Tribeca Resources drills 268m at 0.66% copper and 0.14 g/t gold, incl. 90m at 1.02% copper and 0.23 g/t gold, in 100m step-out first drill hole at La Higuera IOCG project

JANUARY 30, 2023 | VANCOUVER, BC

Tribeca Resources drills 268m at 0.66% copper and 0.14 g/t gold, incl. 90m at 1.02% copper and 0.23 g/t gold, in 100m step-out first drill hole at La Higuera IOCG project

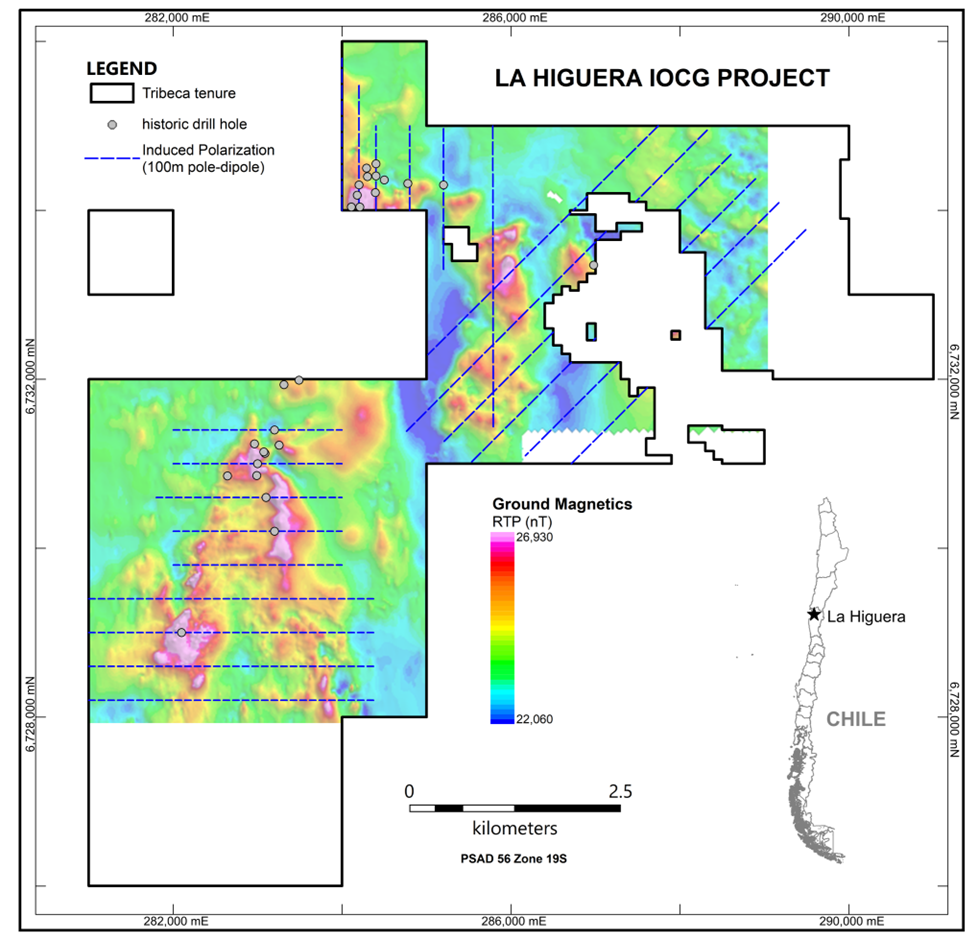

Tribeca Resources Corporation (TSXV: TRBC) (“Tribeca Resources”, the “Company”) is pleased to report assay results from the first three holes of the drilling program under way at its La Higuera iron oxide copper-gold (IOCG) project, located 40km north of La Serena, in the Coquimbo region of northern Chile.

Highlights:

- Hole GBY001 intersected 268m at 0.66% copper, 0.14g/t gold, including 90m at 1.02% copper, 0.23 g/t gold, from the base of gravel cover at 52m.

- Holes GBY002 and GBY003 (Table 1) intersected well-developed sulphide mineralization of a lower grade, albeit peripheral to the main trend.

- Four holes (GBY004 to GBY007) are being geologically processed and analysed, including two drilled as large step-out holes to the north. Results from these holes, together with two additional holes that remain to be drilled at the Chirsposo target 3km to the south, will be released in due course.

All three holes reported here have intersected sulphide mineralization, with GBY001 returning assays that are of significantly higher grade than the best results reported in historic drilling (RCH-LH-07).

Tribeca Resources CEO, Dr Paul Gow commented:

“This is a very strong start for Tribeca with results from the first 100m step-out hole at Gaby, GBY001, surpassing our expectations and intersecting a very thick zone of copper-gold mineralization."

“With only the first three drill holes of a nine-hole program released, we look forward to continued news flow as we work to build on this expanding IOCG mineral system. Its location at low altitude, and with proximity to infrastructure, would expedite development should we define a suitable resource."

Table 1. Summary of significant mineralized intersections in drill holes GBY001 to GBY003.

| HoleID | From (m) | To (m) | Downhole Interval (m) |

Cu (%) |

Au (g/t) |

Co (ppm) | CuEq (%) |

|

| GBY001 | 52 | 320 | 268 | 0.66 | 0.14 | 330 | 0.74 | |

| incl. | 52 | 170 | 118 | 0.61 | 0.13 | 122 | 0.64 | |

| incl. | 178 | 204 | 26 | 0.34 | 0.08 | 260 | 0.41 | |

| incl. | 230 | 320 | 90 | 1.02 | 0.23 | 681 | 1.20 | |

| incl. | 312 | 320 | 8 | 6.37 | 1.65 | 1789 | 6.92 | |

| GBY001 | 326 | 350 | 24 | 0.23 | 0.04 | 409 | 0.33 | |

| GBY002 | 122 | 136 | 14 | 0.27 | 0.06 | 53 | 0.28 | |

| GBY002 | 146 | 160 | 14 | 0.42 | 0.09 | 43 | 0.43 | |

| GBY003 | 100 | 114 | 14 | 0.21 | 0.05 | 43 | 0.22 | |

| GBY003 | 158 | 172 | 14 | 0.29 | 0.07 | 106 | 0.32 |

Note: Apart from the summary intersection (from 52-320m in GBY001) and the high-grade zone (312-320m in GBY001) the grade intersections are calculated over intervals >0.2% Cu with an approximate maximum internal dilution of 10m @ 0.05% Cu and a minimum interval width of 10m. No top cut has been applied. CuEq (%) grades have been calculated using recoveries from metallurgical test work undertaken in 2006 on drill core from the project, which are 90% for copper, 65% for gold and 50% for cobalt. Metal prices utilised were US$4.21/lb copper, US$1932.45/oz gold and US$22.23/lb cobalt (based on 26 January 2023 closing spot prices).

Drill hole discussion

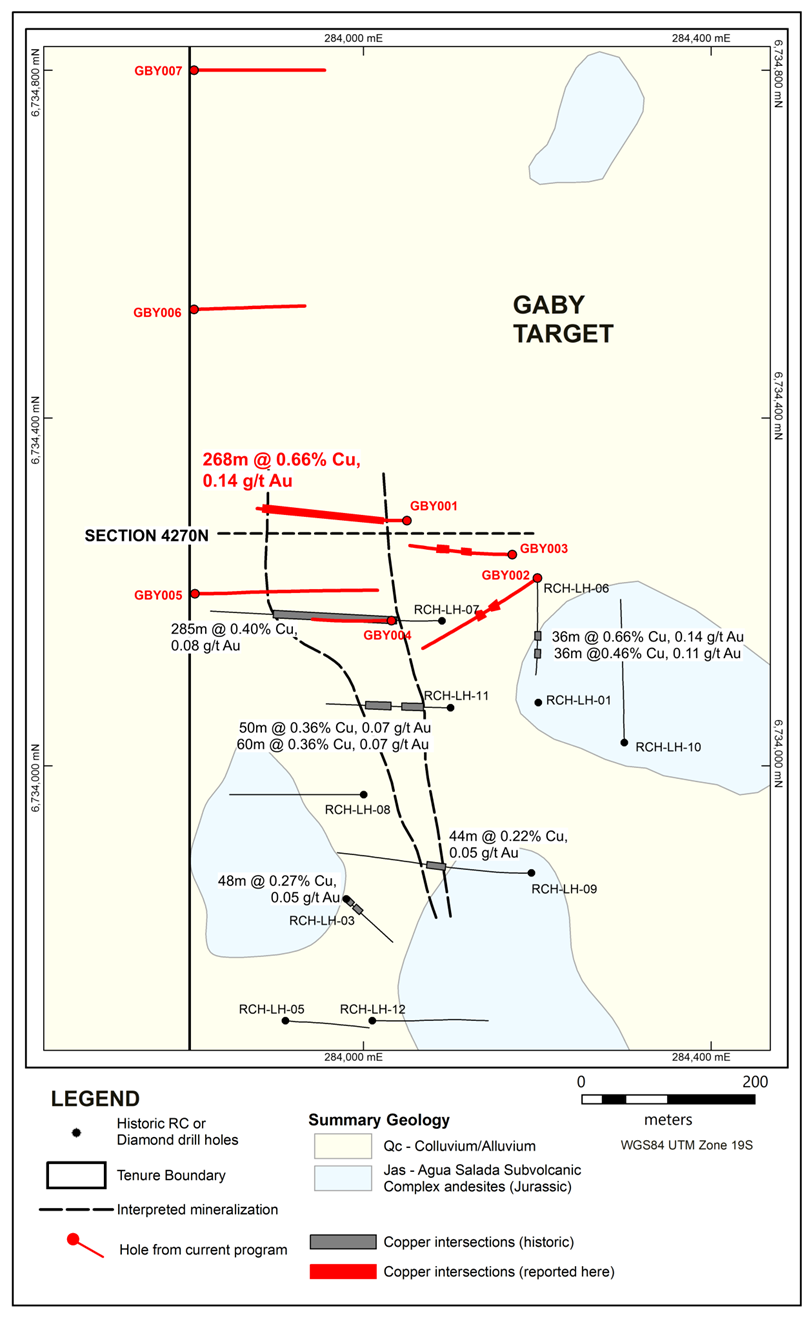

The Gaby target is a NNW-trending zone, 3km to the northwest of the historic La Higuera mining center. Small copper workings and historic drilling indicates the presence of copper mineralization on small outcropping rises, which is interpreted to continue under thin gravel cover. Historic drilling at the Gaby target in 2005 stopped just north of the limit of the outcrop, where hole LH-RC-07 penetrated 31m vertical thickness of gravel cover before intersecting a thick section of IOCG-style mineralization. The mineralization returned an intersection of 285m @ 0.40% Cu, 0.08 g/t Au, 23.5% Fe and 259ppm Co from 100m. This information is documented in the NI 43-101 Technical Report filed by Tribeca Resources on SEDAR on 24 October 2022.

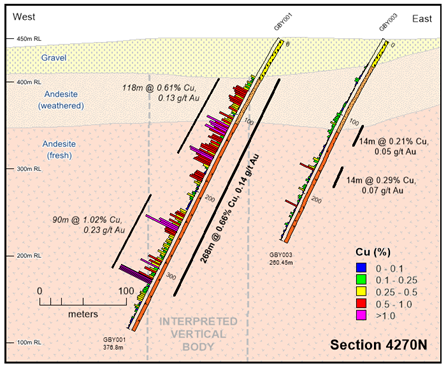

The first hole drilled by Tribeca Resources at Gaby (GBY001), is a 100m step-out to the north of historic drilling (Figure 1) and intersected a thick zone of IOCG-style mineralization with an intersection of 268m @ 0.66% Cu, 0.14 g/t Au, 330ppm Co (0.74% CuEq) from 52m downhole depth, including 90m @ 1.02% Cu, 0.23g/t Au, 681ppm Co (1.20% CuEq) from 230m. The intersection comprised 58m of weathered rocks from 52m to 110m depth and 210m of sulphide mineralization from 110m to 320m. The sulphide mineralization continued beyond 320m to the end of hole at 376.8m, but was dominated by the iron sulphide pyrite, with lesser copper sulphide (chalcopyrite) present.

Drill holes GBY002 and GBY003 were drilled peripheral to the main trend to test potential extensions to mineralization intersected in the historic drillhole RCH-LH-06 (36m @ 0.66% Cu, 0.14 g/t Au from 196m and 36m @ 0.46% Cu, 0.11 g/t Au from 264m) in the eastern section of the prospect. The holes intersected extensive sulphide mineralization, albeit containing thinner lower grade copper intersections compared to GBY001 (Table 1).

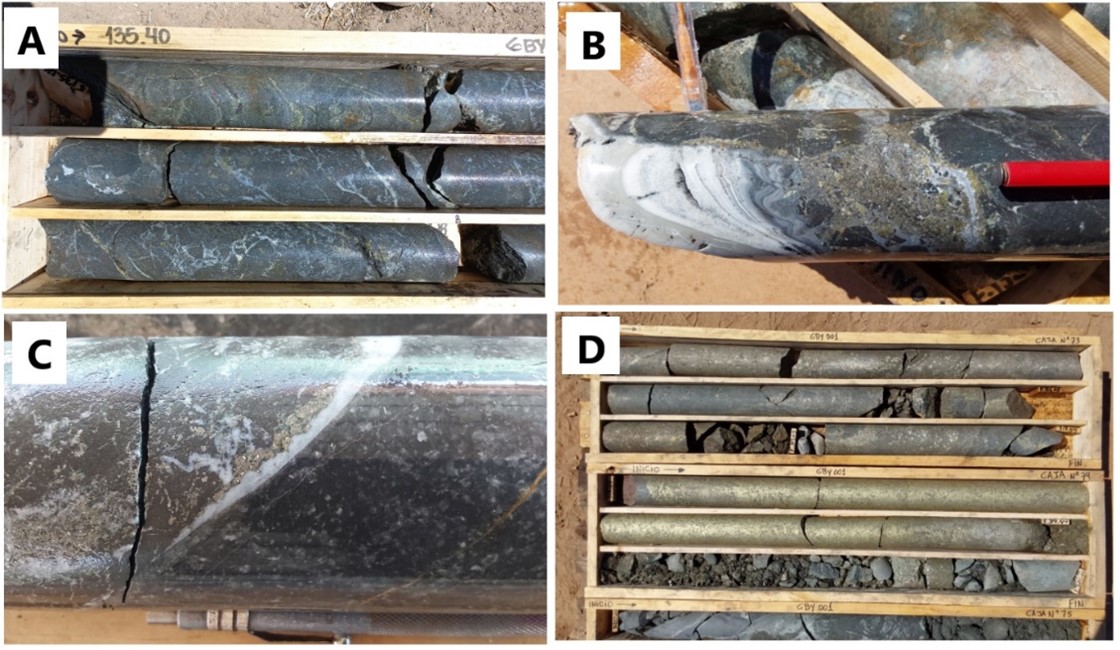

The sulphide mineralization intersected at Gaby is dominantly pyrite-chalcopyrite and hosted in andesitic rocks. A zone of intense sulphide mineralization comprising pyrrhotite and chalcopyrite occurs between 312m to 320m in GBY001. Minor oxide copper and interpreted chalcocite are present in the weathered zone. The alteration indicates the mineralization is of a magnetite-dominated IOCG style (Figure 3).

Elevated cobalt and iron are present with the mineralization. The 268m thick intersection reported from GBY001 yields 330ppm cobalt, which increases to 1800ppm cobalt in the massive sulphide mineralization. Thirty-eight percent of the assayed intervals in GBY001 report iron greater than 30%.

The dip of the mineralization is currently poorly constrained, but preliminary analysis of the drilling results suggests it is likely subvertical to steeply dipping (Figure 2). Drill hole GBY001 was drilled towards the west (270°) with a dip of 60°. True widths of mineralization are unknown given uncertainty in the understanding of the geometry and orientation of the mineralization.

Chirsposo drilling

Drilling within the current program is underway at the Chirsposo target, located approximately 3km south of Gaby (Figure 4), the drilling will test for mineralization down dip from historic drilling, including hole CAB0006. Drillhole CAB0006 was a step-out by 200m under thin gravel cover (~25m), which yielded the best historic copper intersection at the target (82m @ 0.35% Cu and 19.2% Fe from 64m).

Notes on sampling and assaying

Analytical samples were collected using 1/8 of the material from each 2m interval for the reverse circulation drilling or ½ HQ core for the diamond drilling and sent to ALS Lab in La Serena, Chile for preparation and then to ALS Labs in Santiago, Chile and Lima, Peru for analysis. Preparation included crushing the RC and core samples to 70% < 2mm and pulverizing 1000g of crushed material to better than 85% < 75 microns. All samples are assayed using 30g nominal weight fire assay with AAS finish (Au-AA23) and a multi-element four acid digest ICP-AES method (ME-ICP61). Where the ME-ICP61 results were greater than 10,000 ppm Cu the assays were repeated with ore grade four acid digest method (Cu-OG62). The QA/QC procedure for this drilling program utilizes field duplicates, standards and blanks that comprise approximately 10% of the total samples submitted. The QAQC results indicate good accuracy and precision in the assaying program.

Qualified Person

All scientific and technical information in this press release has been prepared by, or approved by, Dr. Paul Gow, who is the CEO of Tribeca Resources. He is a Member of the Australian Institute of Geoscientists (MAIG), a Member of the Australasian Institute of Mining and Metallurgy (MAusIMM) and a qualified person for the purposes of NI 43-101. Dr. Gow has not verified any of the information regarding any of the properties or projects referred to herein other than the La Higuera IOCG Property. Mineralization on any other properties referred to herein is not necessarily indicative of mineralization on the La Higuera IOCG Property.

About Tribeca Resources

Tribeca Resources is a copper exploration company focused on discovering and developing assets in the Coastal IOCG Belt of northern Chile. The company’s management team, whose members are significant shareholders of the Company, has world-leading expertise and a discovery history with iron oxide copper-gold deposits in the world’s great IOCG Belts of the Carajás district in Brazil and the Gawler and Cloncurry provinces of Australia.

Tribeca Resources’ objective is to provide the mineral resources for the next generation of copper mines in Chile. It is focused on building a portfolio of projects, with emphasis on mid to advanced-stage copper exploration and resource development projects. To this end, mineral targets are regularly assessed in pursuit of acquisition, strategic exploration and significant discovery.

Tribeca’s flagship property is the La Higuera IOCG project that comprises 4,047 hectares of granted mining and exploration licences and is located towards the southern end of the Chilean Coastal IOCG Belt in the Coquimbo Region of northern Chile. The 822 hectare Gaby concession area is held under a purchase option (5% Exploration Levy on expenditure incurred during the option period; a US$2 million final payment due March 2024; with a 1% NSR Royalty granted to the owner), with the remainder of the concessions being outright owned (100%) by Tribeca Resources. Further information about the project can be found in the NI 43-101 Technical Report lodged by Tribeca on SEDAR on 24 October 2022.

On behalf of Tribeca Resources Corporation

| Paul Gow | Thomas Schmidt | |

| CEO and Director | President and Director | |

| admin@tribecaresources.com | admin@tribecaresources.com | |

| +1 604 685 9316 | +1 604 685 9316 |

Cautionary Note

Neither the TSX Venture Exchange Inc. nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange Inc.) accepts responsibility for the adequacy or accuracy of this press release.

FORWARD LOOKING INFORMATION

This press release contains forward-looking statements and information that are based on the beliefs of management and reflect the Company's current expectations. When used in this press release, the words "estimate", "project", "belief", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information in this press release include information relating to the strength of the start of the drilling program and the ability of the Company to develop and define a suitable resource at the Project.

Such statements and information reflect the current view of the Company. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: new laws or regulations could adversely affect the business and results of operations of the Company and anticipated work on the Project.

There are a number of important factors that could cause the Company’s actual results to differ materially from those indicated or implied by forward-looking statements and information. Such factors include, among others: reliance on key management; changes in the credit or security markets; results of operation activities; unanticipated costs and expenses; fluctuations in commodity prices; and general market and industry conditions. The Company cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

The Company has assumed that the material factors referred to in the previous paragraph will not cause such forward-looking statements and information to differ materially from actual results or events. The forward-looking information contained in this press release represents the expectations of the Company as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While the Company may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

1305 - 1090 West Georgia Street

Vancouver, BC V6E 3V7 Canada