-south oriented magnetite alteration system of 1.2 km strike length. It is interpreted as hosted within a strand of the Atacama Fault System, which is intensely-developed in this area and cross-cut by several northwest-trending faults. The interpreted body is also coincident with an intense (>30 mV/V) north-south IP chargeability trend that stretches over 2.4km, with the main Chirsposo Sur Target at its northern end where Tribeca Resources drilled significant mineralization (see above). The program is proposed to comprise three holes over the 1.2 km strike length of the most intense magnetic body for a total of approximately 1000m of drilling. Plans for further drilling at the Gaby discovery thereafter are being drawn up.

Two historic vertical diamond holes at the Chirsposo Sur Target, drilled approximately 200m to the west of the body intersected IOCG-style alteration with weak copper mineralisation (8m @ 0.23% Cu from 38m in hole CB-02), and demonstrate strong magnetite alteration with a coarse-grained pyrite-dominated sulphide assemblage similar to the late-stage Association 2 mineralization at the Gaby discovery 4 km to the north (see Tribeca Resources’ news release dated February 6, 2024).

Qualified Person

All scientific and technical information in this press release has been prepared by, or approved by, Dr. Paul Gow, who is the CEO of Tribeca Resources. He is a Member of the Australian Institute of Geoscientists (MAIG), a Member of the Australasian Institute of Mining and Metallurgy (MAusIMM) and a qualified person for the purposes of National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). Dr. Gow has not verified any of the information regarding any of the properties or projects referred to herein other than the La Higuera IOCG Project, the Jiguata Property and the Chiricuto property. Mineralization on any other properties referred to herein is not necessarily indicative of mineralization on the La Higuera IOCG Project, the Jiguata Property and the Chiricuto property.

About Tribeca Resources

Tribeca Resources is a copper exploration company focused on discovering and developing assets in the coastal IOCG belt of northern Chile. The Company’s management team, whose members are significant shareholders of the Company, has world-leading expertise and a discovery history with iron oxide copper-gold deposits in the world’s great IOCG Belts of the Carajás district in Brazil and the Gawler and Cloncurry provinces of Australia.

Tribeca Resources’ objective is to provide the mineral resources for the next generation of copper mines in Chile. It is focused on building a portfolio of projects, with emphasis on mid to advanced-stage copper exploration and resource development projects. To this end, mineral targets are regularly assessed in pursuit of acquisition, strategic exploration and significant discovery.

Tribeca Resources’ portfolio comprises three early- to advanced-stage exploration projects in northern Chile. The flagship La Higuera IOCG Project has seen approximately 10,000m of drilling with mineralization defined over a 1.4 kilometer strike length. The Chiricuto and Jiguata projects are earlier stage porphyry copper-gold-molybdenum targets, held under purchase option agreements.

On behalf of Tribeca Resources Corporation

| Paul Gow | Thomas Schmidt | |

| CEO and Director | President and Director | |

| admin@tribecaresources.com | admin@tribecaresources.com | |

| +1 604 685 9316 | +1 604 685 9316 |

Cautionary Note

Neither the TSX Venture Exchange Inc. nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange Inc.) accepts responsibility for the adequacy or accuracy of this press release.

This press release does not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in the United States. The securities referred to herein have not been and will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), or with any securities regulatory authority of any state or other jurisdiction in the United States, and may not be offered or sold, directly or indirectly, within the United States or to, or for the account or benefit of, U.S. persons, as such term is defined in Regulation S under the Securities Act (“Regulation S”), except pursuant to an exemption from or in a transaction not subject to the registration requirements of the Securities Act.

Forward Looking Information

This press release contains forward-looking statements and information that are based on the beliefs of management and reflect the Company's current expectations. When used in this press release, the words "estimate", "project", "belief", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information in this press release include statements regarding the relationship between geophysical and geochemical survey results and potential mineralization, the size and timing of the proposed 2026 drill programs, the integration of new and historic data to define drill targets, the anticipated commencement and completion of ground magnetic surveying and other field activities (including the potential for weather-related delays), the ongoing engagement of GO and its impact on exploration outcomes, the use of proceeds from recently completed financings, the ability to secure and maintain necessary permits and approvals and the operations and future plans of the Company, including potential additional drilling and property acquisitions.

Such statements and information reflect the current view of the Company. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the ability of the Company to pay the purchase price and make any other payments required under the Jiguata Option Agreement, as well as to complete its option to acquire the Gaby target, risks associated with mineral exploration, including the risk that actual results of exploration will be different from those expected by management, risks of delays or interruptions to exploration activities due to weather, logistical or access issues, risks related to obtaining and maintaining necessary permits and approvals, risks related to the availability and retention of key personnel, the ability to raise additional capital, fluctuations in commodity prices and market conditions, the reliability of historic or third-party data, unanticipated costs or environmental liabilities and the risk that new laws or regulations could adversely affect the business and results of operations of the Company and anticipated work on the Company’s projects.

There are several important factors that could cause the Company’s actual results to differ materially from those indicated or implied by forward-looking statements and information. Such factors include, among others: reliance on key management; changes in the credit or security markets; results of operation activities; unanticipated costs and expenses; fluctuations in commodity prices; and general market and industry conditions. The Company cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

The Company has assumed that the material factors referred to in the previous paragraph will not cause such forward-looking statements and information to differ materially from actual results or events. The forward-looking information contained in this press release represents the expectations of the Company as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While the Company may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

29 OCTOBER, 2025 | VANCOUVER, BC

Tribeca Resources Signs Definitive Option Agreement to Acquire the Jiguata Porphyry Copper Property in Northern Chile

Tribeca Resources Corporation (TSXV: TRBC) (OTCQB: TRRCF) (“Tribeca Resources” or the “Company”) is pleased to announce that, further to the Company's news release dated June 19, 2025, it has entered into a definitive option agreement dated October 28, 2025 (“Option Agreement”) with private arm’s length vendors (the “Project Vendors”) to acquire a 100% interest in the 10,000 hectare Jiguata Porphyry Copper property (the “Jiguata Property”) over a period of 5 years (the “Purchase Option”).

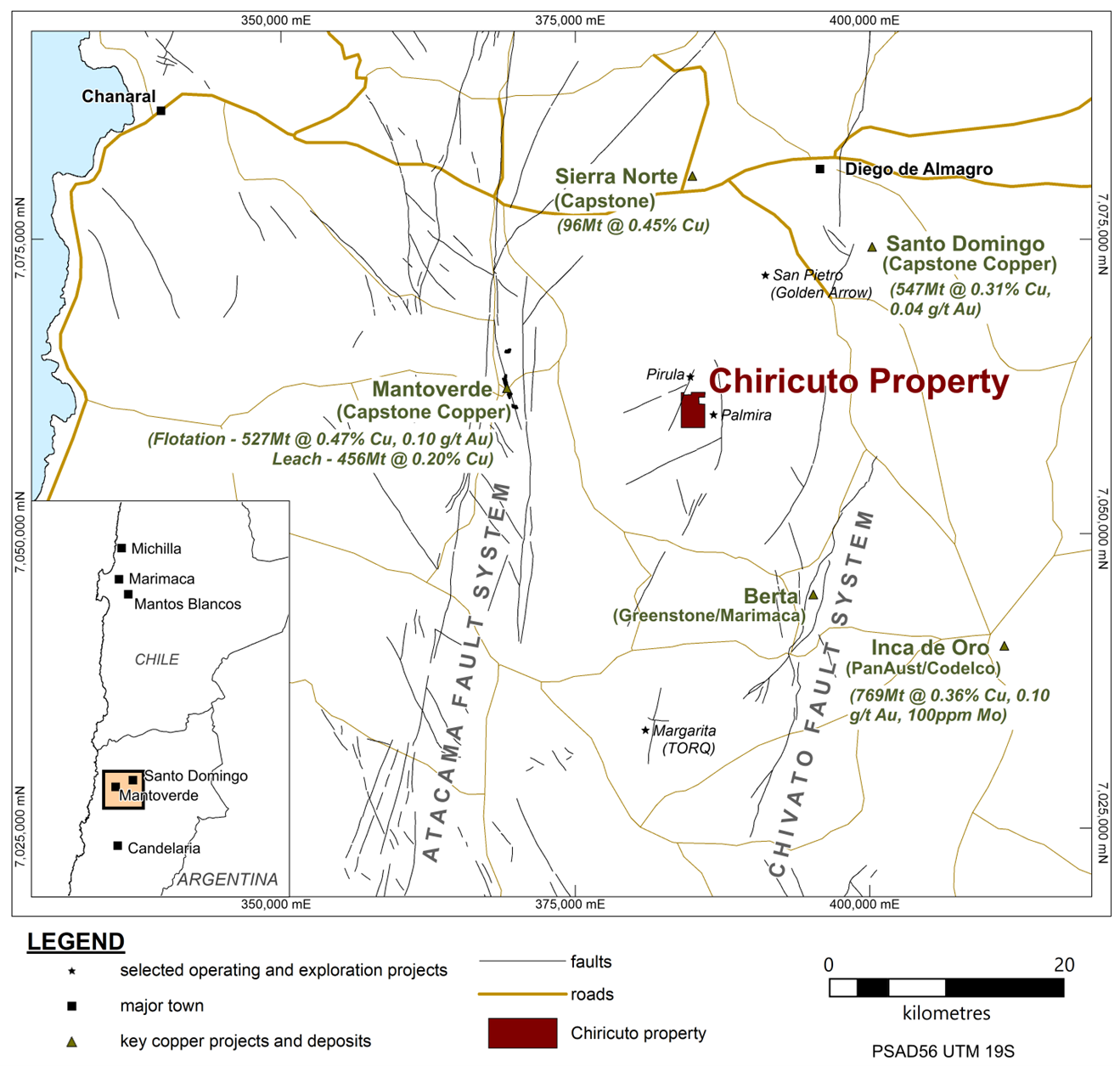

The Jiguata Property, located in northern Chile, 120km north of the major mining company controlled Collahuasi and Quebrada Blanca mines (Figure 1), will be progressed in parallel with the Company’s two existing projects: La Higuera (the “La Higuera Property”) and Chiricuto (the “Chiricuto Property”), both located in the Chilean Coastal IOCG Belt.

Highlights:

- Large epithermal and interpreted porphyry alteration system in the northern extension of the prolific Chilean porphyry-bearing Eocene-Oligocene Belt, with partial overprint and cover by younger Miocene age rocks

- Drive-up access via paved Collahuasi road, nearby accommodation and associated infrastructure

- Soil sampling, historic drilling, geological mapping and geophysics highlight a large 5km x 3km exploration target zone, with two existing discrete near drill-ready targets

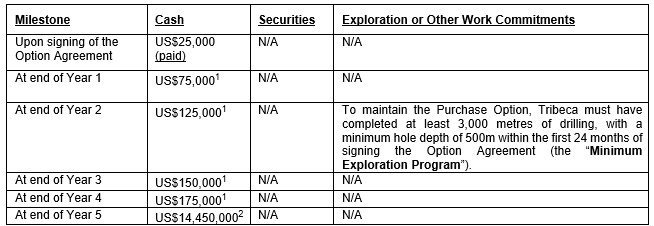

- Under the Option Agreement, during the first two years, Tribeca will make staged cash payments totalling US$ 100,000 and undertake a minimum of 3,000 meters of drilling

- Pre-drilling activities at the Jiguata Property will be undertaken in parallel with further drilling at the Company’s flagship La Higuera Property

Tribeca Resources CEO, Dr. Paul Gow commented:

“We are very pleased to have now signed the definitive Option Agreement for this exciting porphyry copper exploration opportunity at Jiguata. Following the successful financing last week, preparations now are underway to commence fieldwork at Jiguata in the coming weeks.”

“The next twelve months will be a period of high activity for Tribeca, with drilling planned at our cornerstone La Higuera Property as well as at the Jiguata Property. Our now expanded portfolio of three high potential Chilean copper projects positions Tribeca Resources to capitalise on growing interest in quality copper exploration.”

The Jiguata Property option agreement

Tribeca has entered into a 5-year Option Agreement, giving it the right, but not the obligation, to acquire a 100% interest in the Jiguata Property. Tribeca has made a payment to the vendors of US$25,000 in connection with signing of the definitive Option Agreement, and will reimburse the Project Vendors approximately US$44,000 for the 2025 licence fee already paid by them. Under the terms of the Option Agreement, the total consideration and required work commitments, as applicable, will be as follows on a yearly basis:

Upon exercise of the Purchase Option (which remains at the sole discretion of the Company), the Project Vendors will retain a 2.0% net smelter return royalty (the “NSR Royalty”) over the Jiguata Property. Tribeca will have a right to repurchase 100% of the NSR royalty for US$20 million.

For more information regarding the terms of the Option Agreement, please see the Company’s press release dated June 19, 2025.

The Jiguata Property (see Figure 1 below) comprises 34 exploration concessions covering 10,000 hectares and is located in the northern extension of the Eocene-Oligocene metallogenic belt of northern Chile (Figure 1), where it has been overprinted by the Miocene magmatic belt. The prolific Eocene-Oligocene Belt hosts the giant Collahuasi, Chuquicamata and Escondida deposits.

The project area encompasses a large advanced argillic alteration zone (25 square km) hosted within a volcanic tuffaceous unit under a thin blanketing cover of fresh unaltered Miocene dacitic volcanic rocks dated at approximately 9-5 Ma. The alteration zone has been exposed via erosional windows in the overlying Miocene volcanic rocks.

Tribeca Resources plans to extend the historic mapping and surface sampling and undertake additional geophysics prior to proceeding with drilling at the Jiguata Property. Tribeca Resources will be the operator of the project.

Tribeca confirms that there are no finder’s fees payable in connection with the entering into of the Option Agreement. The Company’s entry into the Option Agreement and any future acquisition within the Jiguata Property remains subject to the approval of the TSX Venture Exchange (the “TSXV”).

Finder’s Fee in Connection with the Company’s Non-Brokered Private Placement Offering

In connection with the closing of the Company’s non-brokered private placement offering of units further described in its news release dated October 23, 2025 (the “Offering”), the Company previously announced that it had paid an aggregate of approximately $248,694 and issued finder’s warrants to acquire up to an aggregate of 1,184,257 common shares of the Company (the “Finder’s Warrants”) as finder’s fees to certain eligible finders in consideration for introducing certain purchasers to the Company. The Company wishes to clarify that it has also paid an additional $3,717 and issued an additional 17,700 Finder’s Warrants as finder’s fees to certain eligible finders. As a result, the Company paid an aggregate of approximately $252,411 and issued an aggregate of 1,201,957 Finder’s Warrants to eligible finders in connection with the Offering.

Qualified Person

All scientific and technical information in this press release has been prepared by, or approved by, Dr. Paul Gow, who is the CEO of Tribeca Resources. He is a Member of the Australian Institute of Geoscientists (MAIG), a Member of the Australasian Institute of Mining and Metallurgy (MAusIMM) and a qualified person for the purposes of NI 43-101. Dr. Gow has not verified any of the information regarding any of the properties or projects referred to herein other than the La Higuera Property, the Chiricuto Property and the Jiguata Property. Mineralization on any other properties referred to herein is not necessarily indicative of mineralization on the La Higuera, Chiricuto or Jiguata Properties.

About Tribeca Resources

Tribeca Resources is a copper exploration company focused on discovering and developing assets in the Coastal IOCG Belt of northern Chile. The Company’s management team, whose members are significant shareholders of the Company, has world-leading expertise and a discovery history with iron oxide copper-gold deposits in the world’s great IOCG Belts of the Carajás district in Brazil and the Gawler and Cloncurry provinces of Australia.

Tribeca Resources’ objective is to provide the mineral resources for the next generation of copper mines in Chile. It is focused on building a portfolio of projects, with emphasis on mid to advanced-stage copper exploration and resource development projects. To this end, mineral targets are regularly assessed in pursuit of acquisition, strategic exploration and significant discovery.

Tribeca Resources’ flagship property is the La Higuera Property that comprises 4,147 hectares of granted mining and exploration licences and is located towards the southern end of the Chilean Coastal IOCG Belt in the Coquimbo Region of northern Chile. Further information about the project can be found in the NI 43-101 Technical Report lodged by Tribeca Resources on SEDAR on 24 October 2022.

On behalf of Tribeca Resources Corporation

| Paul Gow | Thomas Schmidt | |

| CEO and Director | President and Director | |

| admin@tribecaresources.com | admin@tribecaresources.com | |

| +1 604 685 9316 | +1 604 685 9316 |

Cautionary Note

Neither the TSX Venture Exchange Inc. nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange Inc.) accepts responsibility for the adequacy or accuracy of this press release.

This press release does not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in the United States. The securities referred to herein have not been and will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), or with any securities regulatory authority of any state or other jurisdiction in the United States, and may not be offered or sold, directly or indirectly, within the United States or to, or for the account or benefit of, U.S. persons, as such term is defined in Regulation S under the Securities Act (“Regulation S”), except pursuant to an exemption from or in a transaction not subject to the registration requirements of the Securities Act.

Forward Looking Information

This press release contains forward-looking statements and information that are based on the beliefs of management and reflect the Company's current expectations. When used in this press release, the words "estimate", "project", "belief", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information contained in this press release include statements regarding the Option Agreement in respect of the Jiguata Property, the ability to obtain TSXV approval in respect of the Option Agreement and the Offering, the ability of the Company to develop and define suitable drill targets at the Jiguata and La Higuera Properties, the relationship between geophysical survey results and potential mineralization, the ability of the Company to raise appropriate funding to complete the work program at the Jiguata and La Higuera Properties and other future plans and objectives of the Company, including other exploration projects.

Such statements and information reflect the current view of the Company. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others,: the ability of the Company to obtain TSXV approval in respect of the Option Agreement and the Offering, the ability of the Company to pay the purchase price as well as any other payments required by the Option Agreement, the risks associated with mineral exploration, including the risk that actual results of exploration will be different from those expected by management, and the risk that new laws or regulations could adversely affect the business and results of operations of the Company and the anticipated work performed on the Company’s projects.

There are several important factors that could cause the Company’s actual results to differ materially from those indicated or implied by forward-looking statements and information. Such factors include, among others: reliance on key management; changes in the credit or security markets; results of operation activities; unanticipated costs and expenses; fluctuations in commodity prices; and general market and industry conditions. The Company cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

The Company has assumed that the material factors referred to in the previous paragraph will not cause such forward-looking statements and information to differ materially from actual results or events. The forward-looking information contained in this press release represents the expectations of the Company as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While the Company may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

23 OCTOBER, 2025 | VANCOUVER, BC

Tribeca Resources Closes Upsized C$6.5 Million Non-Brokered Private Placement Offering

Tribeca Resources Corporation (TSXV: TRBC) (OTCQB: TRRCF) (“Tribeca Resources” or the “Company”) is pleased to announce that it has closed its previously announced non-brokered private placement offering of units of the Company (“Units”), pursuant to which the Company issued 30,903,183 Units at a price of $0.21 per Unit for aggregate gross proceeds of $6,489,668.43 (the “Offering”).

Tribeca Resources CEO, Dr. Paul Gow commented:

"The overwhelming and global interest, which led to a significant oversubscription of this Offering, is a strong validation of our growth strategy and the exceptional potential of our growing portfolio of Chilean copper exploration assets. As well as strong support from our current shareholder base, we are extremely pleased to welcome a diverse, international group of new shareholders who share our vision for the Company.

“Closing this financing with such momentum puts us in an excellent position to pursue aggressive exploration and drilling programs with the objective of delivering for all stakeholders.”

Each Unit comprises one common share of the Company (each, a “Share”) and one-half of one common share purchase warrant (each whole warrant, a “Warrant”). Each Warrant is exercisable by the holder thereof to acquire one additional Share (each, a “Warrant Share”, and together with the Units, Shares and Warrants, the “Securities") at an exercise price of $0.30 if exercised within the first 12 months following the Closing Date and $0.40 if exercised within the subsequent 12-month period, for a total exercise period of 24 months from the Closing Date; provided that: (i) the Warrants shall not be exercisable within the initial 60-day period following the Closing Date, and (ii) the Company will have the right to accelerate the expiry of the Warrants in the event the Shares trade on the TSX Venture Exchange (the “TSXV”) (or any such other stock exchange in Canada as the Shares may trade at the applicable time) at a volume weighted average trading price ("VWAP") of $0.50 or more per Share for a ten (10) consecutive trading day period.

The Units issued under the Offering were offered to purchasers pursuant to the listed issuer financing exemption (LIFE) under Part 5A of National Instrument 45-106 – Prospectus Exemptions and in reliance on Coordinated Blanket Order 45-935 – Exemptions from Certain Conditions of the Listed Issuer Financing Exemption and therefore the Securities issued under the Offering are not subject to a hold period pursuant to applicable Canadian securities laws. There is an amended and restated offering document (the “Offering Document”) related to this Offering that can be accessed under the Company’s profile at www.sedarplus.ca and on the Company’s website at www.tribecaresources.com.

The proceeds from the Offering will be primarily used to advance the Company’s La Higuera IOCG project (the “La Higuera Project”), with additional funds allocated to the planned initial exploration and drilling activities at the exciting new Jiguata Project. The Jiguata Purchase Option (as defined below) remains under review by the TSXV and there is no certainty that the Company will obtain the necessary regulatory approvals, including approval of the TSXV, in respect of the Jiguata Purchase Option.

Tribeca Resources intends to use the net proceeds from the Offering as follows:

| Description of intended use of

available funds |

Estimated allocation of funds |

| Expenditures relating to exploration activities at the La Higuera Project(1) | $1,868,000 |

| Exploration activities at the Jiguata project (the “Jiguata Project”)(2) | $1,573,000 |

| Reserved for results-dependent follow-up drilling at the La Higuera Project / the Jiguata Project(2) | $1,331,000 |

| Business development | $181,000 |

| General and administrative | $894,000 |

| Unallocated working capital | $382,000 |

| TOTAL: | $6,229,000 |

(1) The Company does not currently intend to use the available funds to complete its option to acquire the Gaby target, as more fully described in the Offering Document (the “Gaby Acquisition”). Any decision to pursue the Gaby Acquisition is at the Company’s sole discretion and will require the Company to make a final one-time payment of US$1,550,000.00 on September 15, 2026 (the “Gaby Option Payment Date”) subject to (i) any further negotiation between the Company and the vendor party participating in the Gaby Acquisition (the “Vendor”) for the purpose of extending the Gaby Option Payment Date; and (ii) the Company obtaining additional financing (in addition to the Offering) to complete the Gaby Acquisition. The Vendor is not an insider, associate or affiliate of the Company.

(2) The Company only intends to use the part of the available funds as detailed above for exploration activities at the Jiguata Project if it obtains the necessary regulatory approvals, including approval of the TSXV, to enter into the option to purchase 100% of the Jiguata Project (the “Jiguata Purchase Option”), as more particularly set forth in the Offering Document. In the event that the Company does not obtain all necessary regulatory approvals or approval from the TSXV, the Company will use certain proceeds currently contemplated for the Jiguata Project for other purposes as set out herein and in the Offering Document. The Jiguata Purchase Option remains under review by the TSXV and there is no certainty that the Company will obtain the necessary regulatory approvals, including approval of the TSXV, in respect of the Jiguata Purchase Option. The Company confirms that it has obtained and retained all required consents from purchasers in the Offering in respect of the Jiguata Purchase Option.

In connection with the Offering, the Company paid an aggregate of approximately $248,694 and issued finder’s warrants to acquire up to an aggregate of 1,184,257 Shares (the “Finder’s Warrants”) as finder's fees to certain eligible finders in consideration for introducing certain purchasers to the Company. Each Finder’s Warrant entitles the holder to acquire one Share at a price of $0.21 per Share for a period of twenty-four months. The Finder’s Warrants, and Shares issuable upon exercise of the Finder’s Warrants, are subject to a statutory four-month hold period pursuant to applicable Canadian securities laws.

The Offering remains subject to the final approval of the TSXV.

Related Party Disclosure

Certain insiders of the Company subscribed for approximately $936,046 worth of Units in the Offering. This participation by insiders constitutes a “related party transaction” within the meaning of Multilateral Instrument 61-101 – Protection of Minority Shareholders in Special Transactions (“MI 61-101”). The Company has relied on applicable exemptions from the formal valuation and minority approval requirements in Sections 5.5(a), 5.5(b) and 5.7(1)(a), respectively, of MI 61-101. No new insiders were created, nor has there been any change of control, as a result of the Offering. The Company did not file a material change report with respect to the insiders’ participation more than 21 days before the expected closing of the Offering, as the details and amounts of the insider participation were not finalized until closer to the closing and the Company wished to close the Offering as soon as practicable for sound business reasons.

Wildeboer Dellelce LLP acted as legal counsel to Tribeca in connection with the Offering.

About Tribeca Resources

Tribeca Resources is a copper exploration company focused on discovering and developing copper assets in northern Chile. The Company’s management team, whose members are significant shareholders of the Company, has world-leading copper expertise including a discovery history with iron oxide copper-gold deposits in the world’s great IOCG Belts of the Carajás district in Brazil and the Gawler and Cloncurry provinces of Australia, and porphyry-copper project and business development experience in Papua New Guinea, the Philippines, Peru, Argentina and Chile.

Tribeca Resources’ objective is to provide the mineral resources for the next generation of copper mines in Chile. It is focused on building a portfolio of projects, with emphasis on mid to advanced-stage copper exploration and resource development projects. To this end, mineral targets are regularly assessed in pursuit of acquisition, strategic exploration and significant discovery.

Tribeca Resources’ flagship property is the La Higuera Project that comprises 4,147 hectares of granted mining and exploration licences and is located towards the southern end of the Chilean Coastal IOCG Belt in the Coquimbo Region of northern Chile. Further information about the project can be found in the NI 43-101 Technical Report lodged by Tribeca Resources on SEDAR+ on October 24, 2022.

On behalf of Tribeca Resources Corporation

Paul Gow |

Thomas Schmidt |

|

| CEO and Director | President and Director | |

| admin@tribecaresources.com | admin@tribecaresources.com | |

| +1 604 685 9316 | +1 604 685 9316 |

Cautionary Note

Neither the TSXV nor its Regulation Service Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this press release.

This press release does not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in the United States. The Securities issued pursuant to the Offering have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or with any securities regulatory authority of any state or other jurisdiction in the United States, and may not be offered or sold, directly or indirectly, within the United States or to, or for the account or benefit of, U.S. persons, as such term is defined in Regulation S under the Securities Act (“Regulation S”), except pursuant to an exemption from or in a transaction not subject to the registration requirements of the Securities Act.

Forward Looking Information

This press release contains forward-looking statements and information that are based on the beliefs of management and reflect the Company's current expectations. When used in this press release, the words "estimate", "project", "belief", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information contained in this press release may include, but are not limited to, the approval of the Offering by the TSXV, the ability of the Company to obtain the necessary regulatory approvals, including TSXV approval, to enter into the Jiguata Purchase Option, and the planned use of proceeds for the Offering.

Such statements and information reflect the current view of the Company. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the ability to obtain regulatory approval for the Offering, the ability to obtain the necessary regulatory approvals, including TSXV approval, to enter into the Jiguata Purchase Option, the state of equity markets in Canada and other jurisdictions, market prices, exploration successes, and continued availability of capital and financing and general economic, market or business conditions. Additional risks and uncertainties regarding the Company are described in its publicly-available disclosure documents, filed by the Company on SEDAR+ at www.sedarplus.com.

There are several important factors that could cause the Company’s actual results to differ materially from those indicated or implied by forward-looking statements and information. Such factors include, among others: reliance on key management; changes in the credit or security markets; results of operation activities; unanticipated costs and expenses; fluctuations in commodity prices; and general market and industry conditions. The Company cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. Factors that could cause actual results to differ materially from those anticipated in these forward-looking statements are described under the caption “Cautionary Statement Regarding Forward-Looking Information” in the Company’s Offering Document dated as of October 15, 2025, which is available for view on SEDAR+ at www.sedarplus.com.

The Company has assumed that the material factors referred to in the previous paragraph will not cause such forward-looking statements and information to differ materially from actual results or events. The forward-looking information contained in this press release represents the expectations of the Company as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While the Company may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

15 OCTOBER, 2025 | VANCOUVER, BC

Tribeca Resources Upsizes Previously Announced Non-Brokered Private Placement to C$6.5 Million and Provides Clarification Regarding Prior Announcement

Tribeca Resources Corporation (TSXV: TRBC) (OTCQB: TRRCF) (“Tribeca Resources” or the “Company”) is pleased to announce that, due to strong investor demand, it has upsized its previously announced non-brokered private placement from up to 23,809,523 units of the Company (“Units”) for aggregate gross proceeds of up to $5,000,000, to up to 30,952,380 Units for aggregate gross proceeds of up to $6,500,000, at a price of $0.21 per Unit (the “Offering”). The Offering remains subject to a minimum aggregate subscription amount of $2,000,000 (the “Minimum Offering Amount”).

Each Unit will be comprised of one common share of the Company (each, a “Share”) and one-half of one common share purchase warrant (each whole warrant, a “Warrant”). Each Warrant will be exercisable by the holder thereof to acquire one additional Share (each, a “Warrant Share”, and together with the Units, Shares and Warrants, the “Securities") at an exercise price of $0.30 if exercised within the first 12 months following the Closing Date (as defined below) and $0.40 if exercised within the subsequent 12-month period, for a total exercise period of 24 months from the Closing Date; provided that: (i) the Warrants shall not be exercisable within the initial 60-day period following the Closing Date and (ii) the Company will have the right to accelerate the expiry of the Warrants in the event the Shares trade on the TSX Venture Exchange (the “TSXV”) (or any such other stock exchange in Canada as the Shares may trade at the applicable time) at a volume weighted average trading price ("VWAP") of C$0.50 or more per Share for a ten (10) consecutive trading day period.

Subject to compliance with applicable regulatory requirements, the Offering is being completed pursuant to the listed issuer financing exemption (“LIFE”) under Part 5A of National Instrument 45-106 – Prospectus Exemptions and in reliance on the Coordinated Blanket Order 45-935 – Exemptions from Certain Conditions of the Listed Issuer Financing Exemption. The Securities issued under the Offering will not be subject to a hold period in accordance with applicable Canadian securities laws. There is an amended and restated offering document (the “Amended Offering Document”) related to this Offering that can be accessed under the Company’s profile at www.sedarplus.ca and on the Company’s website at www.tribecaresources.com. Prospective investors should read this Amended Offering Document before making an investment decision.

The Company previously announced that it intended to use some of the gross proceeds of the Offering for exploration activities at the Company’s La Higuera project (the “La Higuera Project”) and the Jiguata Project (as defined below), and for general working capital purposes. The Company wishes to clarify that the gross proceeds of the Offering will only be used for exploration activities at the Jiguata Project if it: (i) raises more than the Minimum Offering Amount; and (ii) obtains the necessary regulatory approvals, including approval of the TSXV, to enter into the option to purchase 100% of the Jiguata Project. In the event that the Company does not obtain all necessary regulatory approvals or approval from the TSXV, the Company will use certain proceeds currently contemplated for the Jiguata Project for other purposes as further set out in the Amended Offering Document. There is no certainty that the Company will raise the Minimum Offering Amount or that it will obtain the necessary regulatory approvals, including approval of the TSXV, to enter into the option to purchase 100% of the Jiguata Project.

In connection with the Offering, the Company may, at its sole discretion, pay finder's fees consisting of: (i) Shares or cash in an amount equal to up to 6% of the gross proceeds raised in respect of the Offering from subscribers introduced by such finders to the Company; and (ii) finder’s warrants in an amount equal to up to 6% of the number of Shares issued pursuant to this Offering from subscribers introduced by such finders to the Company in accordance with applicable securities laws and the policies of the TSXV.

The closing of the Offering may be completed in one or more tranches and is expected to close by October 29, 2025 (the “Closing Date”). The closing of the Offering is subject to certain closing conditions, including the approval of the TSXV.

It is anticipated that certain directors and management of the Company (“Insiders”) will participate in the Offering. The participation of any insiders may be considered a “related party transaction” within the meaning of Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"). Such insider participation will be exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 pursuant to sections 5.5(a), 5.5(b) and 5.7(1)(a) of MI 61-101, as the Company is not listed on any of the specified exchanges or markets outlined in subsection 5.5(b) of MI 61-101, and the fair market value of the Securities to be distributed to the insiders will not exceed 25% of the Company's market capitalization.

Jiguata Project Definitive Agreement and Due Diligence Period

As previously announced in the Tribeca Resources news releases dated June 19, 2025 and October 7, 2025, the Company signed a letter of intent (the “LOI”) to enter into an option to purchase a 100% interest in the Jiguata project, a 10,000 hectare exploration property located 120 km north of the Collahuasi copper-molybdenum mine in northern Chile (the “Jiguata Project”). The LOI was amended on August 5, 2025, and September 30, 2025, to extend the Company’s due diligence period and the deadline to execute a definitive purchase option agreement by 15 days and 30 days, respectively, resulting in a new deadline of October 31, 2025, for the Company to execute a definitive purchase option agreement. The Company is continuing to work towards finalizing a definitive purchase option agreement in respect of the Jiguata Project, which it expects to complete on or before October 31, 2025; however, there is no guarantee that the Company will enter into a definitive purchase option agreement on the terms currently contemplated by the Company, or at all. The Company’s entry into the option to purchase a 100% interest in the Jiguata Project has not been approved by the TSXV as of the date hereof.

About Tribeca Resources

Tribeca Resources is a copper exploration company focused on discovering and developing copper assets in northern Chile. The Company’s management team, whose members are significant shareholders of the Company, has world-leading copper expertise including a discovery history with iron oxide copper-gold deposits in the world’s great IOCG Belts of the Carajás district in Brazil and the Gawler and Cloncurry provinces of Australia, and porphyry-copper project and business development experience in Papua New Guinea, the Philippines, Peru, Argentina and Chile.

Tribeca Resources’ objective is to provide the mineral resources for the next generation of copper mines in Chile. It is focused on building a portfolio of projects, with emphasis on mid to advanced-stage copper exploration and resource development projects. To this end, mineral targets are regularly assessed in pursuit of acquisition, strategic exploration and significant discovery.

Tribeca Resources’ flagship property is the La Higuera Project that comprises 4,147 hectares of granted mining and exploration licences and is located towards the southern end of the Chilean Coastal IOCG Belt in the Coquimbo Region of northern Chile. Further information about the project can be found in the NI 43-101 Technical Report lodged by Tribeca Resources on SEDAR+ on October 24, 2022.

On behalf of Tribeca Resources Corporation

| Paul Gow | Thomas Schmidt | |

| CEO and Director | President and Director | |

| admin@tribecaresources.com | admin@tribecaresources.com | |

| +1 604 685 9316 | +1 604 685 9316 |

Cautionary Note

Neither the TSXV nor its Regulation Service Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this press release.

This press release does not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in the United States. The securities referred to herein have not been and will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), or with any securities regulatory authority of any state or other jurisdiction in the United States, and may not be offered or sold, directly or indirectly, within the United States or to, or for the account or benefit of, U.S. persons, as such term is defined in Regulation S under the Securities Act (“Regulation S”), except pursuant to an exemption from or in a transaction not subject to the registration requirements of the Securities Act.

Forward Looking Information

This press release contains forward-looking statements and information that are based on the beliefs of management and reflect the Company's current expectations. When used in this press release, the words "estimate", "project", "belief", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information contained in this press release may include, but are not limited to, the terms and completion of the Offering, the ability to raise the minimum and maximum amounts of the Offering, the payment of finder’s fees and issuance of finder’s securities, the anticipated Closing Date and the planned use of proceeds for the Offering.

Such statements and information reflect the current view of the Company. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the ability to obtain regulatory approval for the Offering, the state of equity markets in Canada and other jurisdictions, market prices, exploration successes, and continued availability of capital and financing and general economic, market or business conditions. Additional risks and uncertainties regarding the Company are described in its publicly-available disclosure documents, filed by the Company on SEDAR+ at www.sedarplus.com.

There are several important factors that could cause the Company’s actual results to differ materially from those indicated or implied by forward-looking statements and information. Such factors include, among others: reliance on key management; changes in the credit or security markets; results of operation activities; unanticipated costs and expenses; fluctuations in commodity prices; and general market and industry conditions. The Company cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. Factors that could cause actual results to differ materially from those anticipated in these forward-looking statements are described under the caption “Cautionary Statement Regarding Forward-Looking Information” in the Company’s Amended Offering Document dated as of the date hereof, which is available for view on SEDAR+ at www.sedarplus.com.

The Company has assumed that the material factors referred to in the previous paragraph will not cause such forward-looking statements and information to differ materially from actual results or events. The forward-looking information contained in this press release represents the expectations of the Company as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While the Company may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

7 OCTOBER, 2025 | VANCOUVER, BC

Tribeca Resources Announces Non-Brokered Private Placement of up to C$5M

Tribeca Resources Corporation (TSXV: TRBC) (OTCQB: TRRCF) (“Tribeca Resources” or the “Company”) is pleased to announce that it intends to complete a non-brokered private placement of up to 23,809,523 units of the Company (“Units”) at a price of $0.21 per Unit, for aggregate gross proceeds of up to $5,000,000 (the “Offering”). The Offering is subject to a minimum aggregate subscription amount of $2,000,000.

Each Unit will be comprised of one common share of the Company (each, a “Share”) and one-half of one common share purchase warrant (each whole warrant, a “Warrant”). Each Warrant will be exercisable by the holder thereof to acquire one additional Share (each, a “Warrant Share”, and together with the Units, Shares and Warrants, the “Securities") at an exercise price of $0.30 if exercised within the first 12 months following the Closing Date (as defined below) and $0.40 if exercised within the subsequent 12-month period, for a total exercise period of 24 months from the Closing Date; provided that: (i) the Warrants shall not be exercisable within the initial 60-day period following the Closing Date and (ii) the Company will have the right to accelerate the expiry of the Warrants in the event the Shares trade on the TSX Venture Exchange (the “TSXV”) (or any such other stock exchange in Canada as the Shares may trade at the applicable time) at a volume weighted average trading price ("VWAP") of C$0.50 or more per Share for a ten (10) consecutive trading day period.

Subject to compliance with applicable regulatory requirements, the Offering is being completed pursuant to the listed issuer financing exemption (“LIFE”) under Part 5A of National Instrument 45-106 – Prospectus Exemptions and in reliance on the Coordinated Blanket Order 45-935 – Exemptions from Certain Conditions of the Listed Issuer Financing Exemption. The Securities issued under the Offering will not be subject to a hold period in accordance with applicable Canadian securities laws. There is an offering document (the “Offering Document”) related to this Offering that can be accessed under the Company’s profile at www.sedarplus.ca and on the Company’s website at www.tribecaresources.com. Prospective investors should read this Offering Document before making an investment decision.

The Company intends to use the gross proceeds of the Offering for exploration activities at the Company’s La Higuera project (the “La Higuera Project”) and the Jiguata Project (as defined below), and for general working capital purposes, all as more particularly set forth in the Offering Document.

In connection with the Offering, the Company may, at its sole discretion, pay finder's fees consisting of: (i) Shares or cash in an amount equal to up to 6% of the gross proceeds raised in respect of the Offering from subscribers introduced by such finders to the Company; and (ii) finder’s warrants in an amount equal to up to 6% of the number of Shares issued pursuant to this Offering from subscribers introduced by such finders to the Company in accordance with applicable securities laws and the policies of the TSXV.

The closing of the Offering is expected to occur on or about October 29, 2025 (the “Closing Date”). The closing of the Offering is subject to certain closing conditions, including the approval of the TSXV.

It is anticipated that certain directors and management of the Company (“Insiders”) will participate in the Offering. The participation of any insiders may be considered a “related party transaction” within the meaning of Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"). Such insider participation will be exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 pursuant to sections 5.5(a), 5.5(b) and 5.7(1)(a) of MI 61-101, as the Company is not listed on any of the specified exchanges or markets outlined in subsection 5.5(b) of MI 61-101, and the fair market value of the Securities to be distributed to the insiders will not exceed 25% of the Company's market capitalization.

Jiguata Project Definitive Agreement and Due Diligence Period

As announced in the Tribeca Resources news release of June 19, 2025, the Company entered into a letter of intent (“LOI”) to acquire 100% of the Jiguata porphyry copper project (the “Jiguata Project”) located in Chile. The deadline for entering into a definitive agreement for the acquisition has been extended to October 31, 2025.

About Tribeca Resources

Tribeca Resources is a copper exploration company focused on discovering and developing copper assets in northern Chile. The Company’s management team, whose members are significant shareholders of the Company, has world-leading copper expertise including a discovery history with iron oxide copper-gold deposits in the world’s great IOCG Belts of the Carajás district in Brazil and the Gawler and Cloncurry provinces of Australia, and porphyry-copper project and business development experience in Papua New Guinea, the Philippines, Peru, Argentina and Chile.

Tribeca Resources’ objective is to provide the mineral resources for the next generation of copper mines in Chile. It is focused on building a portfolio of projects, with emphasis on mid to advanced-stage copper exploration and resource development projects. To this end, mineral targets are regularly assessed in pursuit of acquisition, strategic exploration and significant discovery.

Tribeca Resources’ flagship property is the La Higuera Project that comprises 4,147 hectares of granted mining and exploration licences and is located towards the southern end of the Chilean Coastal IOCG Belt in the Coquimbo Region of northern Chile. Further information about the project can be found in the NI 43-101 Technical Report lodged by Tribeca Resources on SEDAR+ on October 24, 2022.

On behalf of Tribeca Resources Corporation

| Paul Gow | Thomas Schmidt | |

| CEO and Director | President and Director | |

| admin@tribecaresources.com | admin@tribecaresources.com | |

| +1 604 685 9316 | +1 604 685 9316 |

Cautionary Note

Neither the TSXV nor its Regulation Service Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this press release.

This press release does not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in the United States. The securities referred to herein have not been and will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), or with any securities regulatory authority of any state or other jurisdiction in the United States, and may not be offered or sold, directly or indirectly, within the United States or to, or for the account or benefit of, U.S. persons, as such term is defined in Regulation S under the Securities Act (“Regulation S”), except pursuant to an exemption from or in a transaction not subject to the registration requirements of the Securities Act.

Forward Looking Information

This press release contains forward-looking statements and information that are based on the beliefs of management and reflect the Company's current expectations. When used in this press release, the words "estimate", "project", "belief", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information contained in this press release may include, but are not limited to, the terms and completion of the Offering, the ability to raise the minimum and maximum amounts of the Offering, the payment of finder’s fees and issuance of finder’s securities, the anticipated Closing Date and the planned use of proceeds for the Offering.

Such statements and information reflect the current view of the Company. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the ability to obtain regulatory approval for the Offering, the state of equity markets in Canada and other jurisdictions, market prices, exploration successes, and continued availability of capital and financing and general economic, market or business conditions. Additional risks and uncertainties regarding the Company are described in its publicly-available disclosure documents, filed by the Company on SEDAR+ at www.sedarplus.com.

There are several important factors that could cause the Company’s actual results to differ materially from those indicated or implied by forward-looking statements and information. Such factors include, among others: reliance on key management; changes in the credit or security markets; results of operation activities; unanticipated costs and expenses; fluctuations in commodity prices; and general market and industry conditions. The Company cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. Factors that could cause actual results to differ materially from those anticipated in these forward-looking statements are described under the caption “Cautionary Statement Regarding Forward-Looking Information” in the Company’s Offering Document dated as of the date hereof, which is available for view on SEDAR+ at www.sedarplus.com.

The Company has assumed that the material factors referred to in the previous paragraph will not cause such forward-looking statements and information to differ materially from actual results or events. The forward-looking information contained in this press release represents the expectations of the Company as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While the Company may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

19 JUNE, 2025 | VANCOUVER, BC

Tribeca Resources to Acquire Option Over Jiguata Porphyry Copper Project in Chile

Tribeca Resources Corporation (TSXV: TRBC) (OTCQB: TRRCF) (“Tribeca Resources”, the “Company”) is pleased to announce it has entered into a letter of intent (“the LOI”) with private vendors (the “Project Vendors”) to acquire a 100% interest in a 10,000 hectare property (the “Jiguata Property”) over a period of 5 years. The Jiguata property, located in northern Chile, 120km north of the major mining company controlled Collahuasi and Quebrada Blanca mines (Figure 1), will be progressed in parallel with the Company’s two existing projects: La Higuera and Chiricuto.

Highlights:

- Property

- Large epithermal and interpreted porphyry alteration system in the northern extension of the prolific Chilean porphyry-bearing Eocene-Oligocene Belt. Overprinted and partly covered by rocks of the younger Miocene Belt

- Soil sampling, historic drilling, geological mapping and geophysics highlight a large 5km x 3km exploration target, with two existing discrete near drill-ready targets

- Located 120km north of Collahuasi (Anglo-Glencore-Mitsui) and Quebrada Blanca (Teck-Codelco-Mitsui) at an altitude of 4,200-4,600 meters. Drive-up access via paved Collahuasi road and nearby accommodation

- Proposed work

- The agreement allows for a thorough testing with expenditure going into the ground to advance towards a discovery

- Pre-drilling activities at the Jiguata Property will be undertaken in parallel with planned further drilling at the Company’s flagship La Higuera Project

- Proposed transaction

- Letter of intent entered to acquire a 100% interest in the Jiguata Property

- US$15 million purchase price over a 5-year option period; including US$14.45 million bullet payment upon option exercise

- Parties will work to enter into a definitive agreement within 90 days of the date of the LOI

Tribeca Resources CEO, Dr. Paul Gow commented:

“We are delighted to be acquiring this significant landholding of 10,000 hectares, which hosts two near drill-ready targets, and extensive blue sky potential that has only been lightly explored. This is an extensive alteration system in northern Chile, a district that hosts truly world-class porphyry copper deposits. The system is exposed through an erosional window in the thin overlying younger Miocene volcanics, whose presence is part of the reason, we believe, that this part of the northern extension of the Chilean Eocene-Oligocene Belt has not been adequately explored. While the project is at an altitude of approximately 4400m, the excellent access and infrastructure and the relatively benign winter at this far northern latitude makes for exploration access much of the year.”

“The pre-existing geoscience database at the project fits with the Tribeca strategy of seeking projects with recognised indications of a potential mineralized system and a well populated database so that drill targets can be firmed up in short order. We look forward to working from this LOI to complete the acquisition over the coming months and commence fieldwork.”

The Jiguata Property

Highlights

- 34 exploration concessions covering 10,000 hectares

- Situated in the northern extension of the prolific Eocene-Oligocene porphyry copper belt of northern Chile, approximately 120km north of the Collahuasi and Quebrada Blanca copper-molybdenum deposits.

- Pre-existing geological mapping, soil and rock geochemistry and Induced Polarization (IP) survey and limited historic drill data outline two drill targets, with additional earlier stage targets elsewhere on the property remaining to be detailed with additional field work.

- Excellent existing access to the area via a maintained road that passes through the property.

The Jiguata Property is located in the northern extension of the Eocene-Oligocene metallogenic belt of northern Chile (Figure 1), where it has been overprinted by the Miocene magmatic belt. The prolific Eocene-Oligocene Belt hosts the giant Collahuasi, Chuquicamata and Escondida deposits, while the Miocene Belt, further to the south, hosts many of the current crop of high-profile Chilean-Argentine porphyry copper projects including Filo del Sol, Valeriano, Encierro and Altar.

The project area encompasses a large advanced argillic alteration zone (25 square km) hosted within a volcanic tuffaceous unit under a thin blanketing cover of fresh unaltered Miocene dacitic volcanic rocks dated at approximately 9-5 Ma (Figure 2). The alteration zone has been exposed via an erosional window in the overlying Miocene volcanic rocks. The age of the tuffaceous unit hosting the alteration is unknown age but likely Eocene-Oligocene or Miocene. Within the alteration zone, previously unmapped feldspar-biotite-(hornblende) bearing porphyritic units are recognised. The alteration zone is representative of a lithocap and dominated by epithermal mineralogy and textures (e.g. extensive quartz-alunite alteration and the presence of steam-heated, chalcedonic silica and quartz ledges), although porphyry-style veins are present at surface and propylitic alteration and quartz stockwork is recorded from shallow historic drilling. The historic drilling comprised two reverse circulation (RC) drill holes that were completed in 1993 to depths of 250m and 300m. The drill holes appear to have been targeted at silica ‘ledges’ within a large soil molybdenum anomaly (to 867ppm Mo in soils) in the incised valley. Highly anomalous Mo was recorded in the drill holes (e.g. 248m @ 255ppm Mo in drill hole 3546), with copper above background at 250 ppm. Various copper or molybdenum sulphide minerals have been reported from the drilling, including chalcopyrite, bornite, chalcocite and molybdenite.

IP surveying was completed on six one kilometer-spaced lines over part of the project area in 2014, delineating two large chargeability anomalies which coalesce to form a zone of 1.5km x 5km at >20 mV/V (Figure 3), with associated high- and low-resistivity zones, which comprise high-priority near-term drill targets.

The project area is traversed by an existing good quality maintained road (97-B) which is partly asphalted, allowing for rapid access within 3 ½ hours (220km) from the port city of Iquique via the Collahuasi access road (highway 65). The altitude in the project area generally ranges between 4200m-4600m, but the northerly latitude of the project provides only short interruptions to access for exploration activities, with a variably short snow season in July-August and a rainy period (“Bolivian winter”) in January-February. Other companies holding exploration tenure in the general area include, Vale, Codelco, BHP, Teck, Glencore and Antofagasta Minerals.

Tribeca Resources plans to undertake further mapping, surface sampling and additional geophysics prior to proceeding with drilling at the Jiguata Property.

Key Transaction Terms

The key terms under which Tribeca Resources has the right, but not the obligation, to acquire a 100% interest in the Jiguata Property (the "Purchase Option”) are as follows:

- Duration: 5-year option to purchase a 100% interest in the Jiguata Property

- Purchase price: Cumulative payments totalling US$15M to be paid as follows:

- On signing: US$25,000

- At 12 months: US$75,000

- At 24 months: US$125,000

- At 36 months: US$150,000

- At 48 months: US$175,000

- At 60 months: US$14,450,000

- Holding costs: Tribeca Resources to pay annual concession fees (currently less than US$50,000/year)

- Deliverables: To maintain the Purchase Option, Tribeca must have completed at least 3,000 metres of drilling, with a minimum hole depth of 500m within the first 24 months.

- Extension right: Option period extendible to 6 or 7 years, by paying the Project Vendors US$1,000,000 for each 12-month extension

- NSR Royalty: If the Purchase Option is exercised, the Project Vendors retain a 2.0% NSR Royalty over the Jiguata Property. Tribeca has a right to repurchase 100% of this royalty for US$20 million

With the exception of the reimbursement of 2025 mining licence fees (approximately US$44,000) to the Project Vendors and the US$25,000 payment on signing of a definitive agreement, all payments and work commitments are optional; Tribeca Resources will not be obliged to make any payments or complete any work should it elect not to maintain or execute the Purchase Option.

Tribeca Resources will be the operator of the project. The transaction is subject to approval of the TSX Venture Exchange.

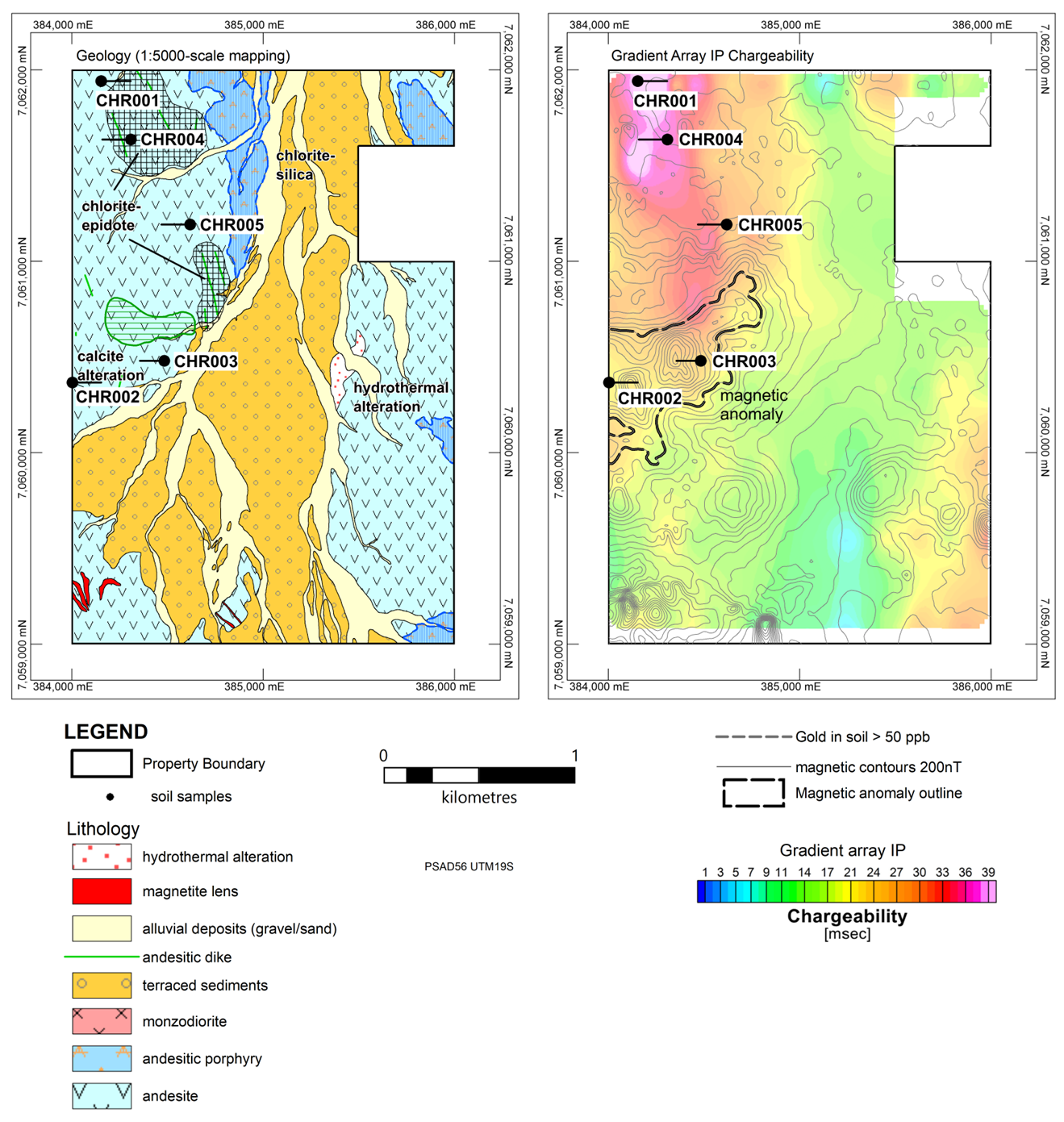

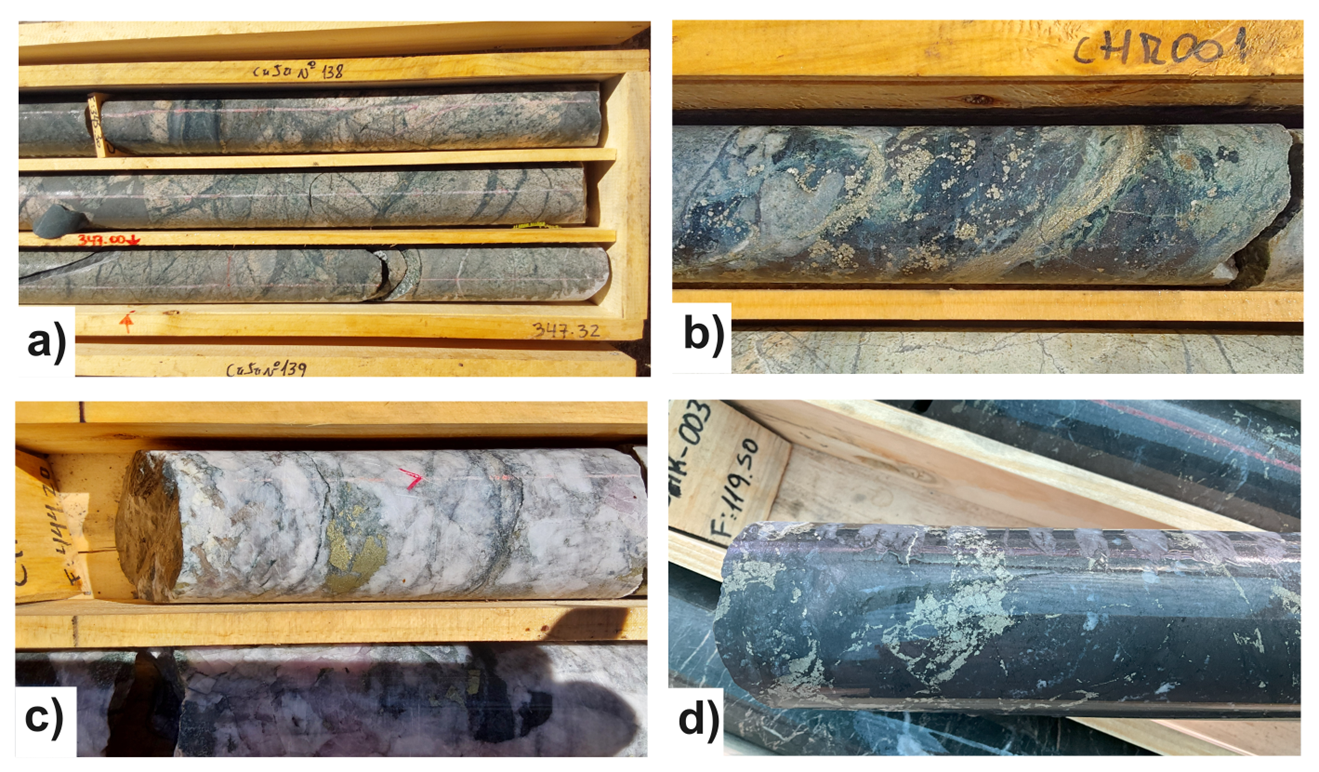

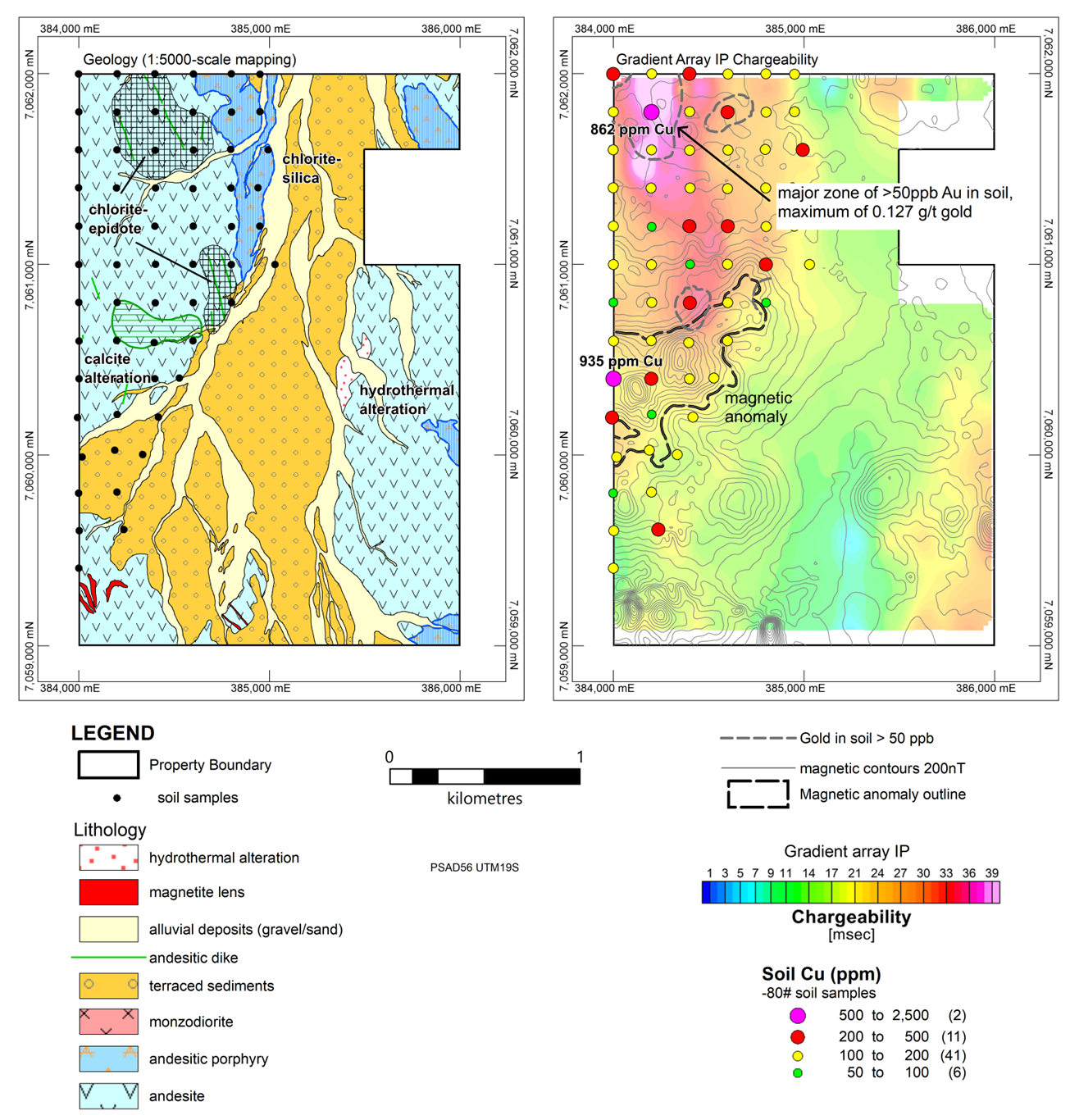

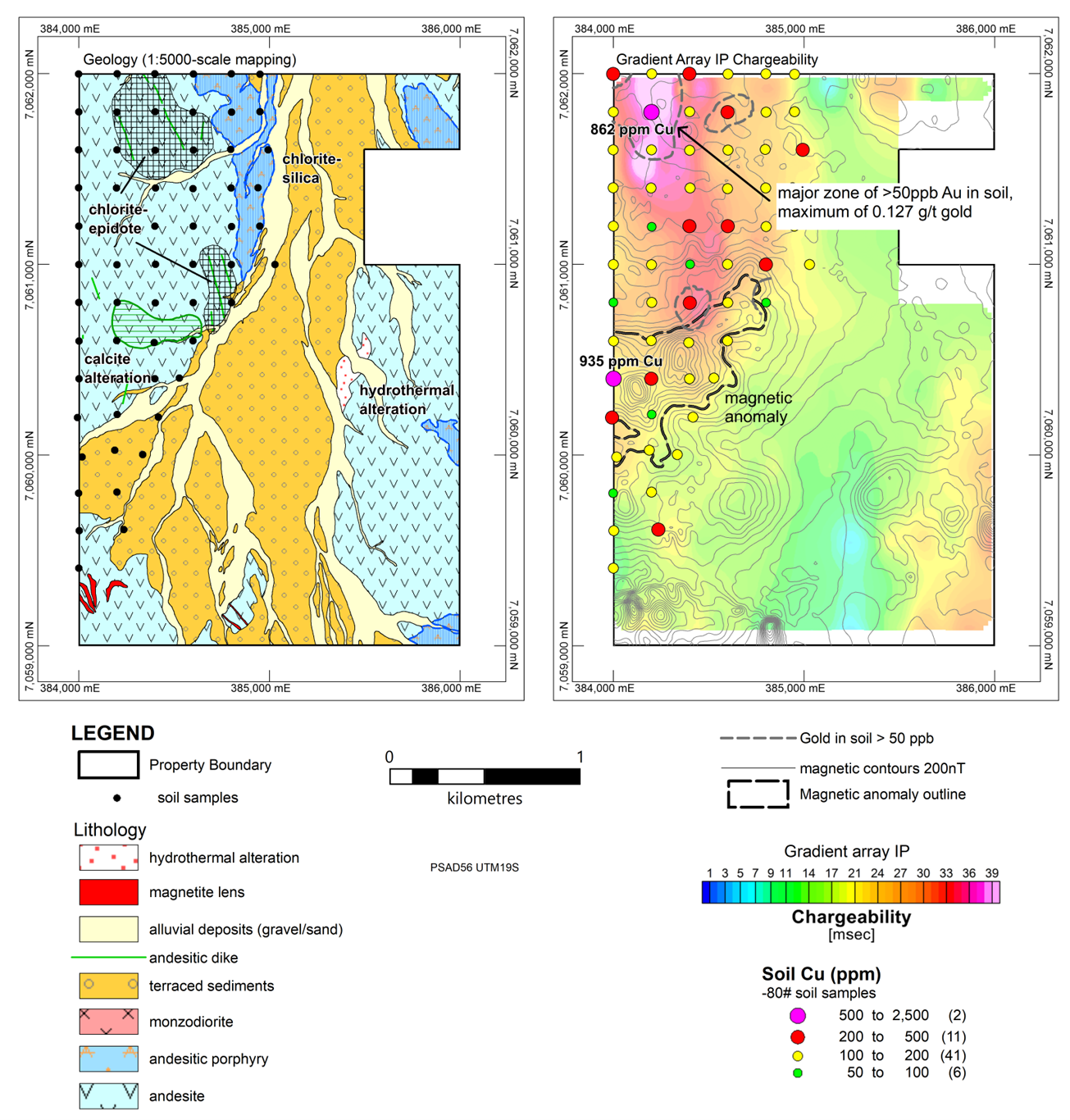

Chiricuto Project final drill results

Assay results were reported from the first three holes (CHR001 TO CHR003) at the Chiricuto project in the northern Atacama region on 7 May 2025, and included the intersection in CHR001 of a thick (>400m) interval of porphyry-style veining and alteration with a strong sulphide component and three 10-12m intervals of 0.10-0.12% copper with gold up to 0.53 g/t. Final assay results have now been received from the final two holes at Chiricuto (CHR004 and CHR005). The holes tested the weaker southern portion of the IP anomaly drilled by CHR001. Both holes intersected altered andesite and monzodiorite with lesser sulphide and copper mineralization, with the best copper-bearing intervals being:

- 8m @ 0.14% Cu, 0.06ppm Au, 76ppm Co and 6.4% Fe from 144m in CHR004

- 6m @ 0.16% Cu, 0.37ppm Au, 31ppm Co and 5.8% Fe from 212m in CHR004

This final data is now being integrated to understand if potential for higher grade copper mineralization exists related to the porphyry-style alteration system intersected in holes CHR001, CHR004 and CHR005.

More detailed information including drilling location maps and drill hole collar details can be found in the news release from Tribeca dated 7 May 2025.

La Higuera Project update

Tribeca intends to recommence drilling at the La Higuera Project in 2H 2025. Targets have been identified from geophysical data and historic drilling under gravel cover on the flanks of the Chirsposo Sur target system, and as follow-up drilling from the 2024 Phase 2 drill program at the Gaby IOCG discovery. Further information on these proposed programs will be released as available.

Qualified Person

All scientific and technical information in this press release has been prepared by, or approved by, Dr. Paul Gow, who is the CEO of Tribeca Resources. He is a Member of the Australian Institute of Geoscientists (MAIG), a Member of the Australasian Institute of Mining and Metallurgy (MAusIMM) and a qualified person for the purposes of NI 43-101. Dr. Gow has not verified any of the information regarding any of the properties or projects referred to herein other than the La Higuera Property, the Chiricuto Property and the Jiguata Property. Mineralization on any other properties referred to herein is not necessarily indicative of mineralization on the La Higuera, Chiricuto or Jiguata Properties.

About Tribeca Resources

Tribeca Resources is a copper exploration company focused on discovering and developing copper assets in northern Chile. The Company’s management team, whose members are significant shareholders of the Company, has world-leading copper expertise including a discovery history with iron oxide copper-gold deposits in the world’s great IOCG Belts of the Carajás district in Brazil and the Gawler and Cloncurry provinces of Australia, and porphyry-copper project and business development experience in Papua New Guinea, the Philippines, Peru, Argentina and Chile.

Tribeca Resources’ objective is to provide the mineral resources for the next generation of copper mines in Chile. It is focused on building a portfolio of projects, with emphasis on mid to advanced-stage copper exploration and resource development projects. To this end, mineral targets are regularly assessed in pursuit of acquisition, strategic exploration and significant discovery.

Tribeca Resources’ flagship property is the La Higuera Project that comprises 4,147 hectares of granted mining and exploration licences and is located towards the southern end of the Chilean Coastal IOCG Belt in the Coquimbo Region of northern Chile. Further information about the project can be found in the NI 43-101 Technical Report lodged by Tribeca Resources on SEDAR on 24 October 2022.

On behalf of Tribeca Resources Corporation

| Paul Gow | Thomas Schmidt | |

| CEO and Director | President and Director | |

| admin@tribecaresources.com | admin@tribecaresources.com | |

| +1 604 685 9316 | +1 604 685 9316 |

Cautionary Note

Neither the TSX Venture Exchange Inc. nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange Inc.) accepts responsibility for the adequacy or accuracy of this press release.