Tribeca Resources acquires properties adjacent to its existing projects in the Chilean Coastal IOCG Belt

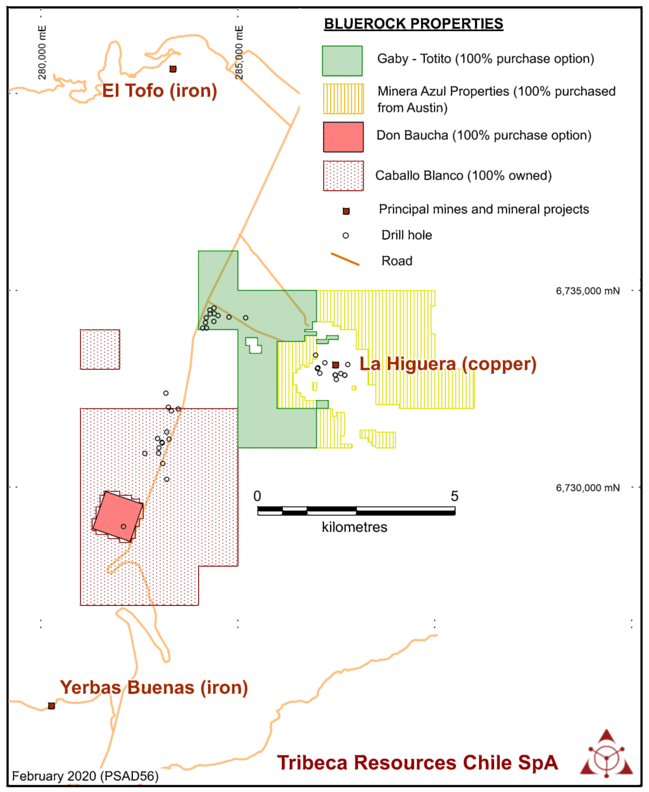

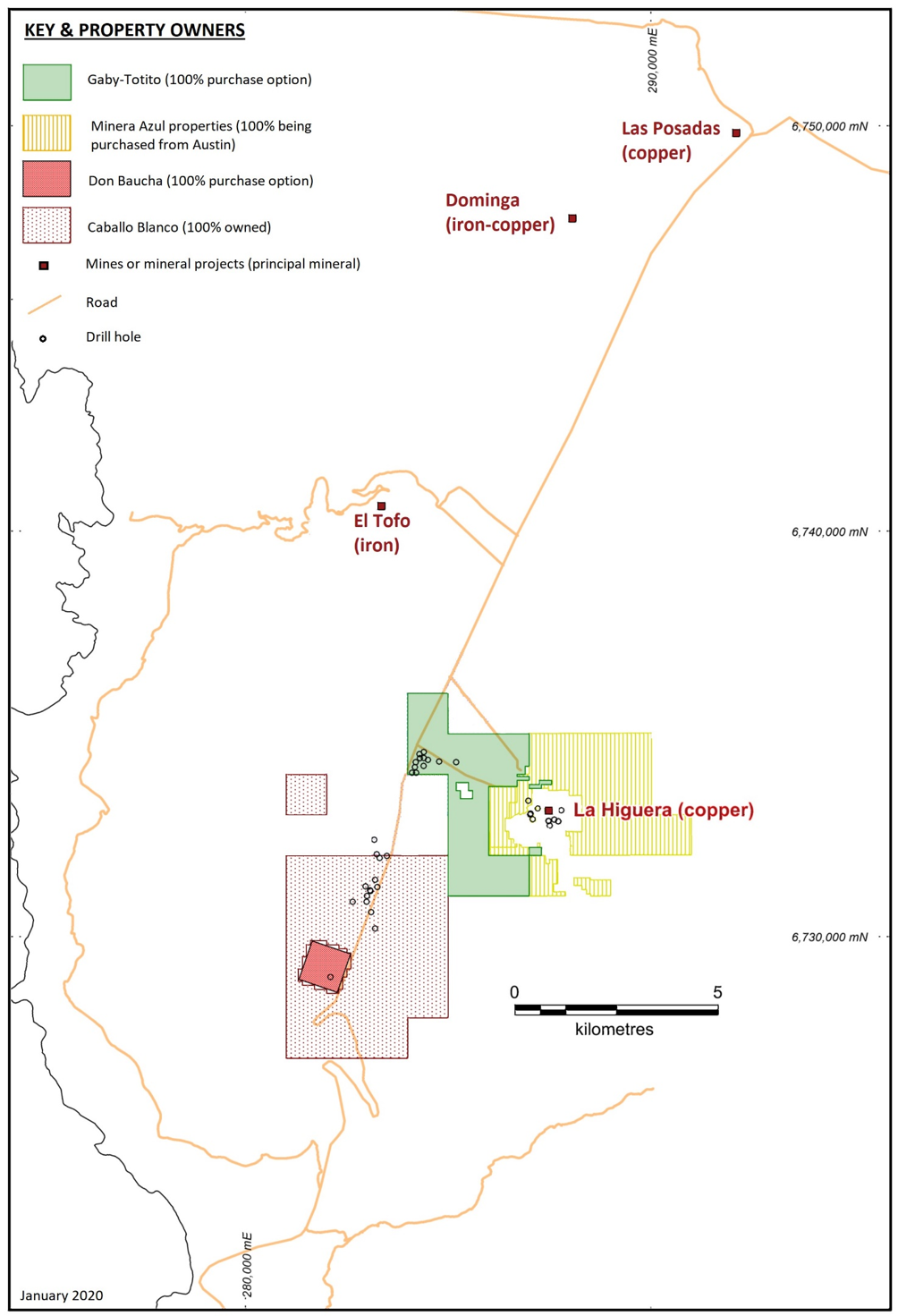

Tribeca Resources Chile SpA (“Tribeca Resources”) is pleased to announce the acquisition of certain mining concessions from TSX Venture Exchange listed Austin Resources Ltd. The Benja & Blanco properties being acquired from Austin Resources (the “Benja & Blanco Properties”) comprise 949 hectares of mining licences and are located immediately adjacent to Tribeca’s Caballo Blanco and Gaby-Totito properties, in the Coquimbo province of Chile.

This transaction further consolidates Tribeca Resources’ ownership of the area covering this large cluster of kilometre scale IOCG systems over this 8km segment of the Atacama Fault Zone, bringing the size of Tribeca’s total concession holdings to 3,747 hectares, an increase of 34%. Notably, this is the first time the ownership of the enlarged project area has been unified under a single owner.

The acquisition of a 100% interest in the properties is being entered into by Tribeca Resources’ 62.5% owned Chilean subsidiary Bluerock Resources SpA (“Bluerock”), whose other assets are an existing 100% interest in the Caballo Blanco properties, and 100% purchase options over the Gaby-Totito and Don Baucha properties.

Under the terms of the agreement, Austin’s 100% owned Chilean subsidiary Minera Azul Ventures Ltda will transfer all of its interest in all exploration properties held by Minera Azul, along with certain drill core, to Bluerock in exchange for Austin being granted a one percent (1%) Net Smelter Return royalty over future cashflows from mineral production from the Benja & Blanco Properties. Bluerock will have the right, but not the obligation, to purchase fifty percent (50%) of the Royalty by making a cash payment of US$63,166 to the Company.

The Benja & Blanco Properties surround the La Higuera copper-gold mining district that, in the late 1800s and early 1900s, was one of the largest copper producers in Chile. Initially, sulphide copper ore was direct shipped via La Serena-Coquimbo to Swansea in Wales for smelting. Later, up to eleven local smelters are reported to have been in operation at La Higuera, from which only slag heaps remain. In 1903 the district produced 11,950 tonnes of copper metal from ores grading up to 10% copper. Gold veins at grades up to 17 g/t gold were also exploited.

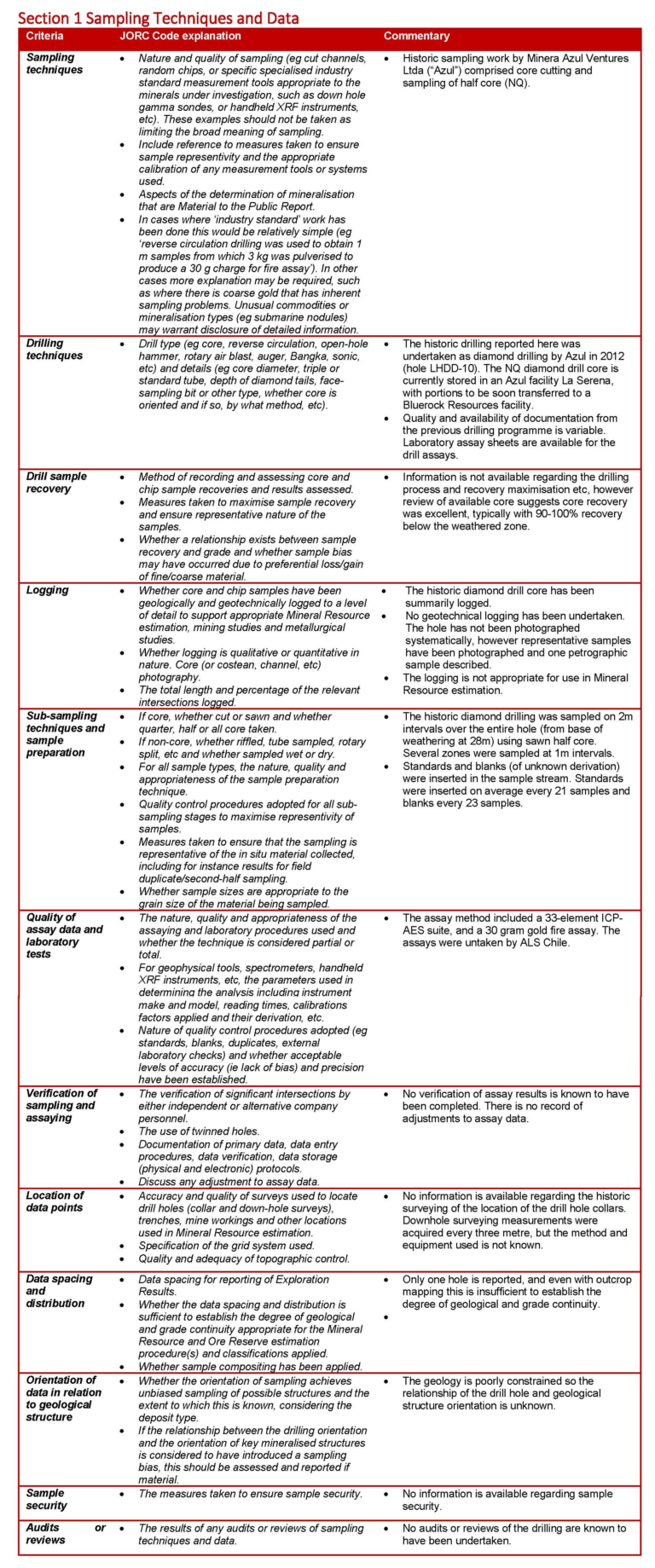

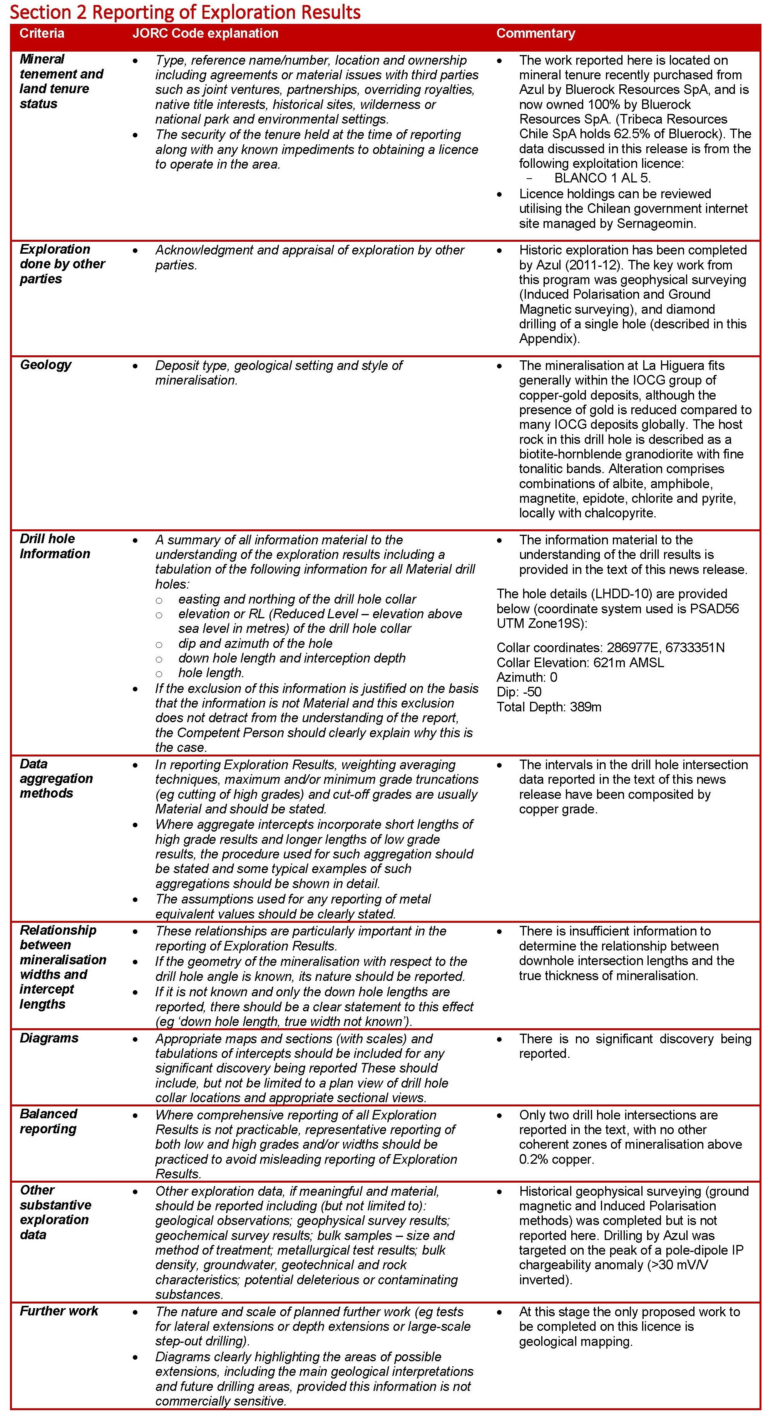

In 2011-12 Minera Azul undertook a programme of geological mapping, surface and underground sampling, geophysical surveying and drilling, with a focus on the third-party Mining Leases at La Higuera, but with part of the geophysical surveying (ground magnetic and pole-dipole IP) and one drill hole completed on the Austin Properties. The geophysical and drill hole results indicate that the strong IOCG alteration system that hosts the high grade La Higuera mineralisation continues to the northwest onto the Austin Properties. The single diamond hole drilled in the Austin Properties (LHDD-10) yielded two sub-economic copper intersections as follows:

- 3m @ 0.66% Cu, 15.7% Fe from 112m (including 1m @ 1.16% Cu)

- 14m @ 0.46% Cu from 142m (including 2m @ 1.4% Cu)

Tribeca Resources intends to undertake work on the property in conjunction with its previously announced work programme focussed primarily on the Gaby and Chirsposo targets located 1 kilometre to 3 kilometres west and southwest of the Austin Properties.

Following the 2019 acquisitions of the Gaby-Totito and Don Baucha properties, acquisition of the Benja & Blanco Properties is yet another step in implementing Tribeca Resources’ strategy of consolidation of advanced copper-gold projects in this under-appreciated portion of the prolific Chilean Iron Oxide Copper-Gold (IOCG) Belt of the Coastal cordillera. The properties are located approximately 40 km north of the city of La Serena, in the Coquimbo province of Chile (see Figure 1).

Austin has received the approval of its shareholders and the TSX Venture Exchange for the transfer, by Minera Azul, of its properties to Bluerock.

ABOUT TRIBECA RESOURCES

Tribeca Resources is a private Chilean exploration and development company. The team behind the company came out of Glencore’s copper business and established Tribeca Resources with the objective of building a portfolio of copper dominant properties in the Chilean Coastal IOCG Belt that can be advanced towards code compliant mineral resources. Via its 62.5% equity interest in Bluerock Resources, Tribeca Resources owns, or has options to acquire, 3,747 hectares of mineral properties in the La Higuera district. Its current property holdings host a best historical drill intersection of 285 metres at 0.4% copper, with significant gold, iron and cobalt by-product credits. Tribeca Resources is partnering with the founding Bluerock owners who retain a significant minority equity interest and have on-going technical and strategic involvement.

For further information:

Paul Gow – CEO Thomas Schmidt – President

paul.gow@tribecaresources.com thomas.schmidt@tribecaresources.com

+61 497 572 956 +44 77 7577 1217

COMPETENT PERSONS STATEMENT

The information in this release has been compiled by by Dr. Paul Gow, Director and CEO of Tribeca Resources Chile SpA, based on the review of information from historical work programmes. Dr. Gow is a Member of the Australasian Institute of Mining and Metallurgy (AusIMM) and the Australian Institute of Geoscientists (AIG), and has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person under the 2012 Edition of the Australasian Code for reporting of Exploration Results, Mineral Resources and Ore Reserves.

APPENDIX 1:

JORC Code, 2012 Edition – Table 1

APPENDIX 2:

Austin Resources news release (dated 4 February 2020)

AUSTIN RESOURCES ANNOUNCES PROPOSED SALE OF MINERAL PROPERTIES TO TRIBECA RESOURCES

TORONTO, ONTARIO (February 4, 2020) Austin Resources Ltd. (“Austin” or the “Company”) (TSX Venture Exchange – AUT) announces that it has entered into an agreement to transfer all of its interests in the mineral exploration properties in Chile held by Minera Azul Ventures Limitada (“Minera Azul”), the Company’s wholly owned Chilean subsidiary. The properties, totaling 949 hectares, are located in the La Higuera district, 50km north of the town of La Serena in the Coquimbo province.

Under the terms of the agreement, Minera Azul will transfer all of its interest in all exploration properties held by Minera Azul, along with certain drill core, to Bluerock Resources SPA (“Bluerock”) in exchange for the Company being granted a one percent (1%) royalty over future cashflows from mineral production from the transferred properties (the “Royalty”). Bluerock, an arm’s length party to the Company, is a majority controlled subsidiary of Tribeca Resources Chile SPA (“Tribeca Resources”), a private Chilean exploration business with adjoining properties. Bluerock will have the right, but not the obligation, to purchase fifty percent (50%) of the Royalty by making a cash payment of USD$63,166 to the Company.

Assuming the completion of the agreement with Bluerock, Minera Azul will no longer have any assets and the Company intends to wind-up operations in Chile and dispose of its interest in Minera Azul.

The agreement, and the disposal of the Company’s interest in Minera Azul, remains subject to the receipt of all regulatory approval including, without limitation, the approval of the TSX Venture Exchange.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information contact:

Austin Resources Ltd.

Jing Peng

Chief Financial Officer

Telephone: 416-848-9888

Email: info@austinresources.ca

Website: www.austinresources.ca

About Tribeca Resources:

Tribeca Resources is a private Chilean exploration and development company. The team behind the company came out of Glencore’s copper business and established Tribeca Resources with the objective of building a portfolio of copper dominant properties in the Chilean Coastal IOCG Belt that can be advanced towards code compliant mineral resources. Via its 62.5% equity interest in Bluerock Resources, Tribeca Resources currently owns or has options to acquire 2,798 hectares of mineral properties in the La Higuera district (Figure 1). Its current property holdings host a best historical drill intersect of 285 metres at 0.4% copper, with significant gold, iron and cobalt by-product credits. Further information about Tribeca Resources can be found at www.tribecaresources.com.

APPENDIX 3:

Austin Resources news release (dated 27 February 2020)

AUSTIN RESOURCES COMPLETES SALE OF MINERAL PROPERTIES TO TRIBECA RESOURCES

TORONTO, ONTARIO (February 27, 2020) Austin Resources Ltd. (“Austin” or the “Company”) (TSX Venture Exchange – AUT) announces that it has received the approval of its shareholders and the TSX Venture Exchange (the “Exchange”) for its previously announced transfer of all of its interests in the mineral exploration properties in Chile held by Minera Azul Ventures Limitada (“Minera Azul”), the Company’s wholly owned Chilean subsidiary (see press release dated February 4, 2020).

As the transaction involved the disposition of more than 50% of the Company’s business, the Exchange required the Company to obtain approval from disinterested shareholders holding more than 50% of the Company’s issued and outstanding common shares (which was accomplished by the Company receiving written consent for the transaction from disinterested shareholders holding in excess of 50% of the Company’s issued and outstanding common shares).

As a result of the completion of the agreement with Bluerock, Minera Azul will no longer have any assets and the Company intends to wind-up operations in Chile and dispose of its interest in Minera Azul.

Additionally, the Company has been advised by the Exchange that, with the closing of the transfer of all of its interests in the mineral exploration properties in Chile, the Company has ceased to have active operations, no longer meets the continued listing requirements of the Exchange and will be transferred to the NEX. As a result of such transfer to the NEX, the Company’s trading symbol with change from AUT to AUT.H once the Exchange issues the final bulletin in connection with this transaction.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information contact:

Austin Resources Ltd.

Jing Peng

Chief Financial Officer

Telephone: 416-848-9888

Email: info@austinresources.ca

Website: www.austinresources.ca

1305 - 1090 West Georgia Street

Vancouver, BC V6E 3V7 Canada